Bearish Reversal Potential

Main Points:

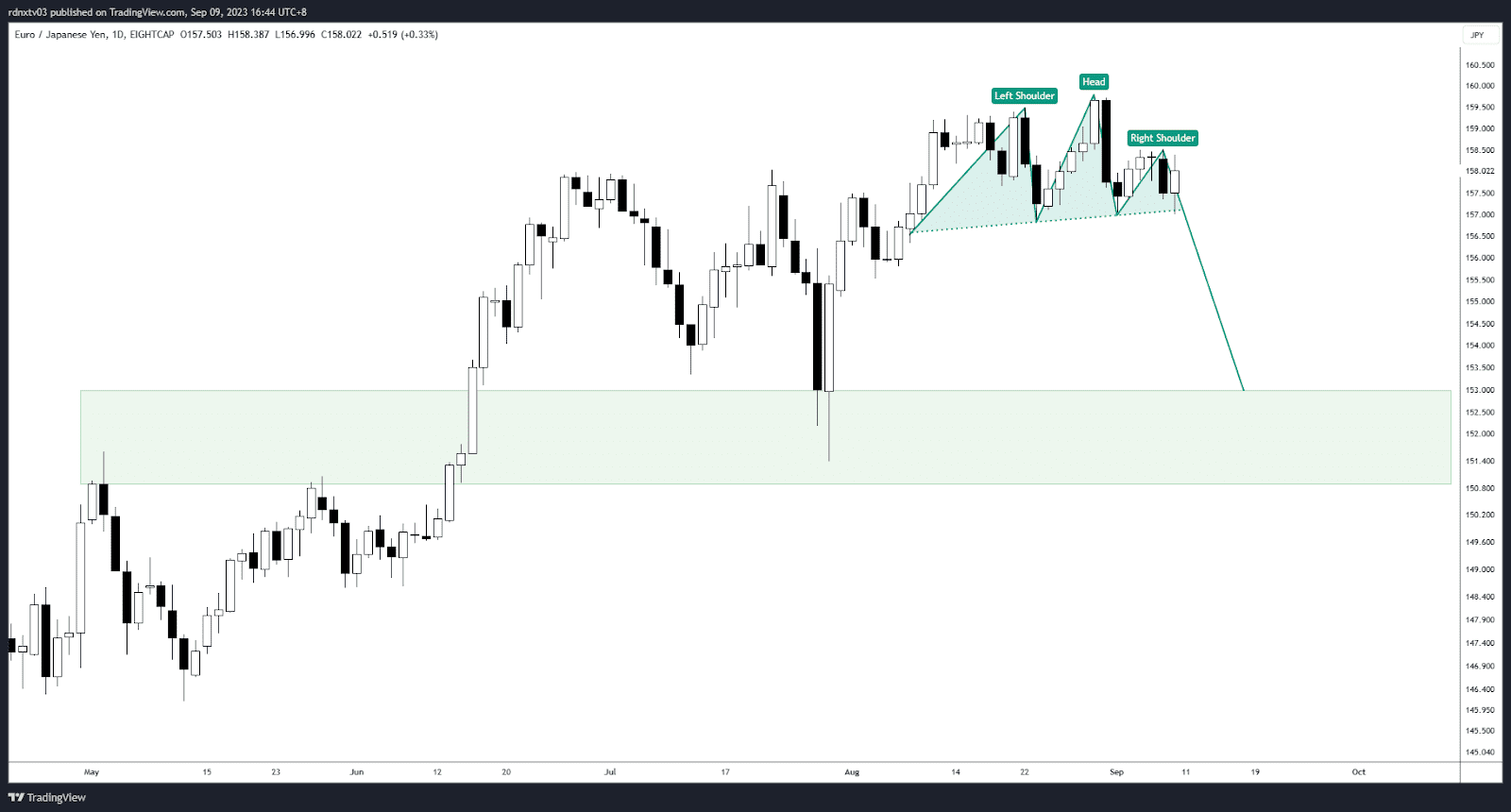

1. Bearish reversal signals as EUR/JPY forms head and shoulders pattern.

2. Bulls face resistance at 159.57, suggesting a possible retracement to 153.00 support.

Technical Analysis:

Head and Shoulders Pattern: The EUR/JPY currency pair is currently displaying a notable bearish reversal signal through the formation of a head and shoulders pattern. The recent peak at 159.57 serves as the head of the pattern. Subsequently, a substantial bearish candle emerged, indicating a strong rejection of higher prices. The lower high formation on the right shoulder suggests that bullish momentum may be waning, potentially necessitating a retracement.

A significant support level to watch is at 153.00, which has historical significance as it has previously acted as resistance that has now turned into potential support.

Deciphering the Head and Shoulders Pattern Trading Strategy

Have you ever looked at a forex chart and thought, “This reminds me of something”? Not so long ago, I had a “lightbulb moment” when I saw a familiar shape that I encounter every day – the head and shoulders! It’s a classic pattern in the world of forex trading, and it got me thinking… Maybe our everyday experiences have more in common with forex than we realize?

The Classic Pattern Explained

The Head and Shoulders Pattern is quite the superstar in trading strategies. Picture this: you’re staring at a chart, and there’s a peak (the head), flanked by two smaller peaks (the shoulders). It’s like a friend waving, signaling you to either buy or sell. But remember, this friend (like all friends) isn’t 100% reliable. It’s essential to use other tools, like Forex Sentiment Analysis and Volatility Analysis, to corroborate what the pattern suggests.

Why is this pattern a big deal?

Patterns in forex give us a glimpse into market psychology. The Head and Shoulders pattern, in particular, hints at a potential reversal of a trend. Think of it as a turning point – a sign that the tide may be about to change. But, before jumping in, it’s crucial to gauge the market’s mood and volatility.

Comparing Tools: Sentiment vs. Volatility Analysis

| Analysis Tool | What it does | Why use it with the Head and Shoulders Pattern? |

|---|---|---|

| Forex Sentiment Analysis | Reveals the mood of the market | Confirms if traders are feeling bullish or bearish |

| Volatility Analysis | Measures market unpredictability | Helps in setting up protective stops |

Additional Analysis:

In addition to technical analysis, it’s crucial to consider market volatility and sentiment analysis when trading forex. Volatility can have a significant impact on currency pairs, affecting trading decisions. Evaluating market sentiment can provide valuable insights into prevailing market conditions.

For traders employing swing trading strategies, closely monitoring technical indicators such as the head and shoulders pattern is essential for informed decision-making. Furthermore, utilizing volatility tools like a Volatility Calculator and a Volatility Heat Map can assist traders in assessing and managing risk effectively.

Comparison Table:

| Aspect | EUR/JPY |

|---|---|

| Pattern Formation | Head and Shoulders |

| Potential Support | 153.00 (Historical) |

| Market Volatility | Medium |

| Market Sentiment | Neutral |

Understanding correlations in the forex market is crucial for traders. Utilizing tools like a Top Correlation Table and a Correlation Comparison Calculator can provide valuable insights for making well-informed trading decisions. Additionally, recognizing technical patterns such as the Shark Pattern, Cypher Pattern, and others can offer valuable hints regarding potential price movements.

Continuous education through articles, glossaries, and refining trading strategies is fundamental for success in forex trading. Regularly analyzing trading accounts helps in evaluating performance and making necessary adjustments to trading strategies.

In conclusion, the EUR/JPY currency pair is currently showing indications of a potential bearish reversal with the formation of a head and shoulders pattern. Traders should take into account technical analysis, market volatility, and sentiment analysis when making trading decisions. The utilization of appropriate trading tools and ongoing education are key factors contributing to success in the forex market.

Got Questions? We’ve Got Answers!

- Q: How reliable is the Head and Shoulders Pattern?

A: It’s a recognized pattern, but always use it alongside other analysis tools for best results. - Q: Do patterns like this appear often?

A: They do, but each one needs careful scrutiny and context! - Q: Can personal experiences really relate to forex trading?

A: Oh, absolutely! Sometimes, life’s patterns are the best teachers.

Comments