Main Points:

- USD/CAD faces corrective downside pressure as it retreats from recent highs near 1.3700.

- Rising WTI oil prices provide support to the Canadian dollar, despite positive US PPI and CPI data.

- Upcoming events, including Canadian CPI and US interest rate decisions, are pivotal for market direction.

Weekly Overview

The USD/CAD pair witnessed a correction in the past week, reversing its bullish momentum after reaching a peak near 1.3700. Throughout the week, except for Friday, it recorded consecutive losses. With no significant events in Canada, the Canadian dollar found support from the surge in oil prices. Despite encouraging US Producer Price Index (PPI) and Consumer Price Index (CPI) data, the pair failed to gain traction. Looking ahead, the upcoming week brings key events, such as Canadian CPI figures and the US interest rate decisions, which are expected to influence the pair’s trajectory.

Technical Analysis

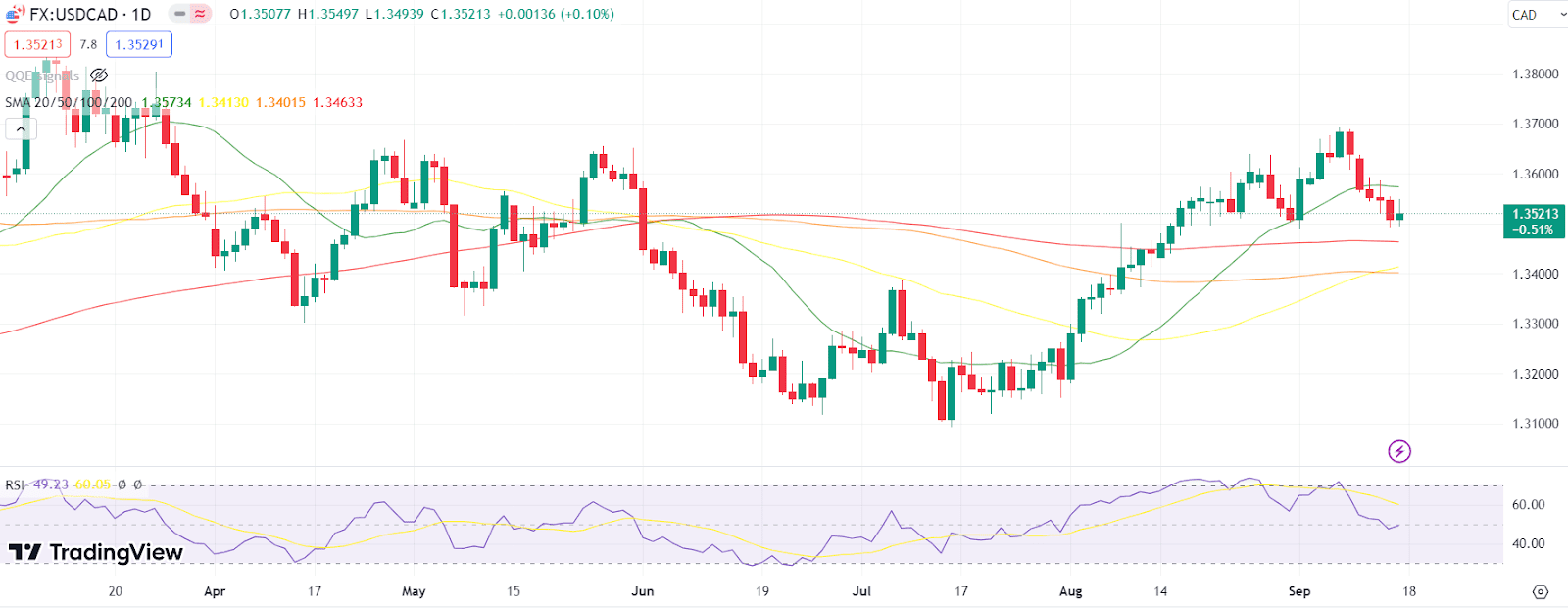

From a technical perspective, the USD/CAD pair has slipped below the 20-day Simple Moving Average (SMA). The next support levels to watch are situated at 1.3460 (200-day SMA), followed by 1.3400, where the 100-day and 50-day SMAs converge. However, it’s essential to note that the daily chart displays choppy price action within an overall uptrend. As a result, there is currently no confirmation of a bearish reversal, indicating that the prevailing trend may be experiencing a corrective downside phase.

Comparison Table: Recent Data

| USD/CAD | Market Influences | |

|---|---|---|

| Price Trend | Corrective downside | Rising WTI oil prices |

| Key Events | Canadian CPI, US interest rate decisions | Impact on market direction |

| Technical Indicators | Below 20-day SMA, support at 1.3460 and 1.3400 | Choppy behavior within an uptrend |

The comparison table summarizes the recent data affecting USD/CAD, including its corrective downside trend influenced by rising WTI oil prices and upcoming events such as Canadian CPI and US interest rate decisions. Additionally, the table highlights key technical indicators, emphasizing the choppy price action within the broader uptrend.

Conclusion

The USD/CAD currency pair experiences a corrective downside phase after reaching recent highs. The surge in WTI oil prices bolsters the Canadian dollar’s strength, overshadowing positive US inflation data. Looking forward, traders and investors should closely monitor upcoming events, particularly Canadian CPI and US interest rate decisions, as they are expected to play a pivotal role in shaping the pair’s future direction. While the USD/CAD may be in a corrective phase, it is essential to remain attentive to potential market shifts. Traders and investors must remain vigilant, employing appropriate trading tools and trading strategy to navigate the evolving forex landscape.

Comments