Forex Correlation Calculator

The importance of volatility for traders

- Risk Management: Assess and manage trade risks effectively.

- Profit Potential: Greater price fluctuations can lead to increased profits.

- Trading Strategies: Choose the right strategy based on volatility levels.

- Portfolio Diversification: Balance high and low volatility assets.

- Entry and Exit Points: Identify optimal points for trades.

- Stop-Loss and Take-Profit: Set appropriate levels using volatility.

- Timeframes: Determine suitable trading timeframes with volatility analysis.

- Market Sentiment: Gauge overall market direction using volatility.

- Leverage Management: Minimize risk with better leverage control.

- Optimal Trading Hours: Find the best times to trade based on volatility patterns.

What is Correlation?

Currency correlation in forex is a statistical measure of how two different currencies move in relation to each other. It’s given as a number between -1 and 1.

What you can find here?

The most advanced reports for detailed forex correlation analysis. These tools help forex traders spot patterns and anomalies to enhance trading outcomes. With diverse reports providing a comprehensive view of currency correlations over time, you’re better equipped to make informed trading decisions.

Correlation Table Analysis

Check our Correlation trading calculator for in-depth analysis

Harness our tools and analysis to make informed trading decisions.

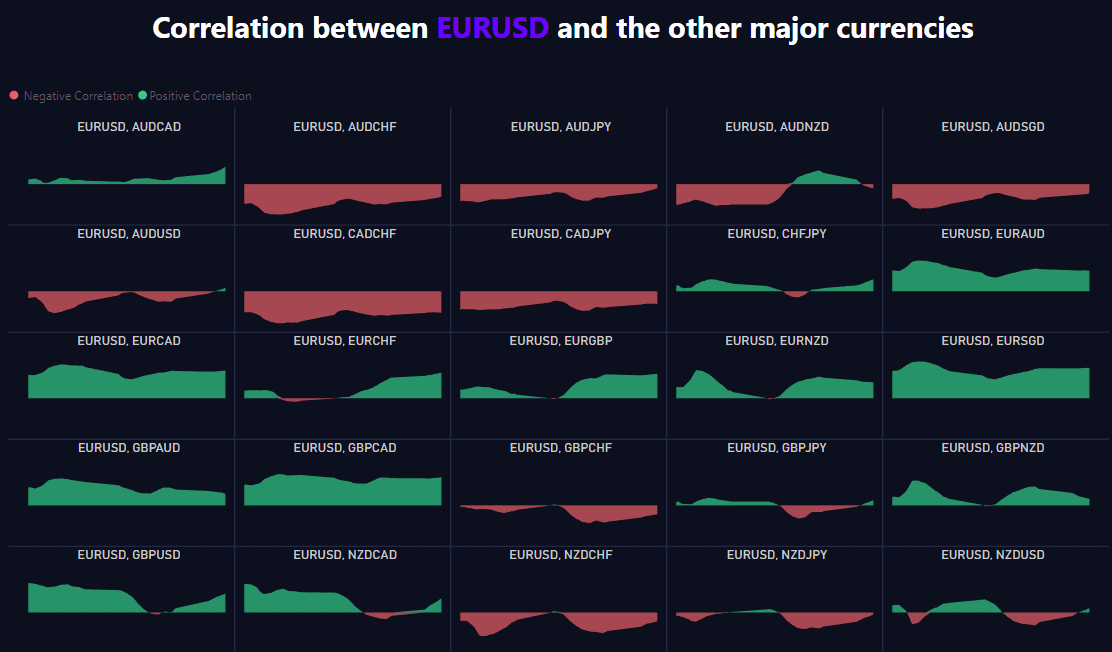

Forex Correlation Compass Map

Quick correlation analysis of all currencies

Navigate the complexities of the Forex market through our dynamic report focusing on currency pair correlations. By choosing a specific pair, gain immediate insights into its correlation with all other pairs.

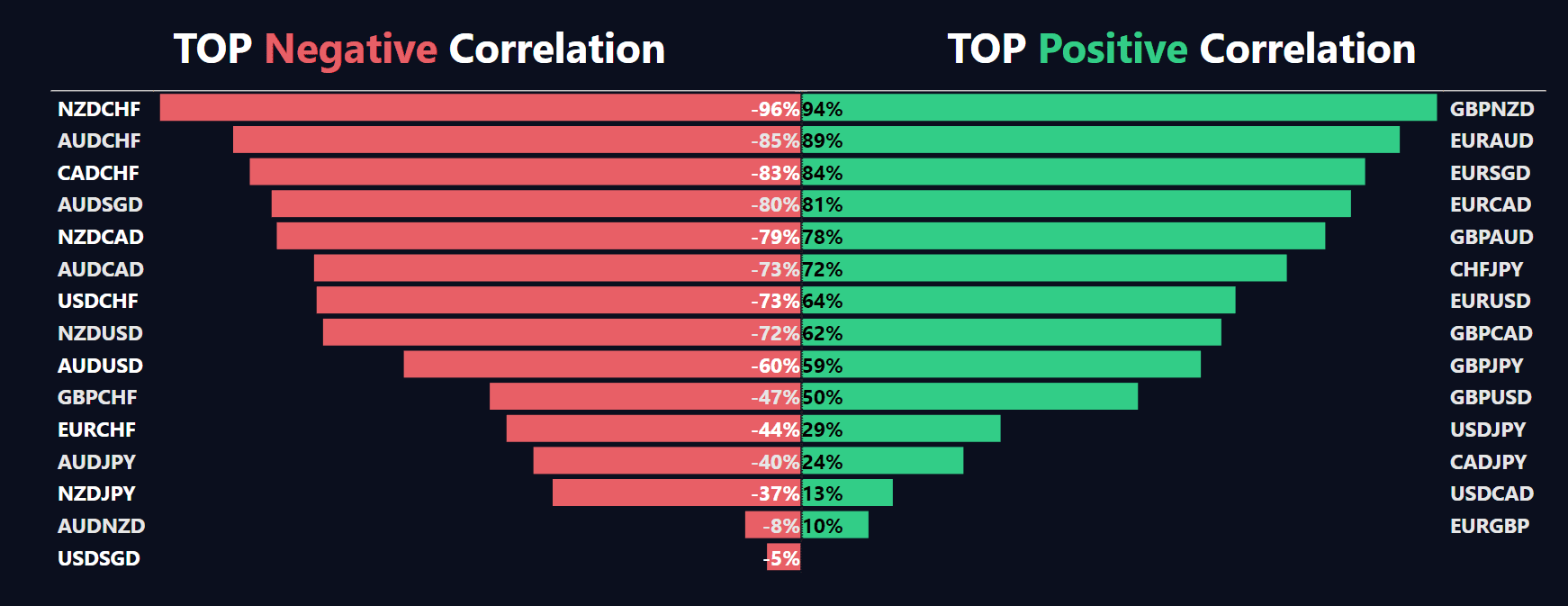

Top Correlation

Find out quickly and clearly which pairs are strongly correlated with each other and in which direction. knowledge is power!

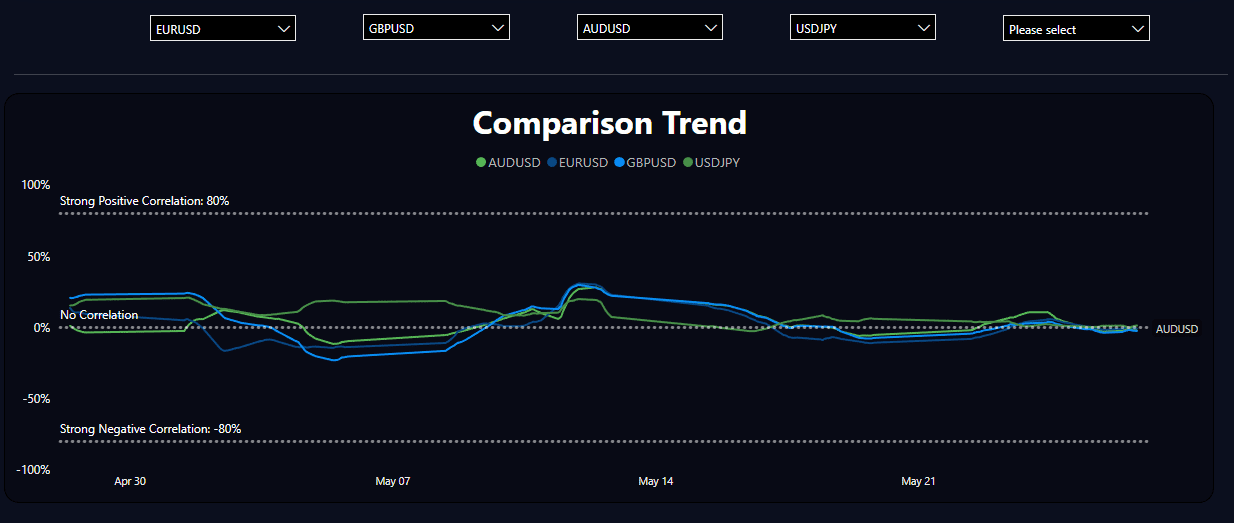

Correlation Comparison

Choose your favorite pairs and easily discover the correlation between them over time

Essential Resources: Must-Read Articles on Correlation

How to Use Forex Correlations to Create a Diversified Trading Portfolio?

Forex correlations are a powerful tool for traders to diversify their trading portfolios. Learn how to use forex correlations to create a diversified trading portfolio and increase your chances of success.

The Benefits of Using Correlations in Forex Trading

Forex trading is a complex and dynamic field, and understanding the correlations between different currency pairs can be a great way to maximize your profits. In this article, we’ll explore the benefits of using correlations in forex trading and how to use them to your advantage.

GBP/USD Correlations: What You Need to Know

In this article, we’ll explore the correlations between GBP/USD and how they can be used to inform your trading decisions.

Understanding the Basics of Forex Correlation Trading

Forex correlation trading is a strategy that is used to identify and exploit the price movements of different currency pairs. This article explains the basics of forex correlation trading and how to use it to your advantage.

Frequently Asked Questions about Correlation

Currency correlation in Forex trading is the measure of the relationship between two currency pairs. When these pairs move in the same direction, they have a positive forex correlation pairs, and when they move in the opposite direction, they have a negative correlation.

Understanding currency correlation offers several benefits to a Forex trader:

Risk Management: By knowing the correlation between different pairs, traders can avoid entering trades that cancel each other out. For example, if two pairs are highly positively correlated and you open long positions on both, it’s like doubling your risk on the same trade because if one goes down, the other is likely to follow.

Diversification: On the other hand, if you want to spread risk across various trades, you can choose pairs that are less positively correlated. This way, even if one trade goes bad, the other might still be profitable.

Identifying Opportunities: Correlation can also help identify potential trading opportunities. For example, if two currencies usually move together, but one starts to diverge, it could signal an upcoming re-correction.

Hedging: If you’re in a situation where you need to protect an open position from an adverse move, you can open another position in a negatively correlated pair, creating a “hedge.”

Remember, however, correlation doesn’t remain constant and can change due to various factors. Thus, traders need to continually monitor and adjust their strategies based on the latest correlation data.

In Forex trading, correlation is a statistical measure of how two currencies move in relation to each other.

Positive Correlation: If two currency pairs have a positive correlation, it means they typically move in the same direction. For example, if the EUR/USD and GBP/USD pairs have a positive correlation, when the value of EUR/USD rises, the value of GBP/USD also tends to rise.

Negative Correlation: If two currency pairs have a negative correlation, it means they typically move in opposite directions. So, if the EUR/USD and USD/CHF pairs have a negative correlation, when the value of EUR/USD rises, the value of USD/CHF tends to fall, and vice versa.

Understanding these correlations can help Forex traders manage their portfolios more effectively. For instance, if you know two pairs are positively correlated, you might not want to risk doubling your exposure by placing the same trade on both. Similarly, knowing that pairs are negatively correlated can help with hedging strategies.

The correlation between two currencies in the Forex market is driven by various factors:

Economic Indicators: These include factors like inflation rates, interest rates, Gross Domestic Product (GDP), employment data, etc. If two countries have similar economic indicators, their currencies tend to move in the same direction, leading to a positive correlation. Conversely, if the economic indicators of two countries move in opposite directions, their currencies tend to have a negative correlation.

Trade Relationships: Countries that trade heavily with each other or share similar trading partners often have positively correlated currencies. For example, Australia and New Zealand have a significant trading relationship, so their currencies (AUD and NZD) often move together.

Geopolitical Events: Major political events, changes in government policies, and global crises can also affect currency correlations. For instance, if political instability affects one Eurozone country, it might negatively impact the euro’s value against multiple currencies.

Commodity Prices: Some currencies, known as commodity currencies (like AUD, CAD, NZD), are closely tied to the prices of specific commodities. When the price of these commodities changes, it can affect the value of these currencies and their correlation with others.

Remember that correlations are not constant and can change over time due to variations in these factors. Therefore, traders should continually monitor currency correlations to adjust their trading strategies accordingly.

Currency correlations can vary significantly depending on the time frame that’s being looked at, and this can have a substantial impact on a trader’s strategies.

Short-Term vs Long-Term: In the short-term (like minutes, hours, or a day), currency pairs might appear to have a strong correlation due to market noise or temporary market conditions. However, over the long term (weeks, months, or years), the same pairs might show a weak or even opposite correlation due to underlying economic factors.

Trade Timing: The time frame also affects when you open or close trades. For example, if you’re a day trader, you’re more concerned with the correlation in a shorter time frame. On the other hand, if you’re a swing trader or a position trader, correlations over longer periods will be more important to you.

Risk Management: Understanding the correlation over your trading time frame helps you manage risk better. For instance, two pairs might be strongly positively correlated over the long term, but in a shorter frame, they could behave differently. Without considering the time frame, you might double your risk unknowingly or miss potential hedging opportunities.

In summary, considering the time frame when examining currency correlations helps you make more accurate predictions and informed trading decisions. It’s always a good idea to check the correlation over several time frames before making a trade.