bullish momentum

Main Points:

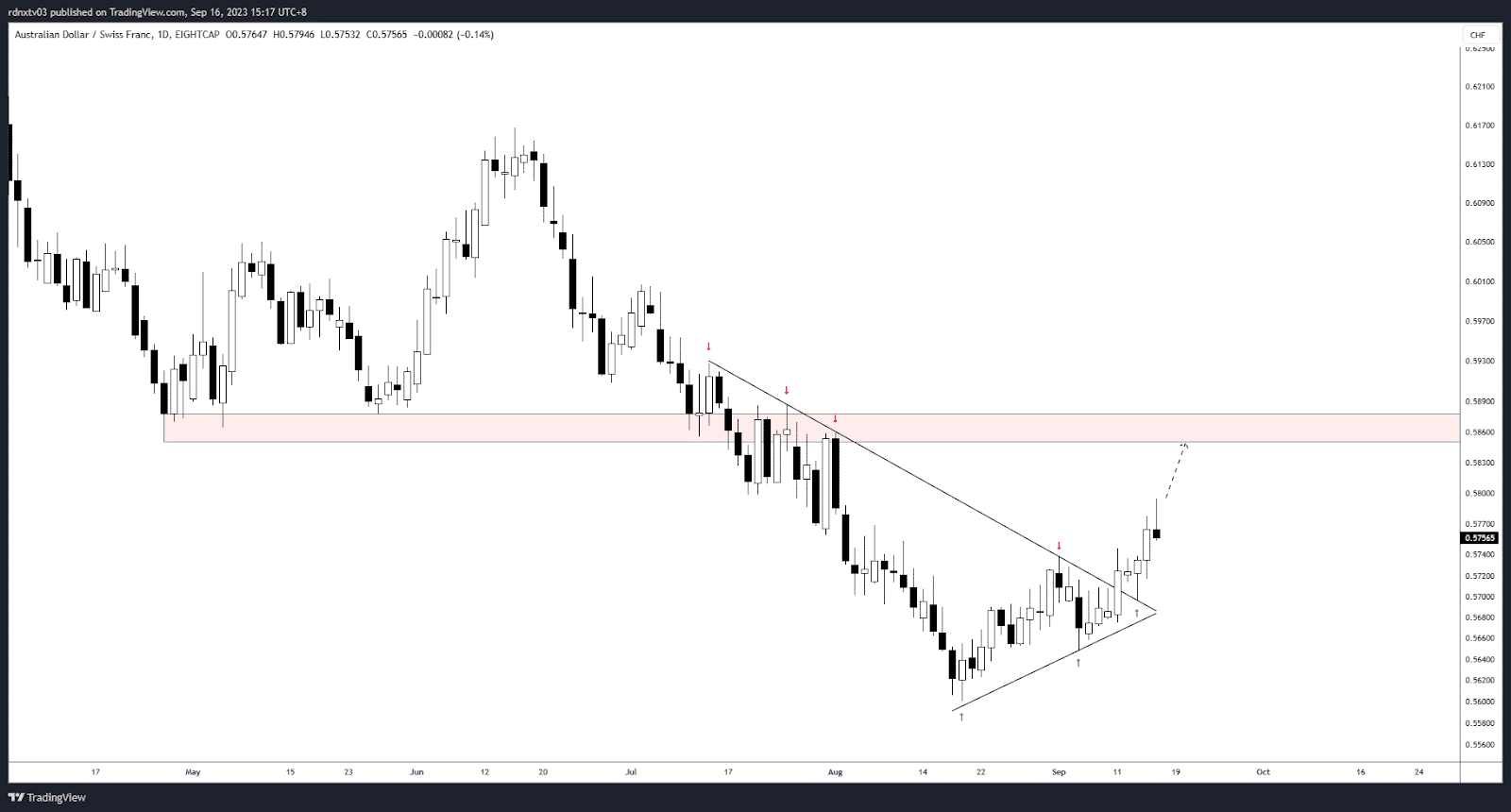

- The AUD/CHF pair reverses a bearish trendline, signaling a bullish trend.

- A former resistance trendline now acts as vital support, confirmed by recent price action.

- Key resistance at 0.56800 presents an important target for bullish momentum.

Positive Shift in AUD/CHF Trend

Building upon last week’s analysis of the AUD/CHF currency pair, we’ve witnessed a significant transformation in market dynamics. The previously dominant downtrend has been effectively reversed, paving the way for a bullish trend. This turnaround gained momentum with a decisive breakout from a robust bearish trendline, which had been rigorously tested four times.

Former Resistance Now Provides Crucial Support

What adds to the significance of this reversal is that the once formidable resistance trendline has now transformed into a vital support level. This transition is clearly demonstrated by the most recent blue arrow on the chart, indicating the day when the AUD/CHF pair successfully retested this level. The resilience and strength displayed during this retest serve as compelling evidence of the evolving trend reversal.

Bullish Momentum and Targeting Historical Support

As we observe the developing bullish momentum, our focus naturally gravitates towards the next significant milestone. The primary target for the burgeoning bullish trend is the historical support level at 0.56800. This level holds immense historical significance as a well-established support zone, making it the logical focal point for the bullish momentum to aim for and ultimately target.

Utilizing Technical Indicators for Confirmation

In this analysis, we have placed significant emphasis on the importance of the bearish trendline transforming into a support level, substantiated by recent price action. This shift in market sentiment underscores the potential strength of the ongoing trend reversal. As traders monitor these developments, it’s crucial to consider this critical support level along with the next resistance target, 0.56800, as pivotal reference points.

Correlation and Sentiment Analysis

Additionally, conducting a sentiment analysis alongside technical indicators can provide a more comprehensive view of market dynamics. The sentiment among traders and investors can significantly impact currency pair movements. Utilizing trading tools such as correlation comparison calculators and sentiment analysis can help refine trading strategy and enhance decision-making processes.

Comments