Forex Sentiment Analysis

What is Sentiment?

Forex sentiment is like a vote where traders show if they think a currency pair will go up or down. If most traders buy a pair (bullish), they believe it will rise, but if most sell (bearish), they expect it to fall.

What you can find here?

Embrace the power of our Sentiment Analysis Calculator that brings you lightning-fast, real-time sentiment analysis for every forex pair.

Turn data into decisions and ride the wave of the market sentiment with confidence!

Live Market Sentiment

Though it may not be real-time and might have a slight delay, it offers you a panoramic perspective of price and sentiment trends. Use it to enrich your strategy, compare price with sentiment shifts, and navigate the forex seas more proficiently. but we don’t recommend to rely solely on it when trading.

Trade against the market Consensus

Since a lot of forex traders end up losing, going against the common market sentiment consensus could be your key to profits.

Turn sentiment into strategy with AnalyticsTrade sentiment analysis

Check our Correlation trading calculator for in-depth analysis

Harness our tools and analysis to make informed trading decisions.

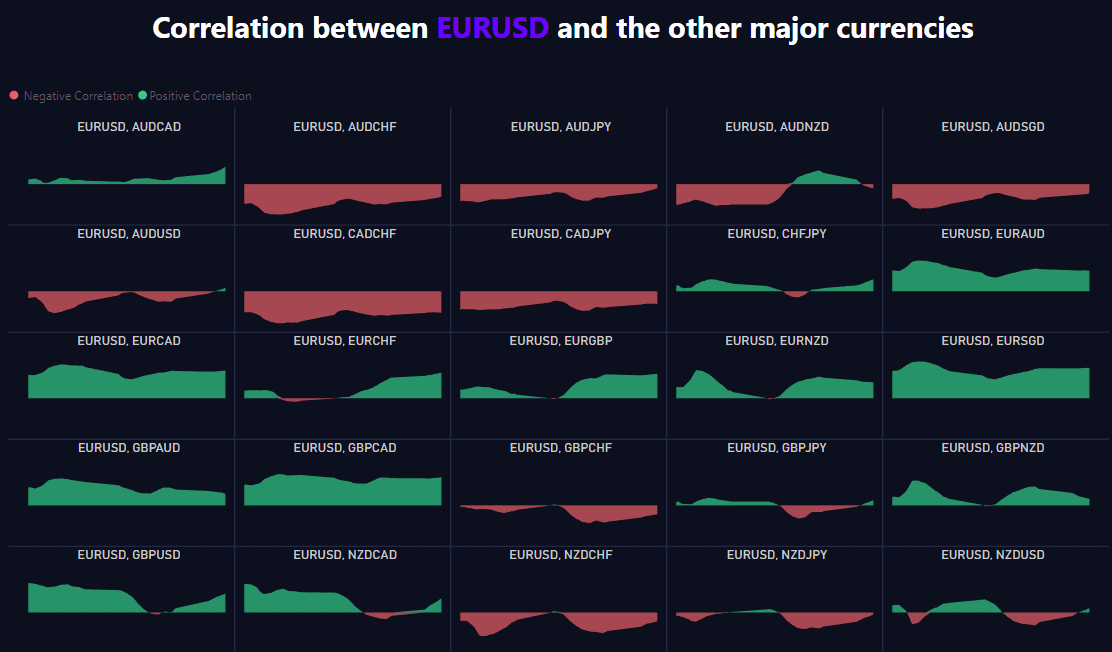

Forex Correlation Compass Map

Quick correlation analysis of all currencies

By choosing a specific pair, gain immediate insights into its correlation with all other pairs

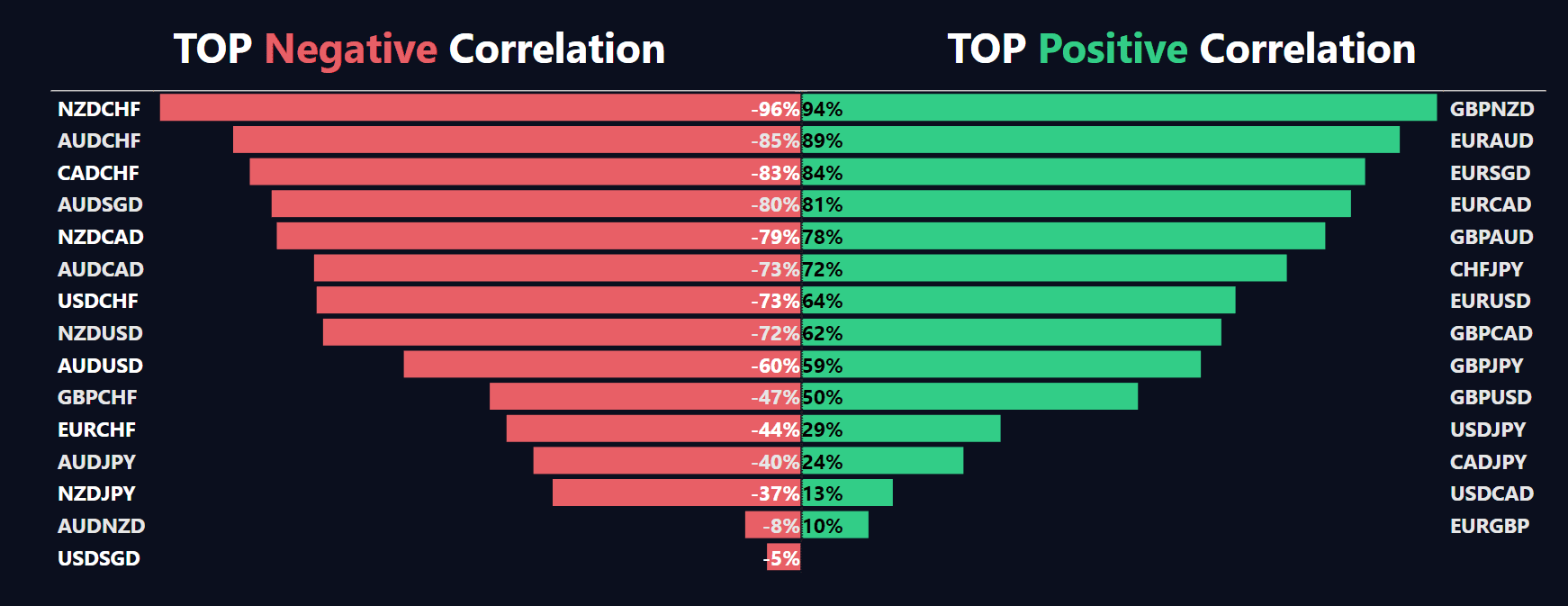

Top Correlation

Find out quickly and clearly which pairs are strongly correlated with each other and in which direction. knowledge is power!

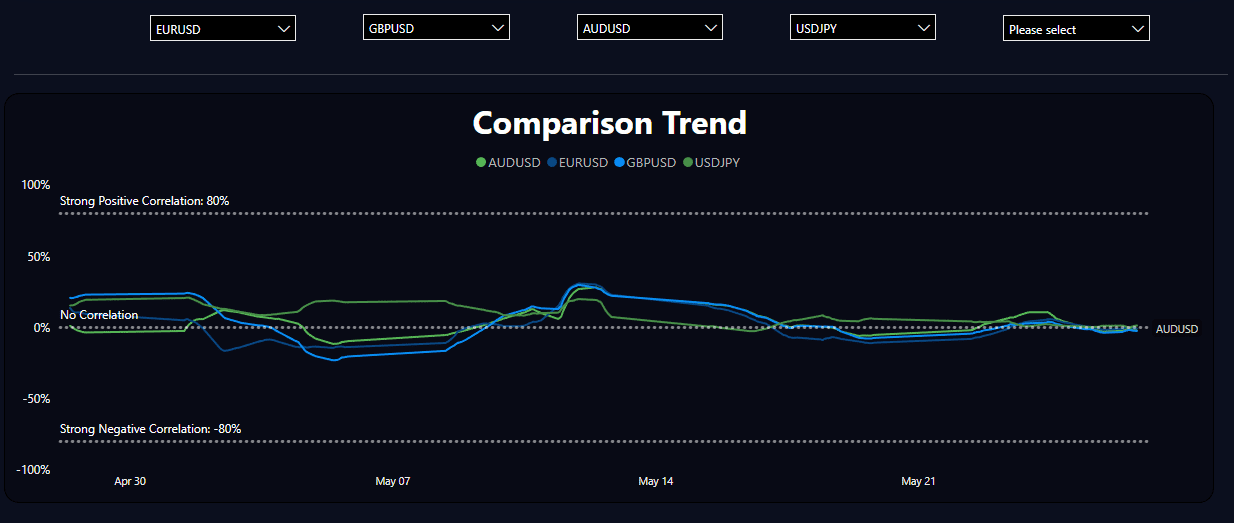

Correlation Comparison

Choose your favorite pairs and easily discover the correlation between them over time

See how price and market sentiment

changes in forex together

After detecting a specific sentiment direction in the market, we should look at how the price chart acts. Reviewing their past might give us insights

Get a quick overview of market sentiment and price together all on one report

Essential Resources: Must-Read Articles on Sentiment Analysis

The Impact of Market Sentiment on Trade Duration in Forex Trading

Forex trading is a complex and dynamic market, and understanding how market sentiment affects trade duration is essential for successful trading. In this article, we discuss the impact of market sentiment on trade duration in forex trading.

Harmonic Patterns and Market Sentiment

Harmonic patterns are a powerful tool for traders to identify potential reversals in the market. Learn how to use harmonic patterns and market sentiment to make better trading decisions.

How to Use Forex Heat Maps to Monitor Market Sentiment?

Forex heat maps are a great way to monitor market sentiment and make informed trading decisions. Learn how to use them to your advantage.

The Effect of Market Sentiment on Currency Volatility

This article explores the effect of market sentiment on currency volatility. It looks at how sentiment can affect the value of a currency and how traders can use this information to their advantage.

Frequently Asked Questions about Forex Sentiment

What is forex market sentiment analysis?

Forex market sentiment analysis is the practice of gauging the overall feeling or mood of market participants towards the currency market. It involves assessing whether traders are bullish or bearish and using this information in your trading decisions.

Why is understanding forex market sentiment important for trading?

Understanding forex market sentiment is crucial because it helps you know what other traders are thinking and doing. It can give you a sense of whether the market is likely to rise or fall, helping you make informed trades.

How can a trader use forex market sentiment analysis in their strategy?

A trader can use sentiment analysis in their strategy by going with the flow if the market sentiment is strong, or trading against the sentiment if it's showing signs of changing. It’s a way to tap into the collective mind of the market.

What are some tools or platforms available for forex market sentiment analysis?

There are various tools for sentiment analysis. These include sentiment indicators like the Fear & Greed Index, Commitments of Traders (COT) report, and social media sentiment tools. Many forex trading platforms also provide sentiment analysis tools.

How can market sentiment analysis help predict price movements?

Sentiment analysis can help predict price movements by indicating potential market reversals. For instance, if the majority of traders are bullish (positive sentiment) and suddenly sentiment turns bearish (negative), this might signal a future price drop.

Can forex market sentiment analysis be used for all currency pairs?

Yes, sentiment analysis can be used for all currency pairs. However, the accuracy and usefulness might vary depending on the market conditions and the volume of trading for each pair.

How often should I check forex market sentiment analysis for effective trading?

The frequency of checking sentiment analysis can depend on your trading style. If you're a day trader, you might want to check it multiple times a day. For longer-term traders, a daily or weekly check might be sufficient.

How reliable is forex market sentiment analysis in predicting future market trends?

Sentiment analysis is a useful tool, but it's not always 100% reliable. It should be used in conjunction with other forms of analysis such as technical and fundamental analysis for more accurate predictions.