AUD/NZD Consolidation Analysis

Main Points:

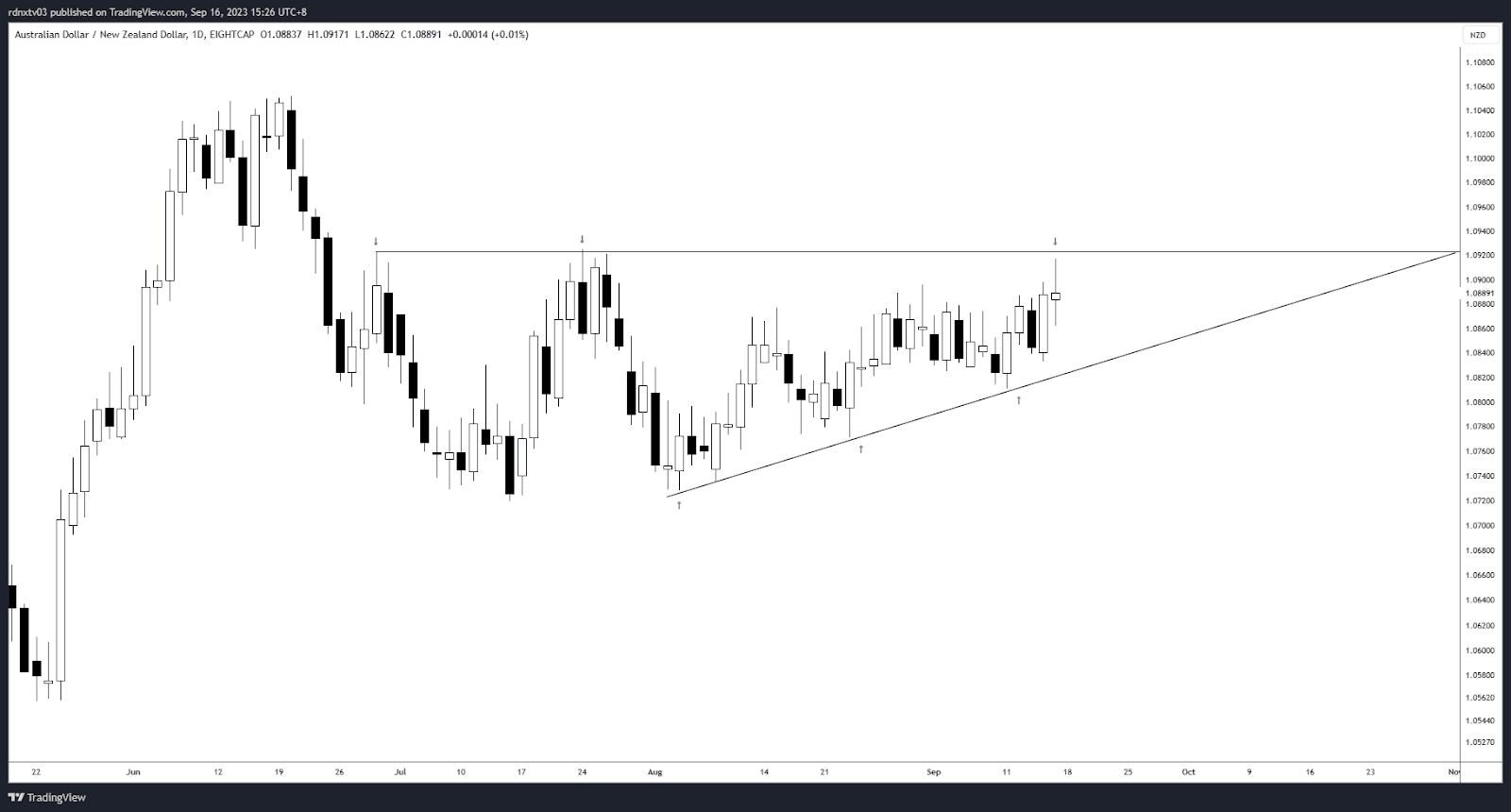

- AUD/NZD has been consolidating after a strong bullish move in June.

- The current consolidation phase suggests the potential for a bullish breakout, given the formation of equal highs and higher lows.

- A breakout above the range could signal a continuation of the previous rally, while a breakdown may indicate a deeper pullback.

Consolidation Phase in AUD/NZD

Turning our attention to the AUD/NZD currency pair, it becomes evident that it has been in a consolidation phase for a significant duration following a substantial bullish surge in June. Subsequent to the bullish move, the pair underwent a retracement and has since been in consolidation mode. This is the current state of affairs for AUD/NZD.

Potential Bullish Momentum

Within this consolidation period, there are notable indications pointing toward potential bullish momentum. One key observation is the formation of a range characterized by multiple equal highs. Simultaneously, the pair has demonstrated strength at the lows, leading to the creation of higher lows.

Breakout Scenarios

The implications of this consolidation are intriguing. An attempted breakout above the range could likely result in a continuation of the bullish rally we witnessed back in June. This would signify a renewed upward trend in the AUD/NZD pair. Conversely, a breakdown from this consolidation range may imply the potential for a deeper pullback in the pair’s value, suggesting a shift in market sentiment.

Technical Indicators and Trading Tools

As traders navigate this phase of consolidation, it’s essential to leverage technical indicators and trading tools to enhance decision-making. Utilizing tools such as volatility calculators and sentiment analysis can provide valuable insights into market conditions and potential trading opportunities. Moreover, it’s prudent to keep a close eye on key support and resistance levels as these often play pivotal roles in trend development.

Comments