Seize the Day with the EMA Trading Strategy

If you’ve ever navigated the vast ocean of forex trading, you’d know it’s much like the sea itself – unpredictable, exciting, and full of opportunity. For day traders like us, riding the market waves is not just a routine, it’s a passion. In my years of experience, the EMA Trading Strategy has been a lighthouse, guiding me through choppy market waters with its remarkable blend of Forex Sentiment Analysis and Volatility Analysis.

Unraveling the EMA Trading Strategy

So, what’s the fuss about EMA (Exponential Moving Average) Trading? It’s a trading strategy that provides more weight to recent data, making it incredibly responsive to price changes. It’s like having a conversation with the market, where the market tells you its current mood, not what it felt last week.

EMA vs. Simple Moving Average (SMA): A Quick Comparison

| Indicator | Benefits | Drawbacks |

|---|---|---|

| EMA | Responsive to recent price changes, perfect for day trading | Slightly more complex to calculate |

| SMA | Simple to calculate, great for long-term trends | Less responsive to recent price changes |

EMA clearly wins the day when it comes to the high-speed rollercoaster of forex day trading.

Timeframe: 5-Minute

Recommend pair: GBP/JPY

Indicator: EMA

Platform: MT4, TradingView

Long trade setup

Entry

The 10-period EMA should cross above the 25-EMA. Wait for the price to move upwards, and refrain from entering if the overall trend is downwards.

Take-profit

Set take-profit at the recent high from the entry point or when the 25-EMA goes above the 10-EMA.

Stop-loss

Place a stop-loss at the recent low from the entry point.

Example:

The chart below shows that when the black 10-EMA goes above the blue 25-EMA, it presents a long entry point.

Long trade setup

Short trade setup

Entry

The 25-period EMA should cross above the 10-EMA. Wait for the price to move downwards, and refrain from entering if the overall trend is upwards.

Take-profit

Set take-profit at the recent low from the entry point or when the 25-EMA goes below the 10-EMA.

Stop-loss

Place a stop-loss at the recent high from the entry point.

Example:

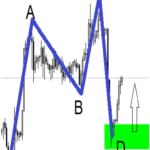

The chart below shows that when the blue 25-EMA goes above the black 10-EMA, it presents a short entry point.

Short trade setup

Top 10 Rules for Successful EMA Trading

- Understand the Market Trend

- Choose the Right Timeframe

- Use Correct Position Sizing

- Always Set a Stop-Loss

- Don’t Overtrade

- Be Patient

- Combine with Other Indicators

- Backtest Your Strategy

- Don’t Chase the Market

- Keep Emotions at Bay

Master these, and you’ll become an unstoppable force in the forex market.

Digging Deeper: EMA Trading Strategy FAQs

1. Why is EMA Trading popular among day traders?

EMA Trading is popular for its sensitivity to recent price changes, which suits the fast-paced nature of day trading.

2. How does Forex Sentiment Analysis complement the EMA Trading Strategy?

Forex Sentiment Analysis gives traders a peek into market psychology. Combined with the EMA’s responsiveness, it allows for real-time, informed decisions.

3. Can Volatility Analysis enhance my EMA Trading Strategy?

Absolutely! Volatility Analysis offers a view of potential market swings. When used with the EMA, it could help you pinpoint high-probability trading opportunities.

With its finger on the pulse of the market, EMA Trading Strategy is a true companion for forex day traders. Combine it with Forex Sentiment Analysis and Volatility Analysis, and you have a potent mix to make the most of the market’s twists and turns.

So gear up, my fellow traders. The day awaits!

Comments