AUD/USD Weekly Forecast: Double Top Resistance

Main Points:

- The AUD/USD pair ended the week with a 0.83% gain despite mixed economic data.

- Charts show potential bullish signs with the pair closing above the 20-day SMA.

- FOMC interest rate decision and RBA’s minutes will drive market sentiment next week.

Weekly Overview

The AUD/USD currency pair had an eventful week, initially fueled by strong Australian employment data, but later facing headwinds from robust US CPI figures. Despite this, the pair managed to close the week with a net gain of 0.83%. Looking ahead, market participants are closely eyeing the upcoming events, including the Federal Open Market Committee (FOMC) interest rate decision and the Reserve Bank of Australia’s (RBA) release of meeting minutes.

Technical Analysis

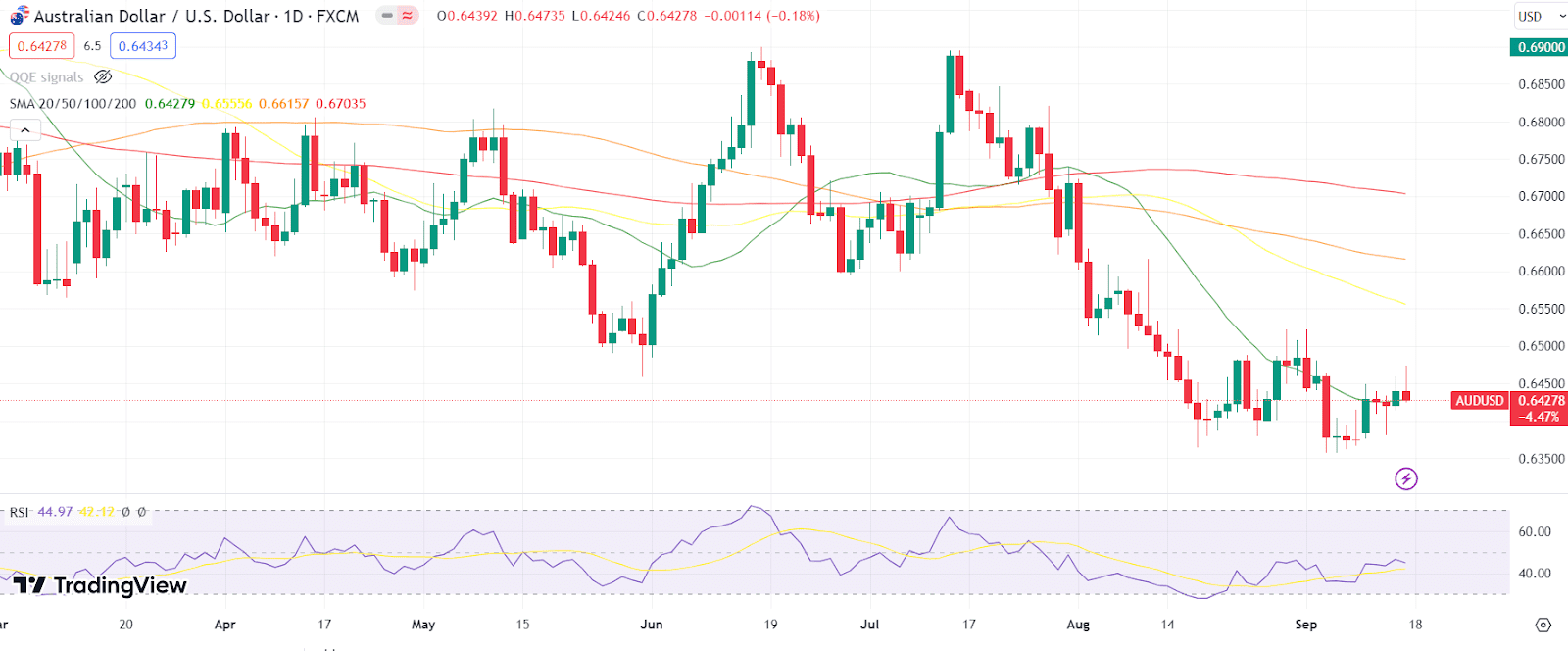

On the technical front, the AUD/USD pair displayed some positive signs. Notably, it closed the week above the 20-day Simple Moving Average (SMA), indicating a potential bullish sentiment. However, Friday’s candle formed a bearish pin bar, suggesting some caution among traders. To confirm a bullish trend, the pair must break decisively above the range’s high and the double top resistance level at 0.6522.

Technical Indicators Comparison

| Indicator | Current Value | Signal |

|---|---|---|

| 20-Day SMA | Above Price | Bullish |

| Bearish Pin Bar | Present | Caution |

| Double Top Resistance | 0.6522 | Key Level |

Market Sentiment and Fundamental Analysis

As we look ahead to the next trading week, market sentiment is expected to be influenced by two critical events. First, the FOMC interest rate decision will provide insights into the US central bank’s monetary policy stance. Secondly, the release of RBA’s meeting minutes will shed light on the Australian central bank’s views and potential policy adjustments. Both of these events have the potential to impact the AUD/USD pair significantly.

Conclusion

Despite facing resistance from a double top pattern, the AUD/USD pair managed to record a weekly gain. Technical analysis suggests a cautious bullish sentiment, with the 20-day SMA acting as a support level. Traders should closely monitor the upcoming FOMC and RBA events for potential shifts in market sentiment. Breaking above the 0.6522 resistance level is key to establishing a sustained bullish trend in the coming week. Traders and investors must remain vigilant, employing appropriate trading tools and trading strategy to navigate the evolving forex landscape.

Comments