Navigating AUD/USD’s Waters: Daily Outlook

Main Points:

- Impact of rising US yields and latest news from China.

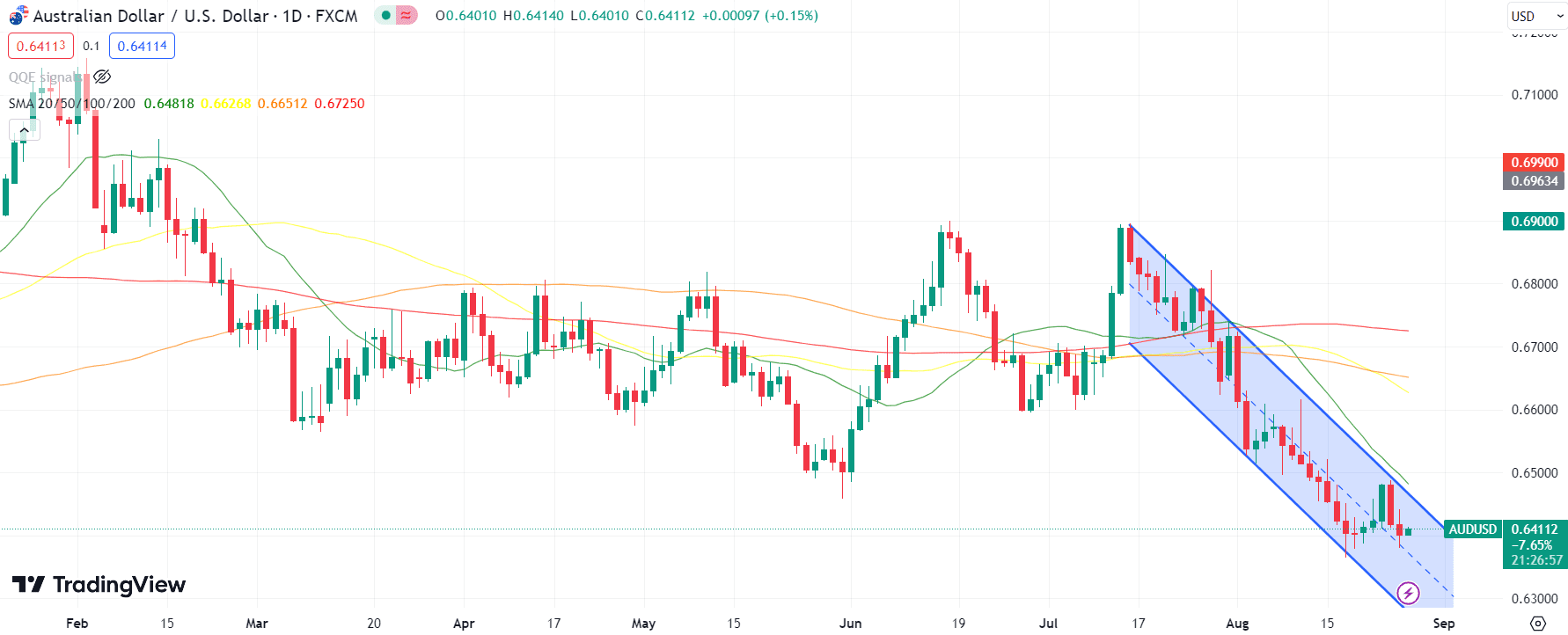

- AUD/USD’s position in a descending trend channel.

- Key technical levels to monitor in the coming week.

The Pulse of US Yields and China’s Whispers

The recent surge in US yields, owing to market anticipations of the Federal Reserve’s shift towards curtailing its bond purchases, has rendered a supportive backbone for the US dollar. This, in turn, has mounted pressure on the AUD/USD pair. While this trajectory appears to continue, one shouldn’t overlook the potential for course reversals. For instance, any unfavorable US economic data or cautious tones from Federal Reserve members might swing the pendulum, giving the Australian dollar some breathing room.

Charting the Descending Path

The past few weeks have witnessed the AUD/USD treading in a rather tight space. After touching its 10-month nadir a fortnight ago, the currency pair has since plateaued. Yet, the overall sentiment remains bearish as it stays enveloped within a descending trend channel. As we progress, traders would be wise to mark out potential breakout or breakdown zones within this channel.

Comparison Table: AUD/USD Influencers

| Factor | Positive Influence on AUD/USD | Negative Influence on AUD/USD |

|---|---|---|

| US Yields News | Dovish remarks from the Fed or weak US economic data | Rising yields due to anticipated bond-buying tapering |

| News from China | Stable economic growth and positive trade relations | Any economic slowdown or tensions in the region |

Eyeing the Horizon

For those steering their ships in the vast ocean of forex, particularly in the AUD/USD corridor, it becomes essential to stay updated with the latest breezes from the US yields landscape and any rumblings from China. As these two behemoths sway, so will the waves that the AUD/USD sails upon. Let the coming week’s tides, marked by these key factors and levels, guide your trading decisions.

Dissecting the Trader Sentiment

Observing the sentiment data for AUD/USD, a pronounced tilt is evident towards long positions, with the long percentages predominantly exceeding the short percentages over the last thirty days. Especially noteworthy is the sentiment on 2023-08-13, where a staggering 86% of traders held a long view while only 14% expected a decline. This bias towards bullish sentiment, especially on days like 2023-08-16 and 2023-07-30, where the long percentage exceeded 80%, is indicative of an overall positive sentiment towards AUD against USD in the market. However, with this being said, a contrarian might argue that when sentiment is too skewed, it could signal a potential reversal.

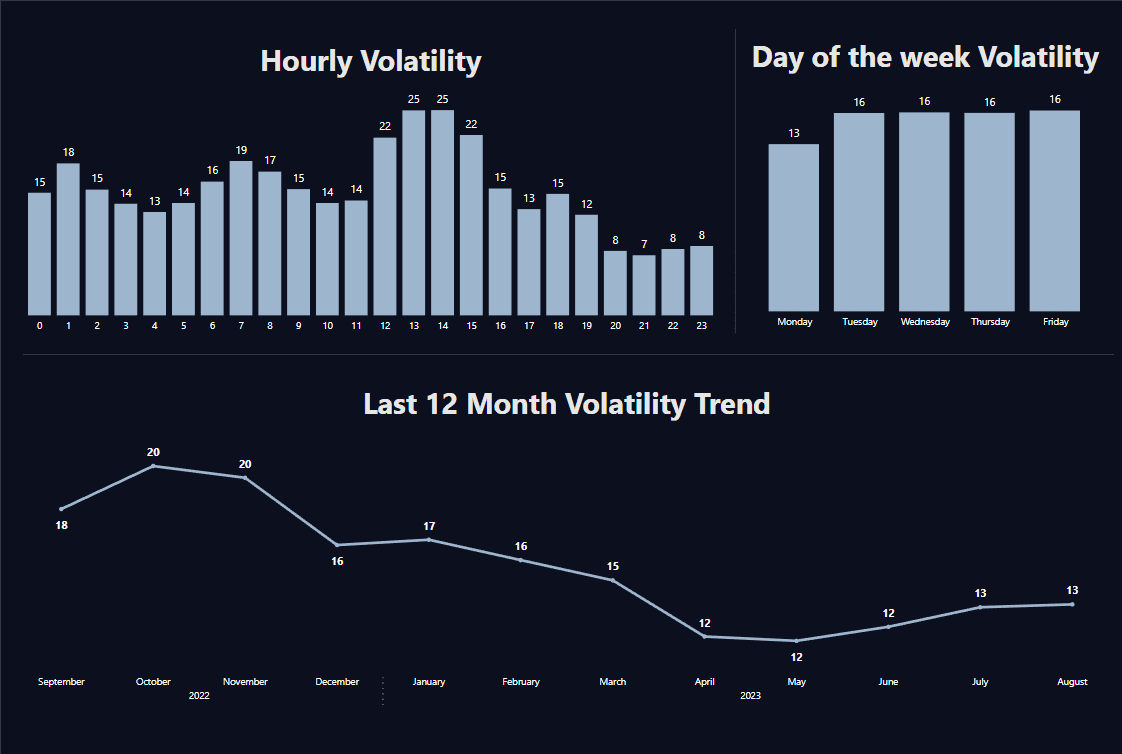

Decoding the Volatility Patterns

The volatility data paints a varied picture for the AUD/USD pair. The pair has shown some significant price swings, particularly on dates like 2023-07-31 and 2023-08-01, with the pair dropping by 121.5 and 103 pips respectively. These bearish movements were accompanied by high body percentages, which signify strong bearish momentum. Contrarily, the pair has also exhibited some robust bullish days, such as on 2023-08-22, with a rise of 70.8 pips. Additionally, there are numerous instances like on 2023-08-20 and 2023-08-06 where the pair’s movement has been relatively subdued, with less than 40 pips change, signaling consolidation or a potential indecision in the market. It’s also worth noting that after such major declines, there’s a tendency for the AUD/USD to bounce back, possibly due to oversold conditions or buy-the-dip sentiment.

Conclusion for This Week

The past thirty days for the AUD/USD pair have been a roller coaster of sentiment and volatility. The prevailing bullish sentiment, coupled with sporadic sharp declines, presents opportunities for both trend-followers and contrarian traders. As we step into the next trading week, it’s crucial to remain nimble, considering both sentiment and technical factors, to navigate the potential opportunities and challenges that lie ahead for AUD/USD.

AUD/USD Economic Outlook: Deciphering Economic Puzzles

Main Points:

- RBA Bullock’s speech to shed light on the Australian economic stance.

- A mix of data from the US, with focus on consumer confidence and manufacturing.

- Significance of retail sales from Australia and its potential impact on AUD.

Economic Highlights from Down Under

The upcoming week is peppered with significant releases for the Australian economy. Topping the list is the much-anticipated speech by RBA’s Bullock. Market participants will keenly tune in for insights and cues regarding the RBA’s stance on interest rates and the broader economic outlook. Furthermore, the Retail Sales MoM Prel data release, forecasted at 0.3%, following a dip of -0.8%, will be closely scrutinized. Positive numbers can provide a much-needed tailwind for the Australian dollar.

US Economic Indicators in the Limelight

The US side is bustling with a mix of data releases. The CB Consumer Confidence index, forecasted to slightly dip to 116.0 from 117.0, will gauge the mood of American consumers, acting as a pulse for their willingness to spend. Additionally, data on crude oil stocks, manufacturing, and housing will fill the economic calendar. Of keen interest is the Dallas Fed Manufacturing Index. A further dip might signal continued struggles for the manufacturing sector, which could weaken the USD.

Week’s Event Table

| Date | Country | Indicator | Previous | Forecast | Currency | Importance |

|---|---|---|---|---|---|---|

| 2023-08-28 | AU | Retail Sales MoM Prel | -0.8% | 0.3% | AUD | Medium |

| 2023-08-28 | US | Dallas Fed Manufacturing Index | -20.0 | -21.6 | USD | Medium |

| 2023-08-29 | AU | RBA Bullock Speech | N/A | N/A | AUD | Medium |

| 2023-08-29 | US | CB Consumer Confidence | 117.0 | 116.0 | USD | Medium |

Conclusion for This Week

As the AUD/USD pair sails through another week, traders must remain vigilant and responsive to the barrage of economic data expected. With potential market-moving events from both countries, staying informed and prepared is paramount. Keeping an eye on the indicators mentioned can provide a clearer picture and guide traders in making informed decisions.

Comments