Main Points:

- GBP/USD bears might target the 1.2447 level, a previous swing low.

- Significant US economic data releases, including US Core PCE Index, could influence GBP/USD’s direction.

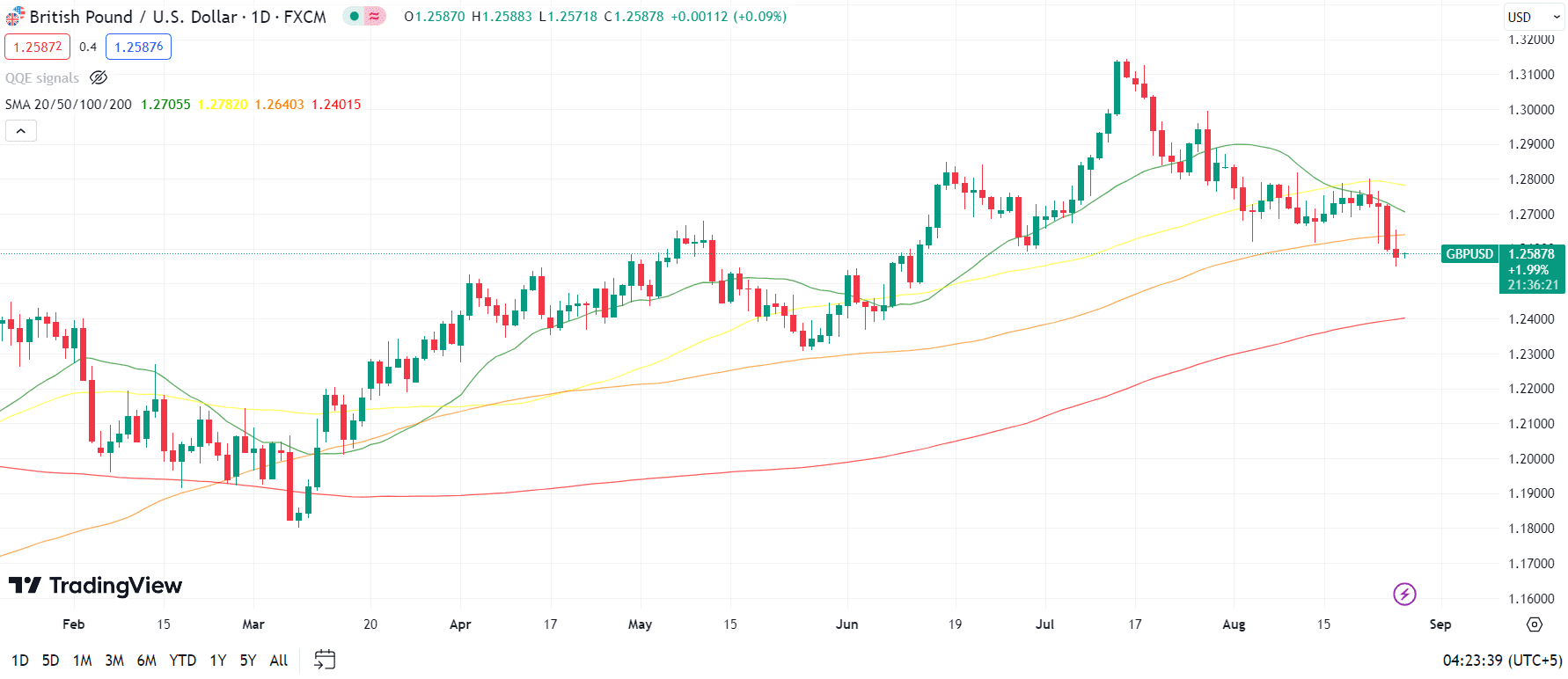

- The pair’s position below the 20- and 50-day SMA suggests a bearish trend.

Anticipation Around Upcoming US Data

The spotlight next week will be on the US economic indicators as the UK data calendar remains sparse. Events like the US Core PCE Index, US ADP Employment, and US NFP are of prime importance and might influence the GBP/USD pair considerably. Market participants should stay vigilant and track these data points closely, as they can induce significant volatility.

Delving into the Technical Levels

The GBP/USD has recently witnessed downward momentum, having breached the multi-week support level at 1.2620. The pair is now grappling with the challenge of a looming support level at approximately 1.2550, which could see another test in the forthcoming sessions. Notably, GBP/USD’s position below the 20- and 50-day simple moving averages (SMA) signals a bearish trend. Although the CCI indicator portrays an oversold GBP/USD, traders should exercise caution as it doesn’t necessarily imply an immediate reversal.

Key Levels to Monitor

| Type | Level | Description |

|---|---|---|

| Support | 1.2550 | Near-term support, possibility of another test. |

| Support | 1.2447 | Previous swing low; key level for bears. |

| Resistance | 1.2620 | Former support now turned resistance. |

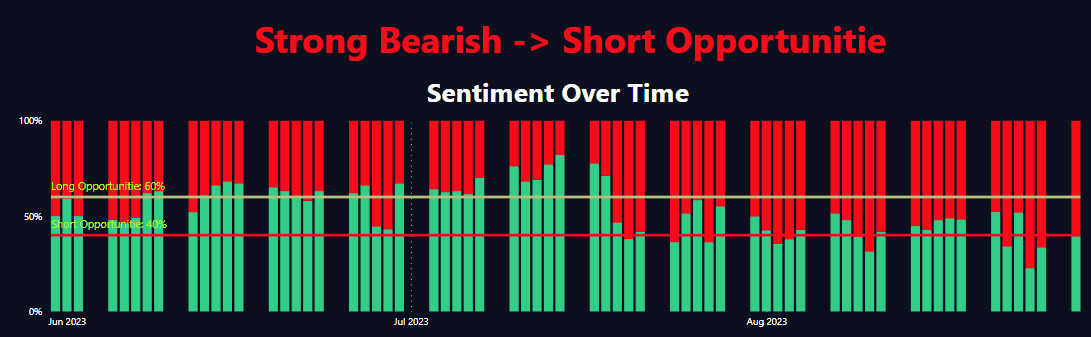

Sentiment Analysis

Over the past thirty days, the GBP/USD has witnessed varying trader sentiment. The data portrays a generally balanced picture, with both bullish and bearish sentiments oscillating in close ranges. For example, the most recent data from 2023-08-27 indicates a bullish bias with 68% of traders long on the pair, while only 32% are short. This leans more towards a potential bullish outlook. However, when compared to the sentiment from 2023-07-30, where 65% of traders were short and only 35% were long, we can identify a significant shift in market sentiment. Such shifts could be indicative of changing macroeconomic landscapes or news-driven events impacting trader outlooks.

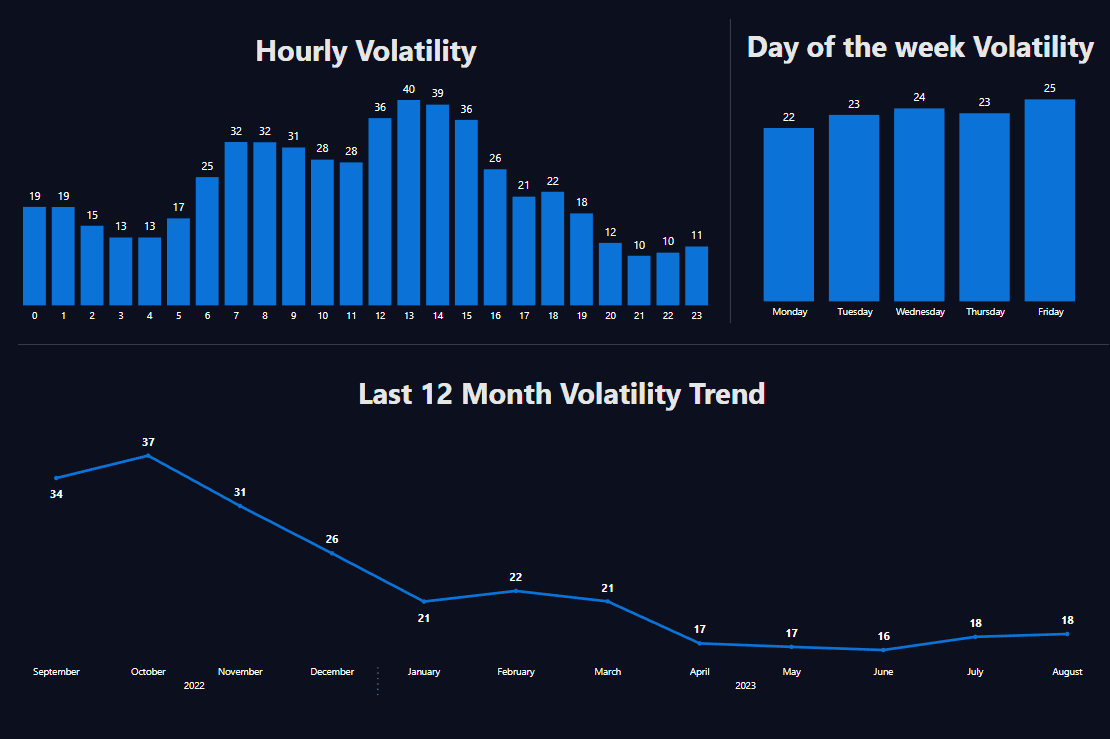

Volatility Overview

Regarding volatility, GBP/USD has seen some notable price swings over the month. On 2023-08-23, the pair declined significantly by 0.9777%, suggesting heightened selling pressure. This is further confirmed by a bar direction labeled ‘Down’ and a notable difference between the opening and closing prices. In contrast, the most recent day, 2023-08-27, presented an uptrend, albeit minimal, with a rise of 0.0564%. It’s essential to note the fluctuations on days such as 2023-08-01 and 2023-07-31, where the pair decreased by 0.4932% and 0.4798%, respectively. Such substantial moves, especially when coupled with the pair’s general downward trajectory for the majority of the days in the data, indicate a prevailing bearish trend.

GBP/USD: Economic Indicators to Monitor

As traders get ready to navigate the Forex markets for the week ahead, a series of key US economic indicators will play a pivotal role in shaping the direction of the GBP/USD pair. With the market often reacting to economic news, these events provide a timely context for traders and analysts alike.

Main Points

- The JOLTs Job Openings data will offer insights into the labor market’s strength and potential momentum in the US economy.

- CB Consumer Confidence and Dallas Fed Manufacturing Index will be closely watched for indications of economic sentiment and manufacturing strength respectively.

- The Case Shiller Home Price Index, presented both monthly and annually, will shed light on the housing market’s current trends.

US Economic Events Table

| Date | Country | Title | Indicator | Previous | Forecast | Currency | Importance |

|---|---|---|---|---|---|---|---|

| 2023-08-28 | US | Dallas Fed Manufacturing Index | Dallas Fed Manufacturing Index | -20.000 | -21.600 | USD | Medium |

The upcoming week is dense with pivotal US economic data, which will inevitably influence the GBP/USD pair’s trajectory. While the JOLTs data will indicate labor market trends, the Dallas Fed Manufacturing Index and CB Consumer Confidence will provide insights into the manufacturing sector and consumer sentiment. Forex traders should remain agile, interpreting these indicators in the context of the broader economic landscape and geopolitical situations. Adapting to real-time data and market reactions will be essential to navigate the trading week successfully.

Conclusion for This Week

Collating sentiment and volatility data, we can infer a bearish trend in GBP/USD for the major part of the month. The fluctuating trader sentiment suggests that traders are closely monitoring the pair and adjusting positions based on macroeconomic events and news releases. As always, for traders and investors, it’s crucial to consider both technical indicators and fundamental news to make informed decisions about market direction. The contrasting sentiment data over the month also suggests that one should stay agile, given the changing dynamics in the forex market.

Considering the bearish stance of GBP/USD, the 1.2447 mark emerges as the next potential target for sellers. A descent below this point may solidify the downtrend, setting the stage for further declines towards the 1.2400 and 1.2330 regions. Conversely, a resurgence from either the 1.2550 or 1.2447 levels, coupled with a false breakout, might signify diminishing selling traction, paving the way for a rebound. In such a bullish scenario, the 1.2620 resistance level will be the prime focal point. A surge above it can neutralize the current bearish narrative, redirecting the trend upwards with potential resistance points at 1.2700 and 1.2775.

Comments