Bearish Momentum in EUR/CHF Weekly Analysis

Bearish Momentum Main Points Sellers taking control in the EUR/CHF consolidation. Lower lows indicate bearish pressure. Opportunity may arise if support level breaks. Technical Analysis Overview In the weekly analysis of the EUR/CHF currency pair, it’s evident that sellers are gaining momentum amidst a prolonged consolidation phase that has persisted since late August. Although the […]

AUD/NZD Consolidation Analysis: Weekly Update and Breakout Potential

AUD/NZD Consolidation Analysis Main Points: AUD/NZD has been consolidating after a strong bullish move in June. The current consolidation phase suggests the potential for a bullish breakout, given the formation of equal highs and higher lows. A breakout above the range could signal a continuation of the previous rally, while a breakdown may indicate a […]

Weekly Analysis: AUD/JPY – Bullish Continuation Pattern Emerges

Bullish Continuation Main Points: AUD/JPY exhibits a bullish continuation pattern with two significant confluences. The pair breaks a bearish trendline and forms a bullish bull flag pattern, reinforcing the bullish sentiment. Anticipated conservative resistance at 95.80, with potential targets at 96.70 and 97.60. Bullish Momentum in AUD/JPY Continuing our analysis of currency pairs, we turn […]

Weekly Analysis: AUD/CHF – Bullish Momentum Gains Strength

bullish momentum Main Points: The AUD/CHF pair reverses a bearish trendline, signaling a bullish trend. A former resistance trendline now acts as vital support, confirmed by recent price action. Key resistance at 0.56800 presents an important target for bullish momentum. Positive Shift in AUD/CHF Trend Building upon last week’s analysis of the AUD/CHF currency pair, […]

AUD/USD Weekly Forecast: Double Top Resistance as Focus Shifts to FOMC and RBA

AUD/USD Weekly Forecast: Double Top Resistance Main Points: The AUD/USD pair ended the week with a 0.83% gain despite mixed economic data. Charts show potential bullish signs with the pair closing above the 20-day SMA. FOMC interest rate decision and RBA’s minutes will drive market sentiment next week. Weekly Overview The AUD/USD currency pair had […]

USD/CAD Weekly Analysis: Corrective Downside Amid Soaring WTI, Eyes on FOMC

Main Points: USD/CAD faces corrective downside pressure as it retreats from recent highs near 1.3700. Rising WTI oil prices provide support to the Canadian dollar, despite positive US PPI and CPI data. Upcoming events, including Canadian CPI and US interest rate decisions, are pivotal for market direction. Weekly Overview The USD/CAD pair witnessed a correction […]

EUR/USD Weekly Analysis: Bearish Outlook Lingers

bearish outlook Main Takeaways: The EUR/USD pair remains under pressure due to the ECB’s cautious stance on rate hikes. From a technical perspective, key Simple Moving Averages (SMAs) signal a bearish trend. Market focus now shifts to the upcoming FOMC rate decision for guidance. Weekly Recap Last week, the EUR/USD pair continued its downward trend, […]

GBP/USD Weekly Forecast: Sellers Find Traction, Eventful Week Ahead

GBP/USD Weekly Forecast Main Points: GBP/USD price faces downward pressure due to below-expected UK GDP. Strong US CPI and PPI data maintain support for the US dollar. Key events ahead include UK CPI, UK PMI, BoE rate decision, and FOMC. Utilize Technical Analysis and Trading Tools for market insights. The GBP/USD currency pair experienced a […]

USD/JPY Weekly Outlook: Buyers Target 148.0 Breakout

USD/JPY Weekly Outlook Key Points: USD/JPY initially experiences minor bearish pressure but rebounds. Support stems from positive US data and a hawkish Federal Reserve (Fed) stance. Bank of Japan (BoJ) maintains a dovish stance. Focus on upcoming Fed rate decision. The USD/JPY currency pair embarked on the week with a brief spell of bearish sentiment, […]

AUD/USD Weekly Analysis: USD Strength and China Woes

AUD/USD Weekly Analysis: USD Strength & China Woes Main Points: AUD/USD faces a bearish week due to a stronger US dollar driven by Fed rate hike expectations. Weaker economic data from China, Australia’s largest trading partner, adds to the pair’s challenges. Technical analysis indicates a break below the 0.64 support level, potential further decline to […]

GBP/USD Weekly Analysis: Navigating Risk and Data Releases

GBP/USD Weekly Analysis Main Points: GBP/USD faces a challenging week amid global uncertainties prompting investors to seek safety. The pair’s direction hinges on reactions to this environment and key economic data from the UK and US. Technical analysis reveals a test of the 1.2650 resistance and a critical support zone at 1.2350, influencing potential trend […]

EUR/USD Weekly: Bearish Trend Ahead

EUR/USD Weekly: Bearish Trend Ahead Main Points: EUR/USD sees ongoing bearish momentum, closing near 1.06982, a level last seen in June. Challenges ahead as the European Central Bank (ECB) prepares for its interest rate decision. Key technical levels: resistance at 1.0700, 1.0750, and 1.0800, support at 1.0650 and 1.0600. Overview The EUR/USD currency pair continues […]

USD/CAD Weekly Analysis: Fed Rate Impact on Trading

USD/CAD Weekly Analysis: Fed Rate Impact Main Points: The USD/CAD pair had a bullish week, driven by Fed rate hike expectations. Economic data and market sentiment will be key factors for the upcoming week’s movement. Technical analysis suggests potential trading opportunities with essential support and resistance levels. Overview The USD/CAD pair displayed bullish momentum during […]

USD/JPY Weekly Analysis: Bullish Trend Persists

USD/JPY Weekly Analysis: Bullish Trend Persists Main Points: The USD/JPY pair continues its strong bullish trend due to monetary policy disparities between the BoJ and the Fed. Technical analysis shows a bullish pinbar candlestick and the pair trading above the 20-day EMA, signaling further upside potential. Market sentiment leans toward USD strength, supported by fundamental […]

EUR/JPY Weekly Analysis – Bearish Reversal Potential

Bearish Reversal Potential Main Points: 1. Bearish reversal signals as EUR/JPY forms head and shoulders pattern. 2. Bulls face resistance at 159.57, suggesting a possible retracement to 153.00 support. Technical Analysis: Head and Shoulders Pattern: The EUR/JPY currency pair is currently displaying a notable bearish reversal signal through the formation of a head and shoulders […]

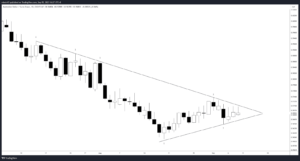

AUD/CHF Weekly Analysis: Symmetrical Triangle Formation

Main Highlights: AUD/CHF currently exhibits a neutral bias with a symmetrical triangle pattern. A bearish trendline has been tested four times, making it a key level for potential reversal. Understanding the implications of a breakdown from the symmetrical triangle is crucial for traders. Analysis of AUD/CHF’s Neutral Bias The AUD/CHF currency pair is currently in […]

EUR/NZD Weekly Analysis: Exploring Long Opportunity

EUR/NZD long opportunity Main Highlights: EUR/NZD presents several confluences indicating a potential long opportunity. A bullish flag pattern and a retested resistance turned support offer compelling bullish signals. The presence of a bullish trendline adds to the attractiveness of the long scenario. EUR/NZD – Analyzing Long Opportunities EUR/NZD is currently exhibiting a confluence of factors […]

AUD/CAD Weekly Analysis: Potential Reversal

AUD/CAD potential reversal AUD/CAD potential reversal Main Highlights: AUD/CAD has experienced a month-long bearish trend since reaching its peak at 0.9050. Potential reversal signals, including the emergence of an inverse head and shoulders pattern, are observed. A breakthrough above the pattern’s neckline could trigger a bullish rally towards the 0.9050 resistance level. AUD/CAD – Bearish […]

USD/JPY Weekly Forecast: Bull Retake the Driving Seat

USD/JPY Weekly Forecast Main Points: US dollar experiences fluctuations amid market uncertainty but closes the week strongly. Wild week for USD against JPY with fluctuations but potential support at 142.50 level. US interest rates, higher than Japanese rates, likely to keep USD strong against JPY. USD/JPY – Weekly Market Overview The US dollar embarked on […]

USD/CAD Weekly Forecast: Buyers Reemerged, Eyes on BoC

Main Points: USD/CAD Weekly Forecast shows intrigue amid disappointing Canadian and US economic data. Canadian GDP growth fell short of expectations, signaling stagflation concerns. Upcoming Bank of Canada (BoC) rate decision holds potential significance for the pair. USD/CAD – Economic Data and Stagflation Worries The USD/CAD pair garnered significant attention on Friday as market participants […]

GBP/USD Analysis: Weekly Forecast & Volatility Insights

Main Points: GBP/USD Weekly Forecast rebounds from two-month low amid risk-off sentiment. Upcoming week lacks major UK and US data, emphasizing technical indicators. Caution urged due to low trading activity during holiday-shortened week. Explore the GBP/USD Weekly Forecast as the Pound Sterling (GBP) makes a recovery against the United States Dollar (USD) from its recent […]

GBP/CAD Analysis: Bullish Bias & Potential Breakout

Main Points: GBP/CAD Analysis maintains a bullish bias, supported by a green zone. Cup and handle pattern formation suggests a bullish trend. Potential for a significant move if multiple patterns materialize simultaneously. GBP/CAD – Bullish Bias and Pattern Analysis In this analysis of GBP/CAD, we observe the pair maintaining a robust bullish bias. It continues […]

AUD/JPY Analysis: Bullish Momentum

Main Points: AUD/JPY signals bullish momentum after breaking key trendline resistance. Bullish flag pattern formation suggests potential upward movement. Expectations of price reaching 94.00 levels if a breakout occurs. AUD/JPY – Bullish Momentum and Trendline Breakout In this weekly analysis of AUD/JPY, we explore its bullish momentum as it successfully breaks above a significant trendline. […]

AUD/USD Analysis: Bearish Momentum & Volatility

Main Points: AUD/USD analysis exhibits bearish momentum following a double top formation. Technical analysis reveals a breakdown of the plotted trendline, indicating seller strength. Volatility analysis using a Volatility Heat Map provides key insights for traders. AUD/USD – Bearish Momentum and Trendline Breakdown In this week’s AUD/USD analysis, we continue to observe the bearish bias […]

GBP/JPY Daily Chart Analysis: Strong Bullish Signals

Main Points: GBP/JPY displays strong bullish indications on the daily chart. A significant resistance zone has transformed into solid support, with multiple rejections. Consolidation and a bullish flag pattern suggest the potential for a higher rally. GBP/JPY Daily Chart Analysis: Strong Bullish Signals Explore our GBP/JPY Daily Chart Analysis and uncover strong bullish signals on […]

EUR/USD Weekly Analysis: Navigating Market Trends

Main Points: EUR/USD Weekly Analysis: A Minor Uptick Following Six Weeks of Decline Market Sentiment Impacted by China’s Economic Challenges and Upcoming US Data Technical Analysis Indicates Bearish Momentum with a Critical Support Level at 1.0635 Understanding the Market Delve into the latest EUR/USD weekly analysis, shedding light on a slight uptick observed after six […]

AUD/USD Weekly Forecast: All Eyes on RBA Meeting

Main Points: 1. Mixed week for AUD/USD, encountering resistance at 0.7400 and support at 0.7220. 2. RBA meeting on Tuesday, the potential impact on the pair’s direction. 3. Key technical level at 0.6500 – a crucial resistance for AUD/USD. Market Overview The AUD/USD currency pair had a turbulent week, facing resistance at 0.7400 and finding […]

Down Under Downtrend: Daily Analysis of AUD/USD’s Bearish Run

Main Points The AUD/USD pair is experiencing bearish pressure on the daily chart, primarily after breaking a key support level. A double-top pattern suggests potential for continuation of the bearish trend. Traders should be cautious about early sells, as several retracement areas could still come into play. Current Market Sentiment and Technical Indicators The daily […]

Turning the Tables: EUR/CHF Seeks Reversal in Daily Timeframe

Main Points The EUR/CHF pair shows signs of a potential reversal, as indicated by a double-bottom pattern on the daily chart. The currency pair offers two distinct target zones for traders, based on risk appetite and market sentiment. Getting a Pulse on Market Sentiment and Technical Indicators The daily chart of the EUR/CHF is starting […]

Swinging Into Highs: GBP/CAD Aims for a Breakout on Daily Timeframe

Main Points The GBP/CAD pair on the daily chart is showcasing a bullish “cup and handle” pattern, suggesting potential upside momentum. The pair is testing a key resistance level, the breakout of which could add volatility and drive the pair higher. A strong historical support level is holding the pair from moving lower, thereby adding […]

The EUR/CAD Daily Chart Unveils a Bull Flag: A Playbook for Swing Traders

Main Points The EUR/CAD currency pair on the daily timeframe is showing a bullish pattern, termed a “bull flag,” with the possibility of reaching 1.51 if it breaks current resistance. If the currency pair fails to break the resistance level, a move down to 1.45 levels is plausible. Market Sentiment and Technical Indicators: A Snapshot […]

An Overview of USDJPY’s Daily Movements

Main Points: The weekly chart indicates a strong uptrend for USDJPY. A resistance level has been identified, which might challenge the bullish momentum. The daily timeframe underscores significant buy signals. Analysis of the Uptrend Taking a glance at the weekly chart for USDJPY, there’s a prominent uptrend. This denotes a consistent strength in the U.S. […]

EUR/USD’s Bearish Stride: Understanding the Landscape

Main Points: EUR/USD has shown a consistent downtrend over the past six weeks. The 61.8% Fibonacci retracement acted as a pivotal turning point. 200-day SMA provides key trend information, but its support strength is uncertain. Backdrop: US Dollar’s Strength and EUR/USD’s Downturn The EUR/USD pair, representing the two heavyweight currencies in the forex market, has […]

How to Trade GBP/USD This Week: US Data and Technical Levels to Watch

Main Points: GBP/USD bears might target the 1.2447 level, a previous swing low. Significant US economic data releases, including US Core PCE Index, could influence GBP/USD’s direction. The pair’s position below the 20- and 50-day SMA suggests a bearish trend. Anticipation Around Upcoming US Data The spotlight next week will be on the US economic […]

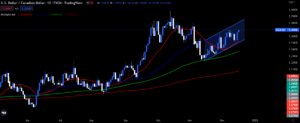

USD/CAD Weekly Forecast: Greenback Strengthens and Eyes 1.38 Level

The Greenback’s Journey: Aiming for New Heights For anyone closely observing the USDCAD on a daily timeframe, this week has been an exciting ride. The US dollar flexed its muscles, demonstrating dominance against its Canadian counterpart. Currently, the pair is setting its sights on the promising 1.38 level, leaving traders and analysts alike in suspense. […]

How to Trade AUD/USD This Week: Key Factors and Levels to Watch

Navigating AUD/USD’s Waters: Daily Outlook Main Points: Impact of rising US yields and latest news from China. AUD/USD’s position in a descending trend channel. Key technical levels to monitor in the coming week. The Pulse of US Yields and China’s Whispers The recent surge in US yields, owing to market anticipations of the Federal Reserve’s […]

EURUSD Daily Analysis: Ascending Channel & Upcoming Volatility

Main Points: EURUSD has maintained an upward path in an ascending channel. It recently hit a significant support zone. A break at this support could set the stage for a rise in the coming month. Dissecting the Channel Movement The EURUSD pair, when observed on the daily chart, shows a consistent upward journey within an […]

AUDUSD Daily Analysis: Harmonic Butterfly in Bearish Terrain

Main Points: The AUDUSD daily chart reveals a pronounced bearish shuffle. It’s nestled within a significant support zone, harmonizing with a butterfly trading pattern. This confluence augments the anticipation of an upward reversal. Current Technical Landscape On delving into the daily dynamics of the AUDUSD, one can’t help but notice the prevailing bearish rhythm that […]

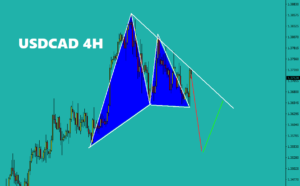

Potentially forming a bullish bat pattern

Hey Forex Traders! Exciting news! The USDCAD pair is potentially forming a bullish bat pattern near a robust demand zone at 1.35500. This is a great opportunity for us to dive in and make some profits! Let’s take a closer look at the current market conditions. The USDCAD pair has been in a downtrend, but […]

Charting a Course to Success: Riding the Rising Wave with DSS Oscillator!

Alright, folks, let’s take a closer look at our charts. In the daily graph, we’ve got the DSS oscillator showing signs of an incoming bullish trend. Moving on to the 4-hour chart, the momentum oscillator is pointing towards an upward swing, even when the price is moving sideways. Now, we can’t make any hasty decisions […]

Euro-Dollar Poised for Bullish Breakout with Bollinger 20 Support!

Alright folks, we’ve seen the Euro-Dollar pair make a mighty surge upwards at Weekly time frame, but it’s taken a step back with a correction lately. Fear not, as it’s currently being propped up by the trusty ol’ middle band of Bollinger 20. This is the perfect opportunity to pounce aggressively and anticipate a further […]

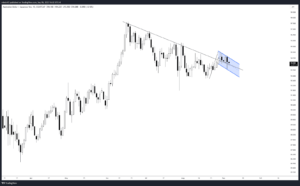

USD/CAD – The pair stays within the bearish flag pattern

The USD/CAD pair is consolidating in the bullish corrective phase. The buyers look too thin to hold and may be dominated by the sellers again. The pair stays within the bearish flag pattern and is on the verge of a bearish breakout. The 100-day moving average could hamper the path of bears. The 200-day SMA […]

USD/JPY – Is the seasonality bearish factor in January will change the direction

The USD/JPY price lost significant gains by the end of the year, thanks to BoJ’s policy tweak. The daily chart shows multiple bearish crossovers. This shows a strong downtrend in play. The price is currently supported by a critical level of 131.00. However, the level looks feeble against the price action. The seasonality factor for […]

AUD/USD – Will the resistance level stop the positive momentum

The AUD/USD closed the month and the year positively. However, the price is still below the recent swing high of 0.6963. Meanwhile, the bullish engulfing bar in the immediate background threatens the recent rally. The bullish crossover between the 50-day and 100-day moving averages is a positive sign for the pair. Moreover, the price is […]

GBP/USD – Will 50-day moving may lend support to the pair

The GBP/USD price is struggling to hold onto the gains after finding a bearish engulfing bar on the daily chart. The price closed below the 20-day moving average and played around the 200-day moving average. The 50-day moving may lend support to the pair. However, the 100-day SMA is flat, and it may attract the […]

EUR/USD – Will the new year end the positive momentum?

The EUR/USD price ended the month on a strong positive note while the year ended, paring losses partially. The pair looks buoyant, closing above the key moving averages on the daily chart. The 50-day and 200-day moving averages have formed a bullish crossover. Meanwhile, the 50-day and 100-day moving averages made a bullish crossover earlier […]

USD/JPY – Continued consolidation or continued trend?

The USD/JPY remained in a consolidation last week. The pair is eying the Bank of Japan’s meeting next week that may stimulate the market. Technically, the pair remains supported by the 200-day SMA. However, the support looks feeble and may be dominated by the sellers. The upside potential has been barred by the 20-day SMA. […]

USD/CAD – Will the flag pattern stay valid?

The USD/CAD price maintains a bullish bias after finding strong support at 1.3521. The pair is now standing around a key resistance level at 1.3700. The pair is eying Canadian GDP and US Core PCE Index data to find further fresh impetus. The daily chart shows further rising prospects as the 20-day, and 50-day SMAs […]

AUD/USD – We may see an upside correction?

The AUD/USD price paused the upside momentum around the 200-day SMA near 0.6900. The price rejection turned into a bearish engulfing pattern, suggesting a strong downtrend ahead. However, the price saw mild support by the 100-day SMA. We may see an upside correction on the lower timeframes before the resumption of a downtrend. The 0.6685 […]

GBP/USD – Will the price meet the 50/100 SMAs

After hawkish Fed meeting minutes, the GBP/USD price stalled the uptrend. The bearish engulfing candlestick on the daily chart reveals a potential downtrend that may lead toward the conjunction of 50-day and 100-day SMAs around 1.1700. However, the price at current levels may find mild support from the 20-day and 200-day SMAs. Breaking below the […]

EUR/USD – Will it remains strongly bullish?

The EUR/USD price remained positive throughout the week until the FOMC meeting revealed a persistent rate hike policy. The US dollar picked strength across the board. Now the focus has turned o Core PCE index data due on Thursday. Technically, the EUR/USD pair remains strongly bullish. However, the price started correcting lower. The probability […]