Master the MACD Crossover: A Timeless Forex Trading Strategy

Timeframe: Any

Recommend pair: Any major pair

Indicator: MACD, SMA 200

Platform: MT4, TradingView

One that consistently stands out is the MACD Crossover strategy. This powerful tool can help you navigate the forex market with confidence, even in challenging conditions. So, grab your favorite beverage, sit back, and let’s delve into the world of MACD Crossovers together!

What is a MACD Crossover?

The Moving Average Convergence Divergence (MACD) is a popular technical indicator used to identify changes in a currency pair’s momentum, direction, and duration. A MACD Crossover occurs when the MACD line (calculated by subtracting the 26-day exponential moving average from the 12-day exponential moving average) crosses above or below the signal line (the 9-day exponential moving average of the MACD line).

Long trade setup

Entry

The pair should trade above the 200-MA. The MACD line should cross above the signal line.

Take-profit

Set TP at a recent high from the entry point, the price moves below the MA, or the MACD line drifts below the signal line.

Stop-loss

Place a stop-loss order near the recent low from the entry point.

Example:

The example below presents a potential buying opportunity when the price moves above the 200-MA and MACD line goes above the signal line.

Long trade setup

Short trade setup

Entry

The pair should trade below the 200-MA. The MACD line should cross below the signal line.

Take-profit

Set TP at a recent low from the entry point, the price moves above the MA, or the MACD line goes above the signal line.

Stop-loss

Place a stop-loss order near the recent high from the entry point.

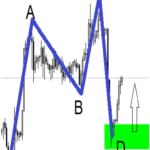

Example:

The example below presents a potential buying opportunity when the price moves below the 200-MA and MACD line goes below the signal line.

Short trade setup

Why the MACD Crossover Deserves Your Attention

The MACD Crossover strategy is beloved by traders for its ability to generate reliable trading signals with minimal lag time. By identifying shifts in market momentum, traders can capitalize on potential reversals and emerging trends, making it an invaluable addition to any forex trading toolkit.

Top 3 Interesting Questions and Answers about MACD Crossovers

- Q: How can I use MACD Crossovers in my trading strategy?

A: MACD Crossovers can be used as entry or exit signals. When the MACD line crosses above the signal line, it’s considered a bullish signal, indicating a potential long trade. Conversely, when the MACD line crosses below the signal line, it’s considered a bearish signal, suggesting a potential short trade. - Q: Can the MACD Crossover strategy be used on any time frame?

A: Yes, the MACD Crossover strategy can be applied to various time frames, making it suitable for both short-term and long-term trading strategies. - Q: Are MACD Crossovers reliable in all market conditions?

A: While no trading strategy is infallible, MACD Crossovers tend to be most effective during trending markets, as they can help identify potential reversals and emerging trends.

Top 5 Tips for Trading with MACD Crossovers

To help you make the most of the MACD Crossover strategy, here are five top tips:

- Combine MACD Crossovers with other technical indicators, such as RSI or Keltner Channels, to increase the accuracy of your trading signals.

- Adjust the settings of your MACD indicator to suit your trading style and the specific currency pair you’re trading.

- Trade in the direction of the overall trend for higher probability trades.

- Practice proper metatrader-4-for-risk-management/”target=”_blank” rel=”noopener” >risk management by setting stop-loss orders and using appropriate position sizing.

- Backtest your MACD Crossover trading strategy on historical data to gauge its effectiveness and fine-tune your approach.

Armed with these tips and insights, you’re ready to tackle the forex market using the MACD Crossover strategy. Remember, success in trading comes with experience and continuous learning, so stay curious and never stop refining your skills. Happy trading!

Comments