EUR/USD Weekly: Bearish Trend Ahead

Main Points:

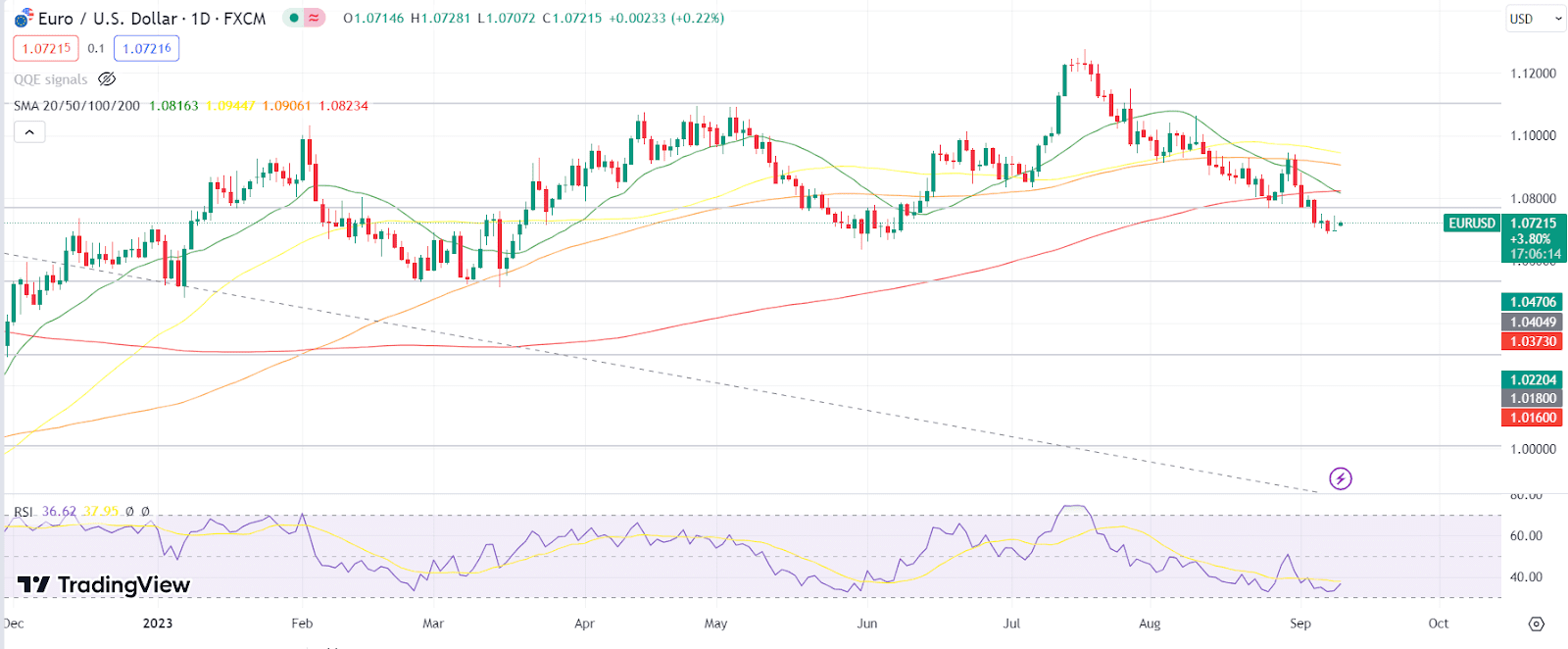

- EUR/USD sees ongoing bearish momentum, closing near 1.06982, a level last seen in June.

- Challenges ahead as the European Central Bank (ECB) prepares for its interest rate decision.

- Key technical levels: resistance at 1.0700, 1.0750, and 1.0800, support at 1.0650 and 1.0600.

Overview

The EUR/USD currency pair continues its bearish trend, ending the week near 1.06982, a level not seen since June. The breach of the crucial psychological support at 1.07000 presents challenges for those anticipating a reversal.

ECB Rate Decision

The European Central Bank (ECB) is expected to maintain its main refinancing rate at 0%, consistent with its long-standing stance. This accommodative monetary policy aims to support the eurozone economy, which has been affected by the Covid-19 pandemic and subsequent lockdowns.

The ECB has also expanded its bond-purchasing program, the Pandemic Emergency Purchase Programme (PEPP), to enhance liquidity and maintain low borrowing costs. ECB President Christine Lagarde’s post-rate decision press conference will provide insights into the bank’s outlook and policies.

Investors will closely analyze the ECB’s inflation forecasts, growth projections, and future plans for the PEPP. A more hawkish stance may boost the euro, while dovish signals could exert downward pressure.

Technical Analysis

From a technical perspective, the EUR/USD trades below 1.0700, now serving as resistance. The pair is also below the 200-day Exponential Moving Average (EMA), indicating a bearish trend. Key levels include resistance at 1.0750 and 1.0800, with support at 1.0650 and 1.0600.

Conclusion

In summary, the EUR/USD pair remains in a bearish trend, closing the week near 1.06982. The upcoming ECB rate decision introduces uncertainty, and traders should monitor key technical levels for potential trading opportunities.

Comments