Main Points:

- USD/CAD Weekly Forecast shows intrigue amid disappointing Canadian and US economic data.

- Canadian GDP growth fell short of expectations, signaling stagflation concerns.

- Upcoming Bank of Canada (BoC) rate decision holds potential significance for the pair.

USD/CAD – Economic Data and Stagflation Worries

The USD/CAD pair garnered significant attention on Friday as market participants analyzed the latest economic data from Canada and the United States. The data revealed that the Canadian economy failed to achieve the anticipated growth, with Q2 Canadian GDP stagnating at 0.0% instead of the expected 0.3%. Year-on-year growth also fell short at 1.12%, compared to the expected 0.3%. Moreover, the economy contracted by 0.2% in June, signaling a precarious situation characterized by low growth and elevated inflation, commonly referred to as stagflation.

BoC Rate Decision: A Decisive Factor

Keep a close watch on the upcoming Bank of Canada (BoC) rate decision scheduled for next week, as it carries the potential to significantly impact the USD/CAD pair’s trajectory. The outcome of this decision could provide critical insights into the pair’s future direction.

USD/CAD Technical Analysis and Key Levels

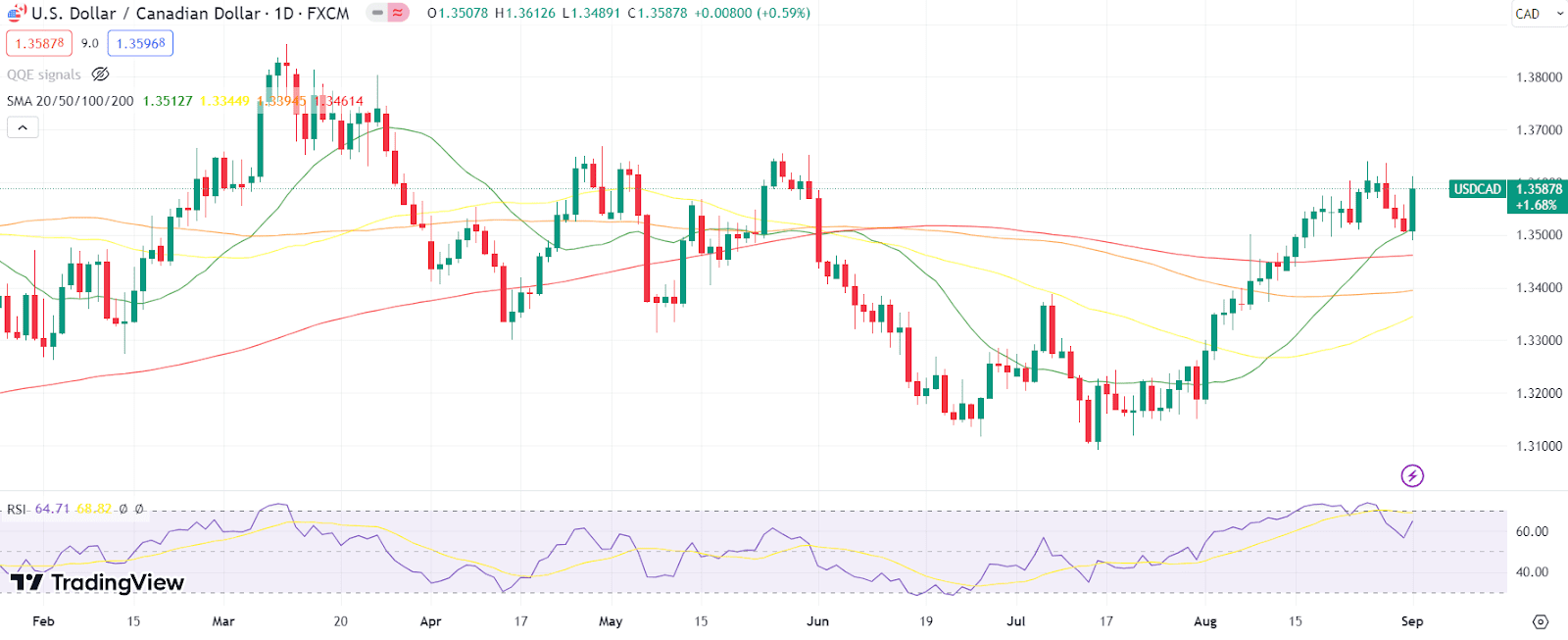

The USD/CAD remains well supported above key Simple Moving Averages (SMAs), with the Relative Strength Index (RSI) yet to enter the overbought territory. However, to sustain its upward momentum, the price must surpass the previous swing high of 1.3636.

Simple Moving Averages & RSI: The Dream Duo of Forex

Picture this: Batman and Robin, peanut butter and jelly, movies and popcorn. Some things just work better in pairs, right? In the electrifying world of forex, it’s the combo of Simple Moving Averages and Relative Strength Index that packs this dynamic punch!

Why These Two? A Closer Look

While the Moving Average smoothes out price data creating a single flowing line, making it easier to identify the direction of the trend, the Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Blend in a hint of Forex Sentiment Analysis, and you’re playing in the big leagues.

Simple MA vs. RSI: A Quick Peek

| Tool | Superpower |

|---|---|

| Simple Moving Average | Spotting trend direction |

| Relative Strength Index | Identifying overbought/oversold zones |

Top 3 Unexpected Lessons from MA and RSI

- Using RSI to explain to my son why binge-watching TV shows might be “overbought” fun.

- Spotting trends in my daily routine using the MA mindset – like my coffee consumption!

- Having a “light bulb” moment during a morning jog about Volatility Analysis complementing this dynamic duo.

Comparison Table: Key Indicators

| Indicator | Observation |

|---|---|

| Market Volatility | Moderate |

| Market Sentiment | Intrigue |

| Fundamental Analysis | Stagflation Concerns |

| Technical Indicators | Positive Momentum |

Exploring Forex Insights

For comprehensive forex analysis, trading strategy, and market insights, explore our collection of forex articles. Stay well-informed from our technical analysis to make informed trading decisions.

Queries You Might Be Pondering

- Q: Can this duo be my go-to trading strategy?

A: Absolutely, but always complement with sentiment and volatility checks. - Q: How often should I consult the RSI?

A: As much as you’d check your mirrors while driving – often enough to stay informed. - Q: Do all successful traders use this combo?

A: Many do, but everyone has their unique potion of strategies.

Comments