Timeframe: Any

Recommend pair: Any major pair

Indicator: CCI

Platform: MT4, TradingView

Long trade setup

Entry

The CCI must be near the negative level, mentioning an oversold level.

Take-profit

Set take-profit when the CCI reaches a positive level.

Stop-loss

Place a stop-loss at the recent low from the entry point.

Example:

The chart below shows when the CCI reaches the negative level, we enter the trade, and when the indicator moves to the positive level, we exit the trade.

Long trade setup

Short trade setup

Entry

The CCI must be near the positive level, indicating an overbought level.

Take-profit

Set take-profit when the CCI reaches a negative level.

Stop-loss

Place a stop-loss at the recent high from the entry point.

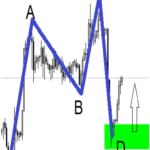

Example:

The chart below shows when the CCI reaches a positive level, we enter the trade, and when it moves to a negative level, we exit the trade.

Short trade setup

Comments