Start Analyzing the Market Like a Pro

Access all the trading information you need in one place – The most advanced trading tools

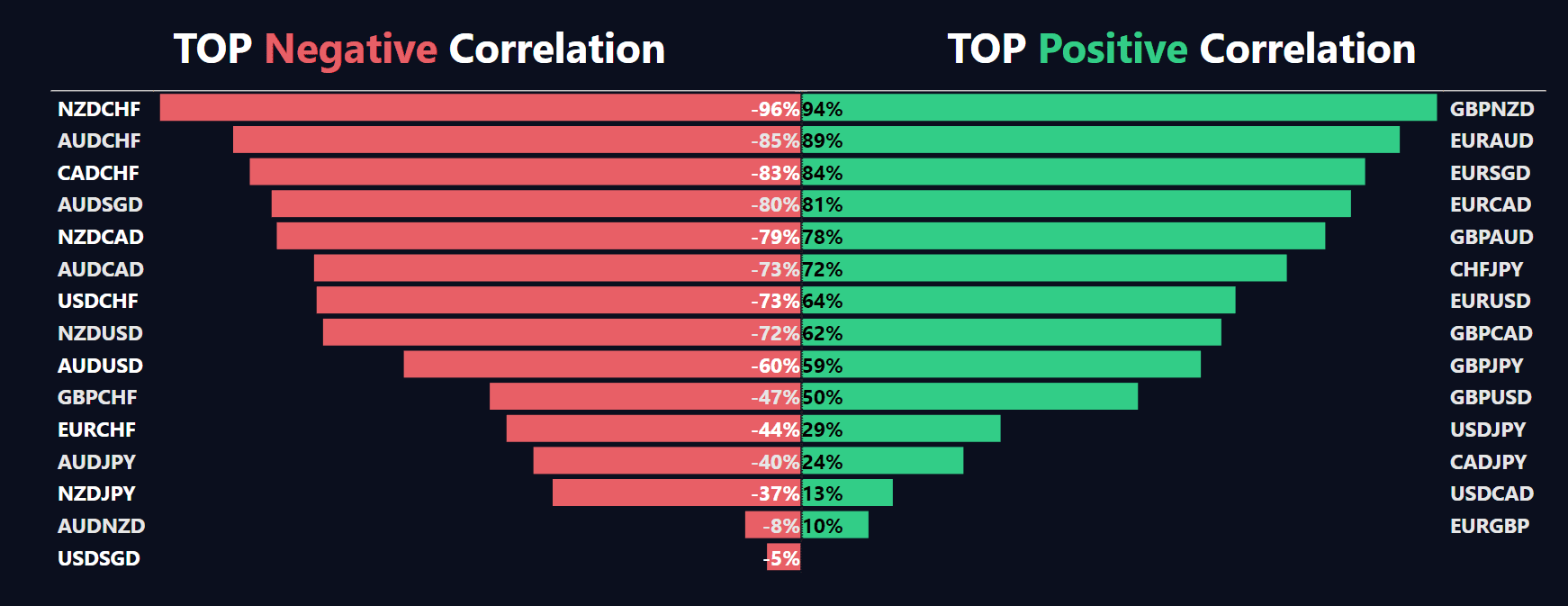

Correlation Calculator

Quick correlation analysis of all currencies

Volatility Heat Map

Find the “cluster of hot spot” volatility during specified timeframes

Market Sentiment

lightning-fast, real-time sentiment analysis for every forex pair.

Volatility Calculator

Learn about the volatility of the selected pair with a quick glance

2010

Historical Data

330M+

Candlestick Analyzed

95K+

Candlestick Added Every Day

100+

Smart Metrics

15

Different Types of Reports

230+

Scripts that Analyze the Data

Check our Top Trading Analysis Tools

Harness our tools and analysis to make informed trading decisions.

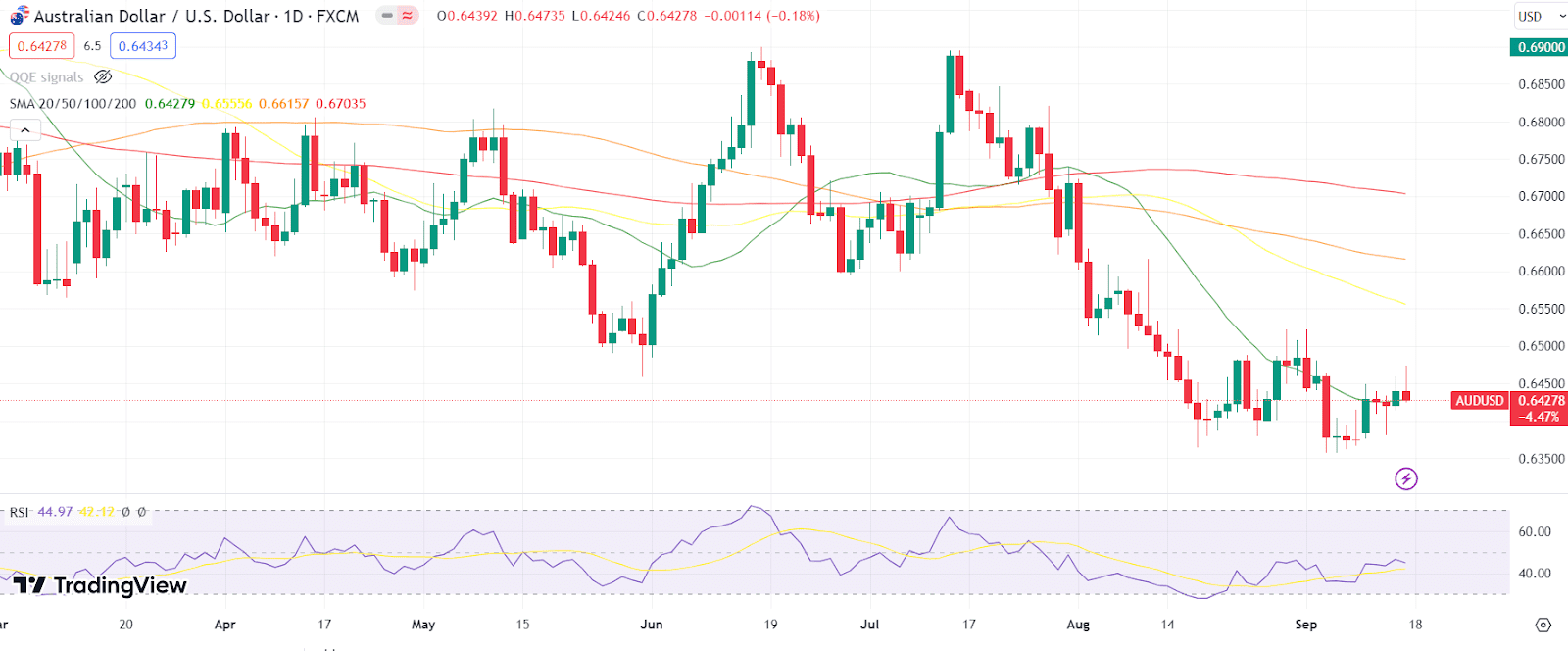

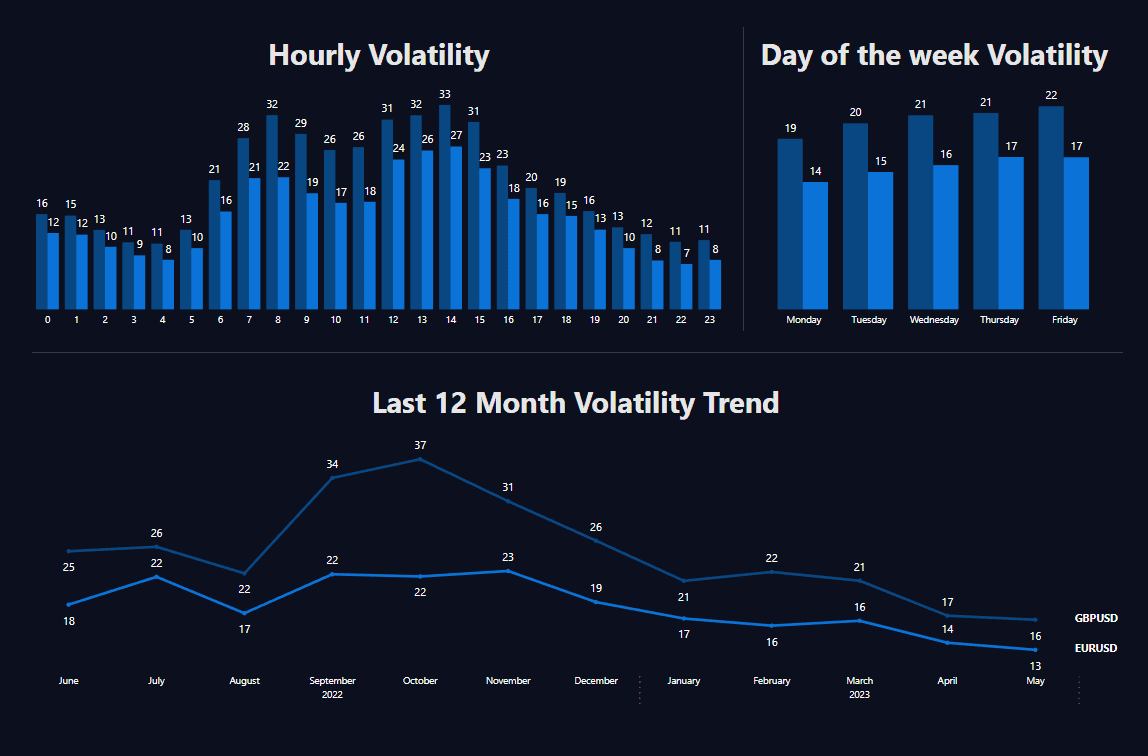

Forex Volatility Calculator

Higher volatility indicates that the currency pair is more unpredictable, while lower volatility suggests more stable price movements

Top Correlation

Find out quickly and clearly which pairs are strongly correlated with each other and in which direction. knowledge is power!

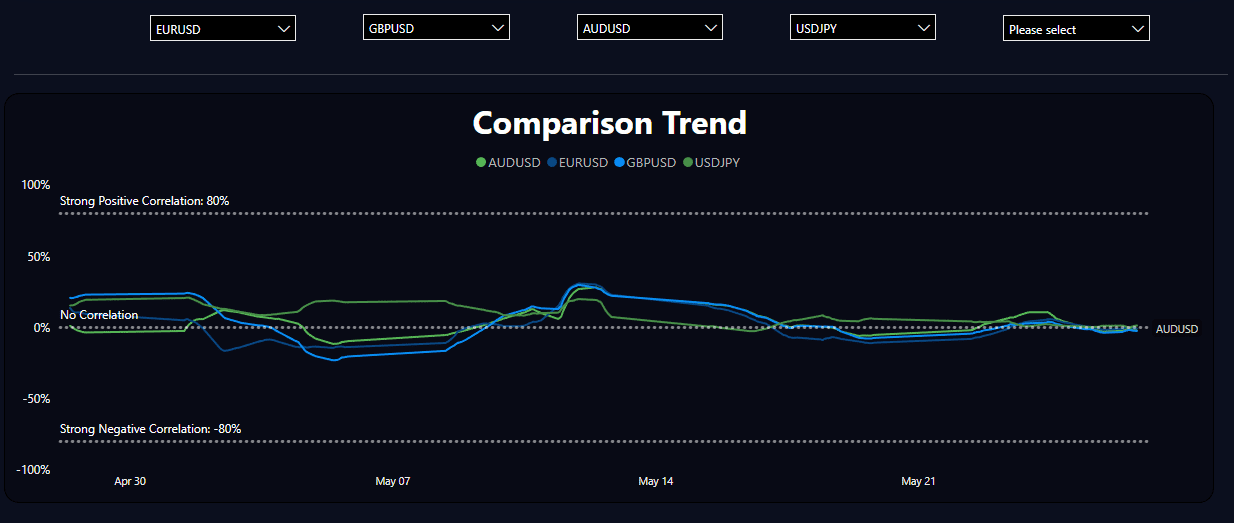

Correlation Comparison

Choose your favorite pairs and easily discover the correlation between them over time

Live Market Sentiment

Though it may not be real-time and might have a slight delay, it offers you a panoramic perspective of price and sentiment trends. Use it to enrich your strategy, compare price with sentiment shifts, and navigate the forex seas more proficiently. but we don’t recommend to rely solely on it when trading.

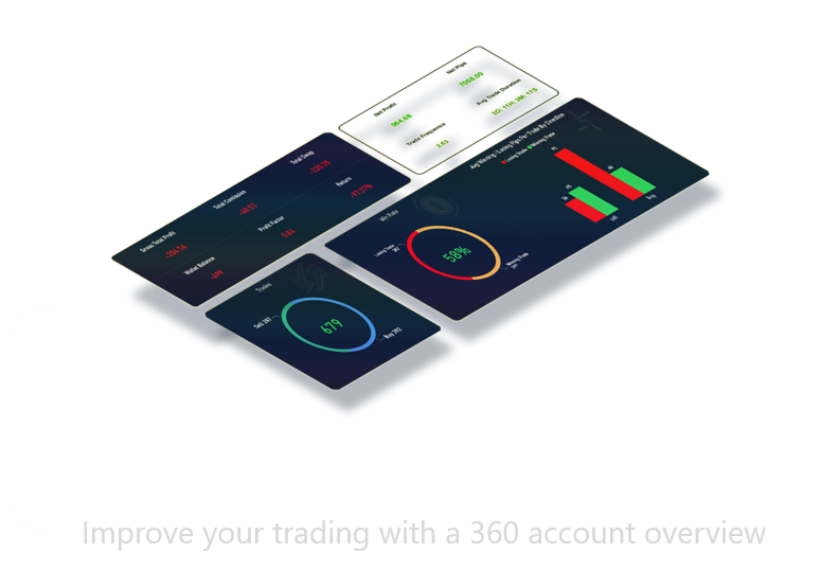

Analyzing Your Trading History

No guessing. Detailed analysis means possibility to improve your results

Take your Trading to the Next level

Improve your trading knowledge and experience by finding weak points and potential for improvement by unlimited number of analysis options

Technical Analysis Tool for Traders

100+

Smart metrics

15+

Different types of reports

Discover the Secrets Beyond the

Charts

Analytics Trade provides you with all the trading analysis tools and information you require to trade effectively and win!

Advanced Analysis Tools

As a trader, it’s crucial to have complete insight into your trading activities to identify areas of improvement.

Analytics Trade offers a unique and unparalleled Forex Trading Account Analysis Tool that provides you with an in-depth analysis of your trading forex performance and helps you find tailored solutions to optimize your results.

With our cutting-edge analysis tools and systematic forex trading strategies, including our Forex Volatility tool, you will have the necessary tools and data to stay ahead of the rapidly changing market and increase your chances of success

Simple, Powerful, Flexible

At Analytics Trade, the satisfaction and success of our users is our top priority. We have designed a user-centered platform that offers a intuitive and streamlined interface, enabling users to effortlessly manage their data, forex report analysis tool generate reports, and construct their portfolios according to their specific needs.

Our platform is equipped with a range of versatile features including customizable filters, interactive reports, sophisticated metrics, and a comprehensive economic calendar, all while maintaining a focus on simplicity.

Analytics Trade is not just a trading tool, it’s a valuable resource to enhance your trading skills and knowledge

FAQ

We at Analytics Trade offer various trading analysis plans so that you can get proper Market Analysis and insights at an affordable price. Our Trading Performance Analysis tools can play a vital role in improving your trading skills.

The term “trading performance” refers to a means of assessing how well a trader is performing. A basic return on capital calculation is an accessible way to measure performance.

Another method to apply the Pareto Principle to trading, such as in Forex, is to concentrate on the 20% of currency pairs that provide 80% of the outcomes. This implies that you would just trade a few currency pairings rather than attempt to trade them all.

There are innumerable ways to analyze the Forex market, but its goal is the same: trying to predict where the price is headed next. The most popular types of forex analysis are: Technical analysis, Fundamental analysis and Sentiment analysis.

- Technical analysis.

- Fundamental analysis.

- Sentiment analysis.

Forex Position Trading – Position trading requires an investor to hold a specific position for months to years. This is the best trading strategy ever, but it requires patience just as you would hold long-term stocks. History shows that you can make significant rewards with this strategy.

Relative Strength Index (RSI)

It is known to be the most commonly used forex indicator and showcases an oversold or overbought condition in the market that is temporary. The RSI value of more than 70 shows an overbought market, while a value lower than 30 shows an oversold market.

Trend trading is one of the most reliable and simple forex trading strategies. As the name suggests, this type of strategy involves trading in the direction of the current price trend. In order to do so effectively, traders must first identify the overarching trend direction, duration, and strength.

There are four main types of forex trading strategies: scalping, day trading, swing trading and position trading. Different trading styles depend on the timeframe and length of period the trade is open for.

There is a steep learning curve and forex traders face high risks, leverage, and volatility. Perseverance, continuous learning, efficient capital management techniques, the ability to take risks, and a robust trading plan are needed to be a successful forex trader.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Less volatility

The fact that major currency pairs such as EUR/USD and EUR/GBP tend to be less volatile overnight may make them the best forex pairs to trade at night for beginner FX traders. They tend to be less active and thus less volatile at night, particularly if they do not involve an Asian currency

Following the trend is probably the easiest trading strategy for a beginner, based on the premise that the trend is your friend. Contrarian investing refers to going against the market herd. You short a stock when the market is rising or buy it when the market is falling.

Overtrading – either trading too big or too often – is the most common reason why Forex traders fail. Overtrading might be caused by unrealistically high profit goals, market addiction, or insufficient capitalisation

In 2022, a successful novice can earn around $100 a day at Forex, provided that: his deposit is at least $200, he trades using the EUR/USD currency pair, with leverage of 1:100, and uses a successfully aggressive strategy. The larger your deposit is, the larger your profit will be

The Euro/US dollar pair is regarded as the most profitable currency pair in forex for the following reasons; High Liquidity: The European economy is the second-largest globally, while the US is the largest