Main Points:

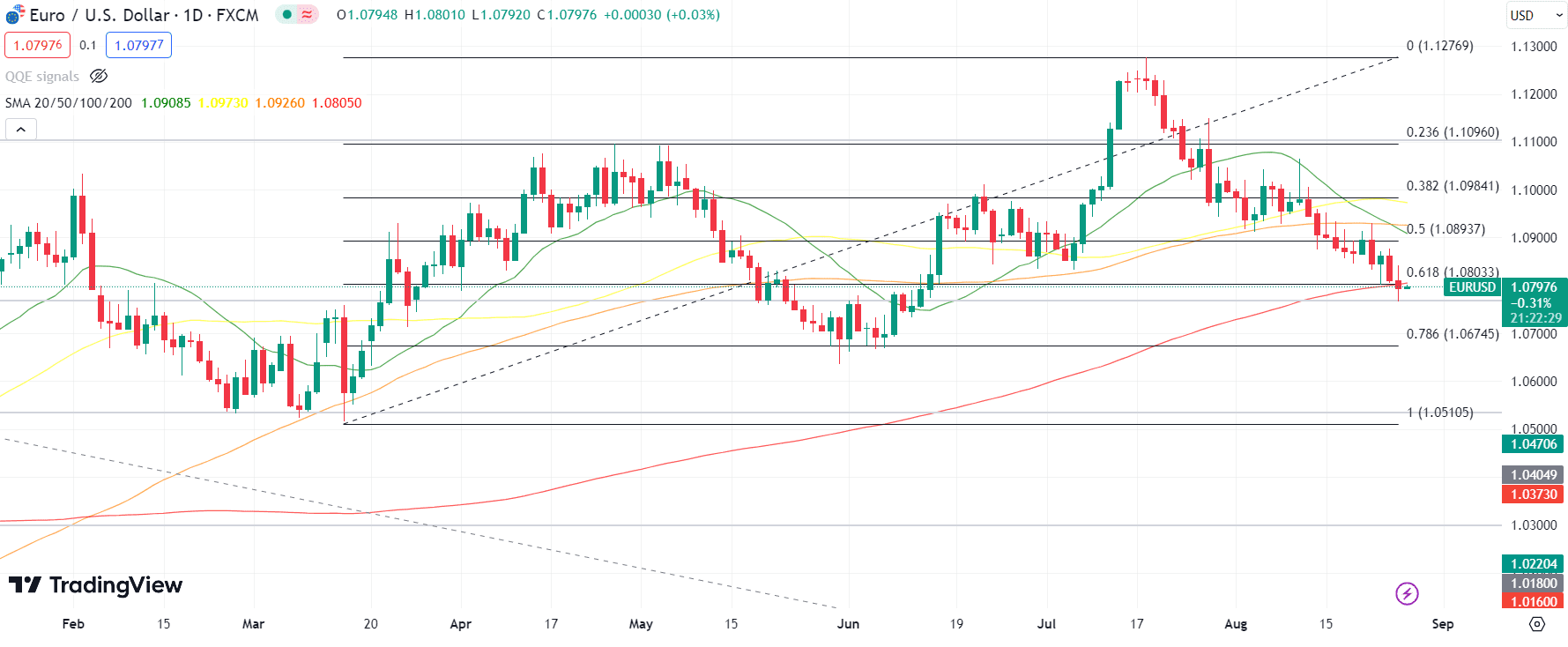

- EUR/USD has shown a consistent downtrend over the past six weeks.

- The 61.8% Fibonacci retracement acted as a pivotal turning point.

- 200-day SMA provides key trend information, but its support strength is uncertain.

Backdrop: US Dollar’s Strength and EUR/USD’s Downturn

The EUR/USD pair, representing the two heavyweight currencies in the forex market, has been swimming against a strong current. Over the last six weeks, a significant rise in US yields has bolstered the US dollar, placing EUR/USD in a downtrend. Even long-established support levels have been surpassed, and the currency pair is now on the brink of reaching channel support.

Fibonacci and Bearish Forces

The daily chart of the EUR/USD pair is like a storybook, telling tales of its recent challenges. After retracing from the 61.8% Fibonacci retracement level, based on its 2021-2022 movement, the pair’s journey south has been uninterrupted. Additionally, persistent bearish pressure is evident from the extended upper wicks seen on the daily candles, which imply failed attempts by the bulls to reclaim territory.

The 200-day SMA Dilemma

Currently, the EUR/USD is dancing near the 200-day simple moving average (SMA), a key technical indicator watched by traders worldwide. This SMA often serves as a barometer for long-term trends. Yet, even with this indicator in sight, the strength it can offer as a support remains a question mark, especially given the absence of bullish reversal indicators.

Comparison Table: Key Levels and Indicators

| Parameter | Description | Relevance |

|---|---|---|

| 61.8% Fibonacci Retracement | Turning point for EUR/USD after retracing from its 2021-2022 move. | High |

| Bearish Pressure | Indicated by extended upper wicks on daily candles, showing failed bullish attempts. | High |

| 200-day SMA | Long-term trend indicator; EUR/USD is currently trading near this level. | Moderate |

Analysis of EUR/USD Pair’s Movement Over Recent Days

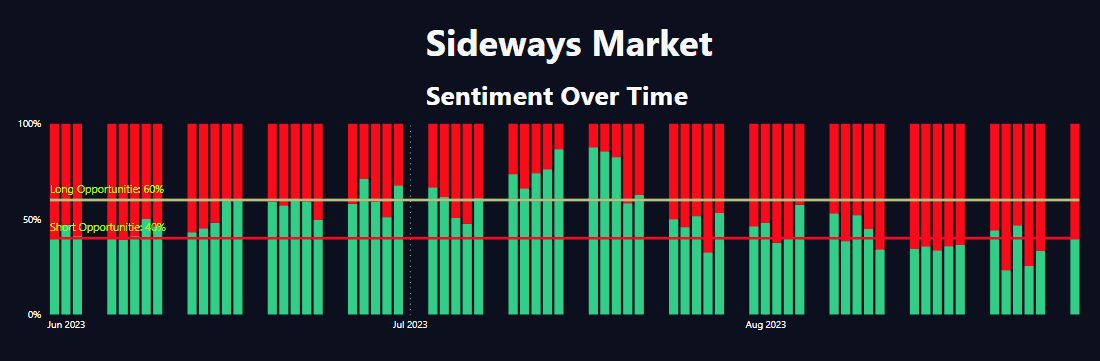

Sentiment Analysis

Based on the sentiment data for the EUR/USD currency pair over the last 20 days, there’s a varied distribution between short and long positions. On 2023-08-27, a significant 71% of traders held long positions, showing an increased bullish sentiment for the day. This is a noticeable change from the 44% long sentiment seen on 2023-08-06. A majority of the days reviewed indicate a nearly balanced sentiment, with a slight inclination towards a bearish outlook, which could suggest uncertainty in the market.

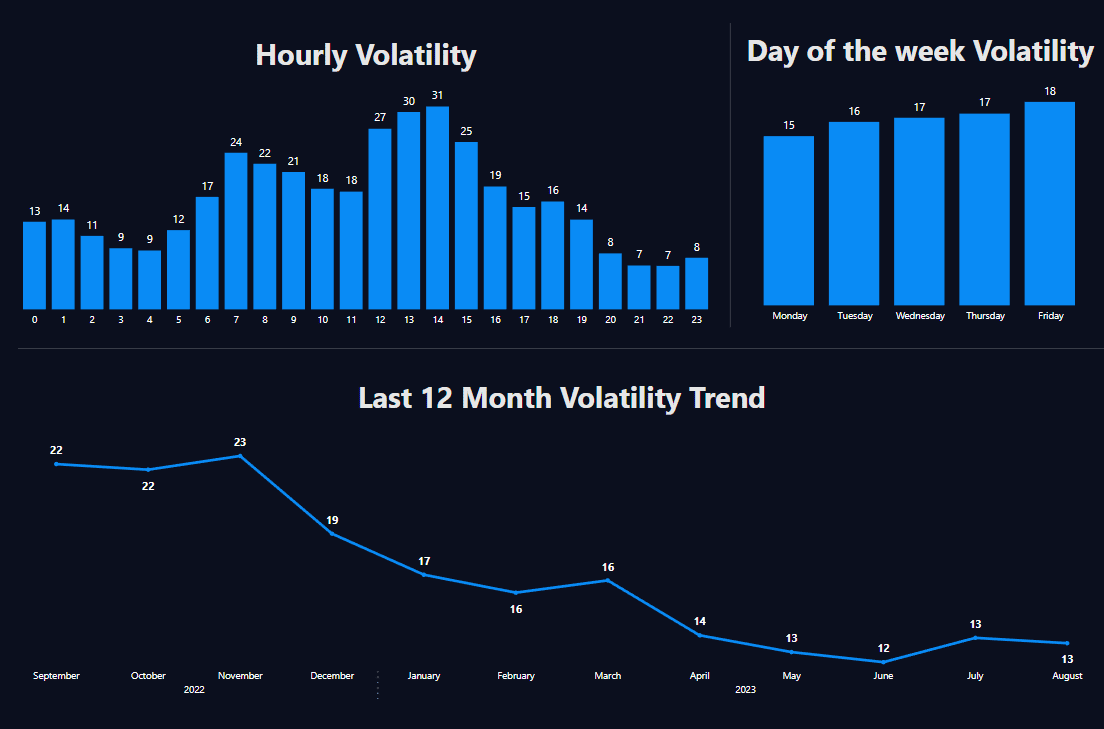

Volatility Analysis

Reviewing the volatility data, the EUR/USD pair experienced varied volatility over the period. Notably, on 2023-08-03, the pair surged upwards by 106.8 pips, marking the highest positive change within the period. This bullish movement was accompanied by a notable PctBodyBar of approximately 0.598%. This significant upward movement indicates the presence of strong buying pressure on that day. On the flip side, the pair experienced its highest decline on 2023-08-23, dropping by 71.8 pips with a PctChange of -0.005135, highlighting a strong bearish sentiment. Furthermore, the days leading to 2023-08-27 showed a mix of bullish and bearish bars, indicating a possible trend of indecision or consolidation in the market. When observing the bar direction for the last 20 days, the market’s indecision is further exemplified. The days 2023-08-24 to 2023-08-23 experienced three consecutive bearish movements, followed by a bullish reversal on 2023-08-22, and again switching to bearish on 2023-08-21.

EUR/USD Daily Analysis: Economic Events to Shape the Week

Main Points:

- High-impact economic events in both US and EU zones are scheduled.

- Consumer confidence data from multiple sources might set the tone for EUR.

- USD traders should keep an eye on job offers, oil stock changes, and manufacturing indicators.

Consumer Confidence: A Double-Edged Sword for EUR

EUR traders will be paying keen attention to the consumer confidence readings from both France and Germany. With France’s forecast matching its previous value and Germany’s predicted to show a slight improvement, any deviation could cause notable volatility for the EUR. Germany’s reading is of particularly high importance, given the size and significance of its economy in the EU.

US Economic Indicators: A Mixed Bag for the USD

The United States has a slew of significant indicators scheduled. The JOLTs Job Openings data will be a crucial point of interest, especially with its high importance rating. A decline in job offers might weaken the USD. Additionally, the oil stock change, if it diverges significantly from the last report, could influence the greenback, considering the crucial role of oil in the US economy. Manufacturing data, as well as housing price indexes, are also on the radar, hinting at the broader health of the economy.

Table of Economic Events:

| Date | Country | Currency | Indicator | Previous | Forecast | Importance |

|---|---|---|---|---|---|---|

| 2023-08-28 | US | USD | Dallas Fed Manufacturing Index | -20.000 | -21.600 | Medium |

| 2023-08-29 | US | USD | JOLTs Job Openings | 9.582 | 9.465 | High |

| FR | EUR | Consumer Confidence | 85.000 | 85.000 | Medium | |

| US | USD | CB Consumer Confidence | 117.000 | 116.000 | Medium | |

| DE | EUR | GfK Consumer Confidence | -24.400 | -24.300 | High | |

| US | USD | API Crude Oil Stock Change | -2.418 | N/A | Medium | |

| US | USD | S&P/Case-Shiller Home Price MoM & YoY | 1.500, -1.700 | 0.600, -1.300 | Medium |

Conclusion for This Week:

Traders handling the EUR/USD pair should brace for a potentially volatile week. Both currencies face impactful economic events that might swing their respective strengths. While consumer confidence readings dominate the scene for the EUR, the USD will be influenced by a broader spectrum of indicators. Being vigilant and using proper risk management will be vital in navigating the week’s forex waters.

The EUR/USD pair has demonstrated varied volatility and sentiment over the recent period. Traders seem divided, with sentiments fluctuating between bullish and bearish outlooks. While there have been significant movements in both directions, there appears to be a prevailing trend of market indecision. Traders are advised to exercise caution and consider employing both fundamental and technical analysis tools for more informed decision-making in the coming days.

Comments