What is the Shark Pattern?

The Shark pattern is a variation of the Gartley pattern, which is one of the most popular harmonic patterns. The Shark pattern is identified by a series of five consecutive price swings, which form a “shark” shape. The pattern is composed of two legs, A and B, and three corrective legs, X, Y, and Z. The Shark pattern is considered to be a strong reversal pattern, and it is often used by traders to identify potential trading opportunities.

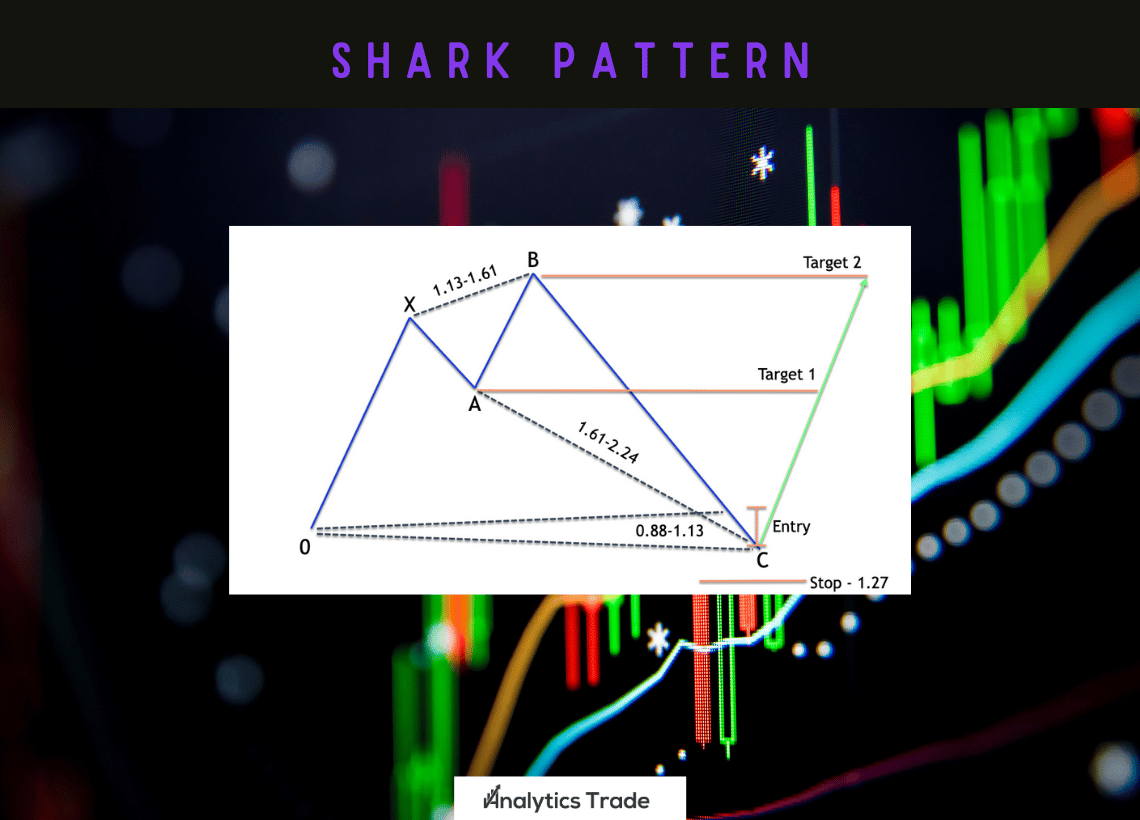

How to Identify the Shark Pattern

The Shark pattern is identified by a series of five consecutive price swings, which form a “shark” shape. The pattern is composed of two legs, A and B, and three corrective legs, X, Y, and Z. The A and B legs are the initial impulse moves, while the X, Y, and Z legs are the corrective moves. The pattern is considered to be complete when the price action retraces to the 0.618 Fibonacci retracement level of the A-B move.

Trading the Shark Pattern

Once the Shark pattern is identified, traders can use it to identify potential trading opportunities. Traders typically look for a break of the X-A trendline as a trading indication of a potential reversal. If the price action breaks the X-A trendline, traders can enter a long position at the 0.618 Fibonacci retracement level of the A-B move. Traders can also place a stop-loss order below the X-A trendline but in this, traders need trend analysis to over such situations.

Conclusion

The Shark pattern is a popular harmonic pattern that is used by traders to identify potential trading opportunities. The pattern is identified by a series of five consecutive price swings, which form a “shark” shape. Forex traders typically look for a break of the X-A trendline as an indication of a potential reversal. If the price action breaks the X-A trendline, traders can enter a long position at the 0.618 Fibonacci retracement level of the A-B move.

Personal Opinion

The Shark pattern is a powerful harmonic pattern that can be used to identify potential trading opportunities. While the pattern is relatively easy to identify, it is important to remember that it is not a guarantee of success. As with any trading strategy, it is important to use risk management techniques to protect your capital. Additionally, it is important to practice trading the chat pattern on a demo account before trading it with real money.

Comments