Main Points:

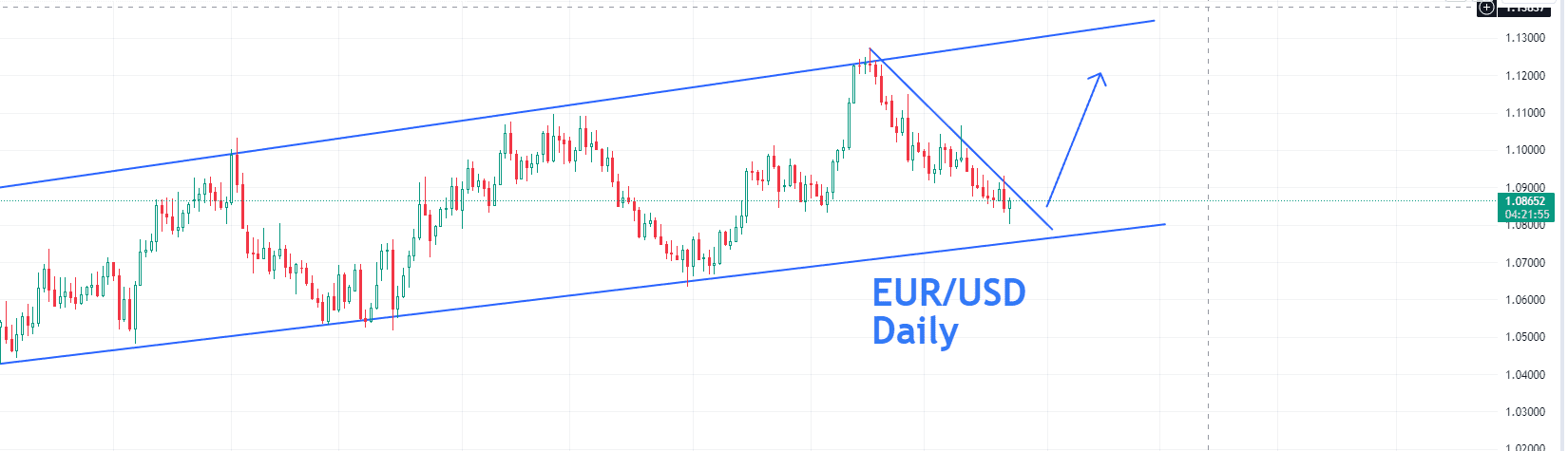

- EURUSD has maintained an upward path in an ascending channel.

- It recently hit a significant support zone.

- A break at this support could set the stage for a rise in the coming month.

Dissecting the Channel Movement

The EURUSD pair, when observed on the daily chart, shows a consistent upward journey within an ascending channel. This type of movement is common and is often depicted using wedges or other chart patterns. The recent drop to the support zone, a critical area where buying interest is typically strong, suggests that we might be at a turning point.

Support Point Break: A Signal to Climb?

Support and resistance levels play a vital role in forex trading. Currently, the EURUSD is dancing around a crucial support point. If there’s a break in this structure, it could be a hint for traders to expect an upward trend for the next month. These breaks, when combined with chart patterns, offer a clearer picture of possible market directions.

| Key Concepts | Importance in Current EURUSD Analysis |

|---|---|

| Support and Resistance Levels | Pinpoints where buying or selling interest is strong, crucial for deciding trade entries or exits. |

| Wedges & Chart Patterns | Helps traders visualize market trends and potential future movements. |

Upcoming Economic Events & Their Impact

Two major economic events are on the horizon this week. Firstly, the USD Initial Jobless Claims, which provides insights into the U.S. labor market’s health. Secondly, a speech by Fed Chair Powell, always a significant event as it can influence global financial markets. These events can stir up volatility in the EURUSD pair. Traders should stay alert as these events can shake up the current support and potentially affect the pair’s trajectory.

Navigating Friday’s Volatility Spike

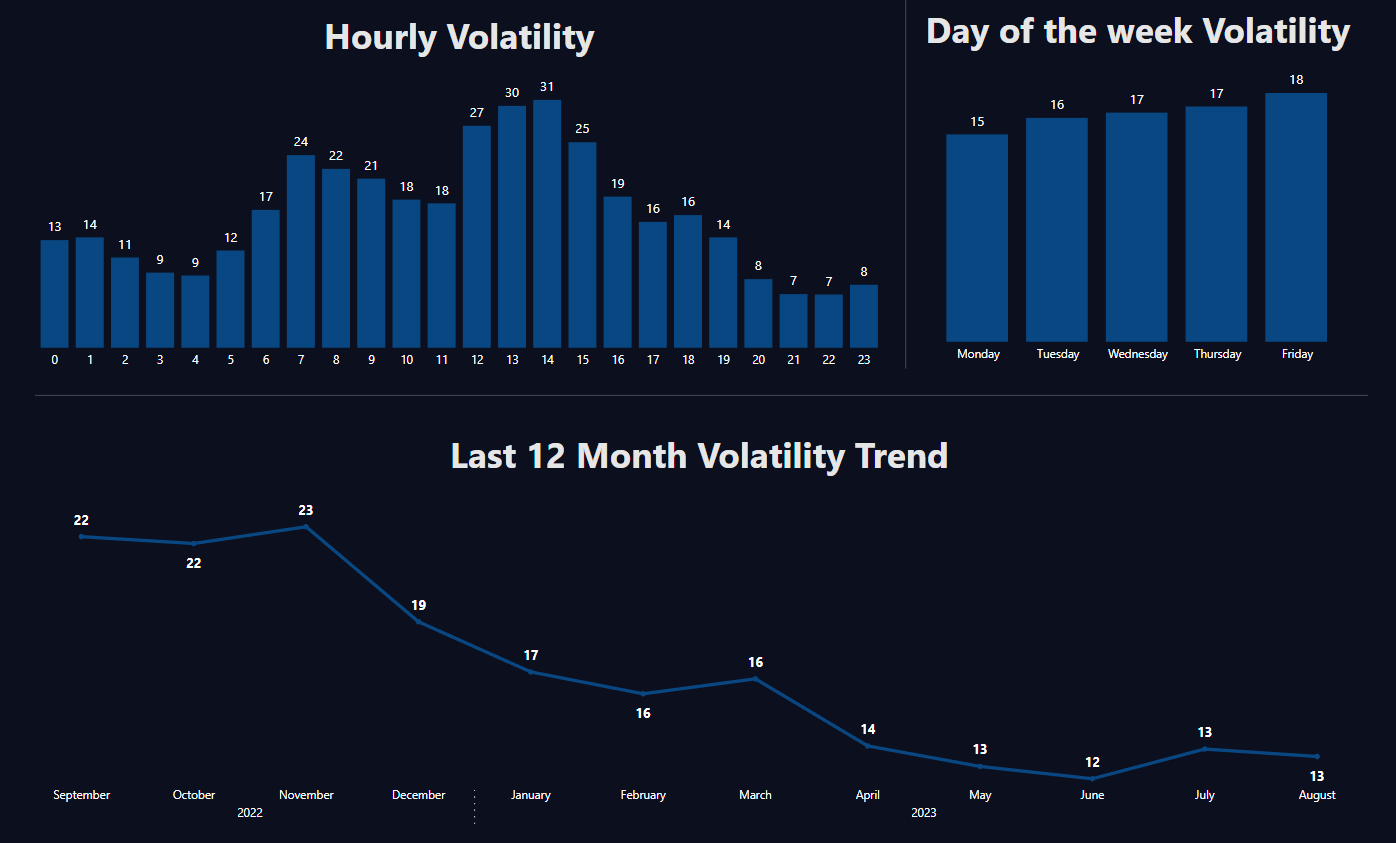

- Friday stands out as the most volatile day for EURUSD.

- Peak volatility is observed between 12 PM and 3 PM UTC.

- Traders should be prepared for sharper price movements during these times.

Unpacking Volatility Trends

Volatility in forex refers to the rate at which a currency pair’s price moves up or down. For EURUSD on a daily timeframe, there’s a significant shift in this rate, especially as the week progresses. Based on data from AnalyticsTrade, it’s evident that the pace of these price changes is notably higher on Fridays.

Prime Hours: Tread with Caution

Not all hours are made equal in the world of forex. Specifically, between 12 PM and 3 PM UTC, the EURUSD pair witnesses a surge in its volatility. This is a crucial window for traders, whether they’re looking to capitalize on quick price movements or trying to avoid unexpected market shifts. Being aware of these high-energy periods can make all the difference in a trader’s strategy.

| Time of Week | Volatility Level |

|---|---|

| Monday-Thursday | Normal |

| Friday (especially 12 PM to 3 PM UTC) | High |

Final Words: Riding the EURUSD Wave

For those eyeing the EURUSD daily movements, understanding the dance between the ascending channel, support levels, and economic events is crucial. By keeping an eye on these elements, traders can make informed decisions in the forex world.

Comments