Main Points

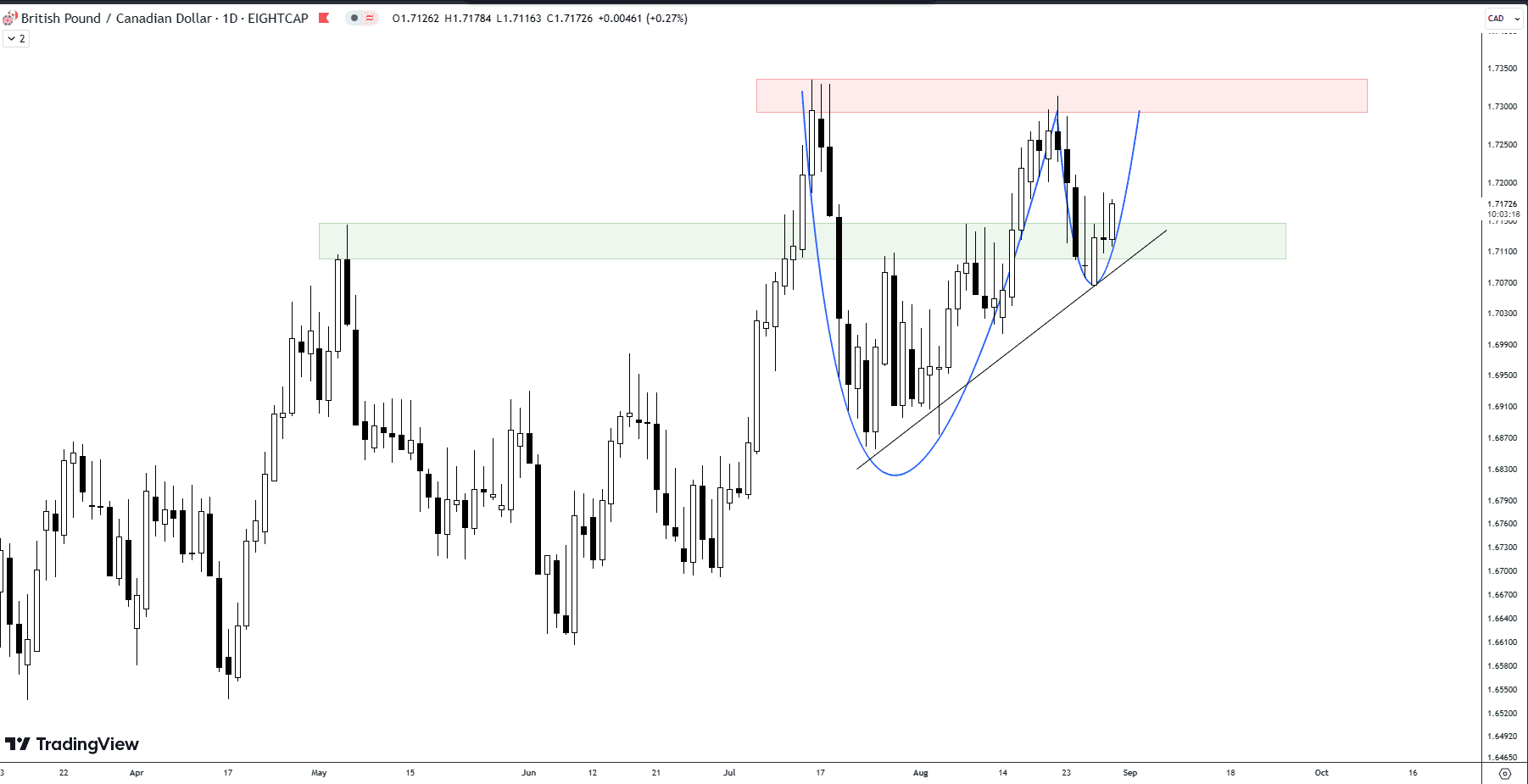

- The GBP/CAD pair on the daily chart is showcasing a bullish “cup and handle” pattern, suggesting potential upside momentum.

- The pair is testing a key resistance level, the breakout of which could add volatility and drive the pair higher.

- A strong historical support level is holding the pair from moving lower, thereby adding weight to the bullish outlook.

Setting the Scene: Market Sentiment and Technical Indicators

When it comes to the daily chart of the GBP/CAD currency pair, market sentiment seems to favor the bulls. This optimistic market sentiment is reinforced by a series of technical indicators, most notably the formation of a bullish pattern known as the “cup and handle.”

Deciphering the Cup and Handle

The “cup and handle” pattern is considered a bullish signal and is commonly used in swing trading strategies. In this particular instance, the GBP/CAD has completed the formation of the ‘cup,’ and is in the phase of forming the ‘handle.’ During this phase, the pair has experienced some consolidation but is showing resistance to moving lower. This behavior indicates the likelihood of the pair seeking higher prices soon.

The Importance of Fundamental Analysis

While technical indicators like the “cup and handle” can provide valuable insights, it’s critical not to overlook fundamental analysis. Economic events or geopolitical tensions involving Great Britain or Canada could have a direct impact on the GBP/CAD pair, either supporting or negating the technical analysis. Keeping an eye on economic indicators and news releases will offer a more holistic view of the market.

Swing Trading Opportunities: Navigating Market Volatility

Given the bullish signals on the daily chart and the market sentiment leaning towards optimism, swing traders could find this an opportune time to capitalize on market volatility. A successful breakout from the current resistance level could offer a profitable swing trade, targeting higher levels.

Comparison Table: Breakout vs. No Breakout

| Scenario | Price Target | Market Volatility | Trading Strategy |

|---|---|---|---|

| Breakout | Higher Levels | High | Long Position |

| No Breakout | Lower Levels | Moderate to Low | Short Position or Hold |

Analyzing Trader Sentiment

Over the past 30 days, GBPCAD has shown interesting shifts in trader sentiment. On the most recent day of our analysis, August 30, 2023, the short percentage stands at 0.63 compared to a long percentage of 0.37. This bias toward short positions is a reversal from earlier sentiment, where, for instance, on August 1, the long positions dominated at 0.55. The significant increase in short sentiment in the recent days suggests traders are expecting the pair to weaken.

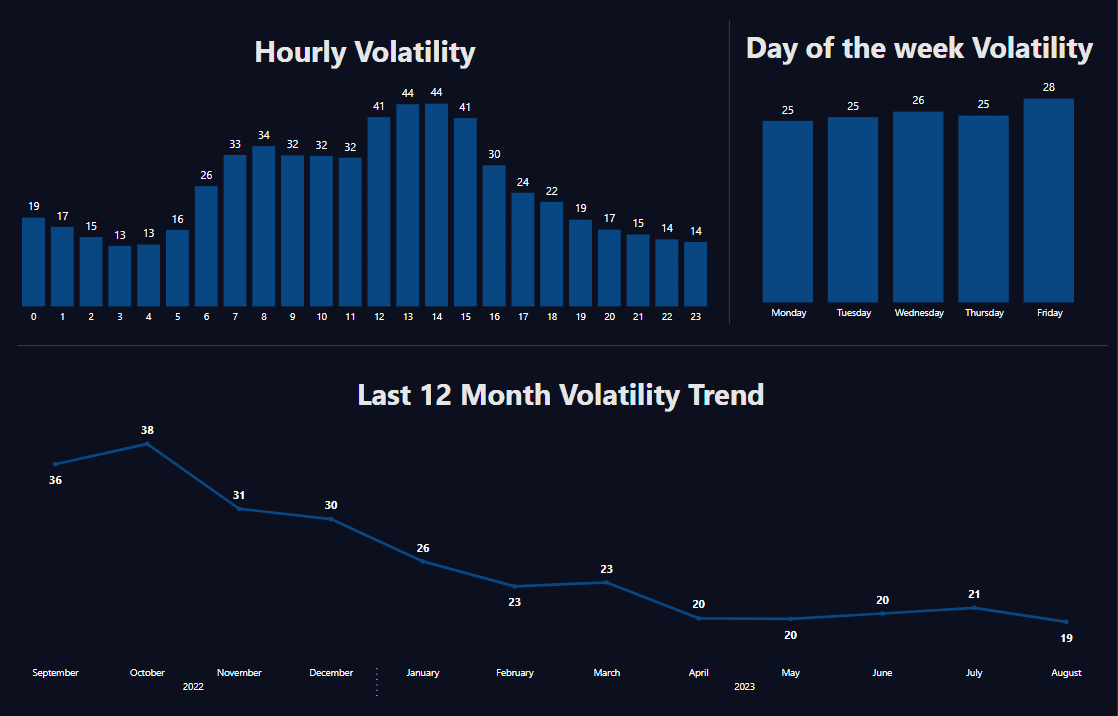

Understanding Market Volatility

The volatility of GBPCAD has been notably varied. On the latest day, August 30, the pair opened at 1.72164 and closed at 1.72072, with a percentage change of -0.000534. The Bar Direction is marked as ‘Down’, and it experienced a relatively modest Pips Change of 21.3. Contrarily, on August 29, the pair soared with a percentage change of 0.004640 and a Pips Change of 120.0. The significant changes in volatility, notably between August 29 and August 30, signal the presence of major market events affecting this pair. The variation in % Body Bar also suggests that traders should exercise caution and employ risk management strategies.

Conclusion for This Week

Given the recent shifts in sentiment leaning towards short positions and the erratic volatility observed, traders should be cautious. The market is showing signs of uncertainty, which is evident from the fluctuating % Body Bar and % Change percentages. For the coming week, traders might want to look into employing hedging strategies or setting tighter stop-loss and take-profit levels to navigate the apparent market ambiguity.

In summary, whether you’re a swing trader or someone looking to understand the GBP/CAD market better, both technical indicators and fundamental analysis should be part of your toolkit. Combine these with an understanding of market volatility and sentiment, and you’ll be well-equipped to navigate the forex market.

Comments