What are Harmonic Patterns?

Harmonic patterns are a powerful tool for traders to identify potential reversals in the market. Harmonic patterns are based on Fibonacci ratios and use price action to identify potential reversals in the market. Harmonic patterns are used by traders to identify potential reversals in the market. They are based on Fibonacci ratios and use price action to identify potential reversals in the market.Harmonic patterns are based on the idea that price action follows certain patterns. These patterns are based on Fibonacci ratios and use price action to identify potential reversals in the market. The most common harmonic patterns are the Gartley, Butterfly, Bat, and Crab.

How to Use Harmonic Patterns

Harmonic patterns are used by traders to identify potential reversals in the market. They are based on Fibonacci ratios and use price action to identify potential reversals in the market.When trading with harmonic patterns, traders should look for certain patterns in the price action. These patterns are based on Fibonacci ratios and use price action to identify potential reversals in the market.Traders should look for certain patterns in the price action. These patterns are based on Fibonacci ratios and use price action to identify potential reversals in the market. Traders should look for certain patterns in the price action. These patterns are based on Fibonacci ratios and use price action to identify potential reversals in the market.

Gartley Pattern

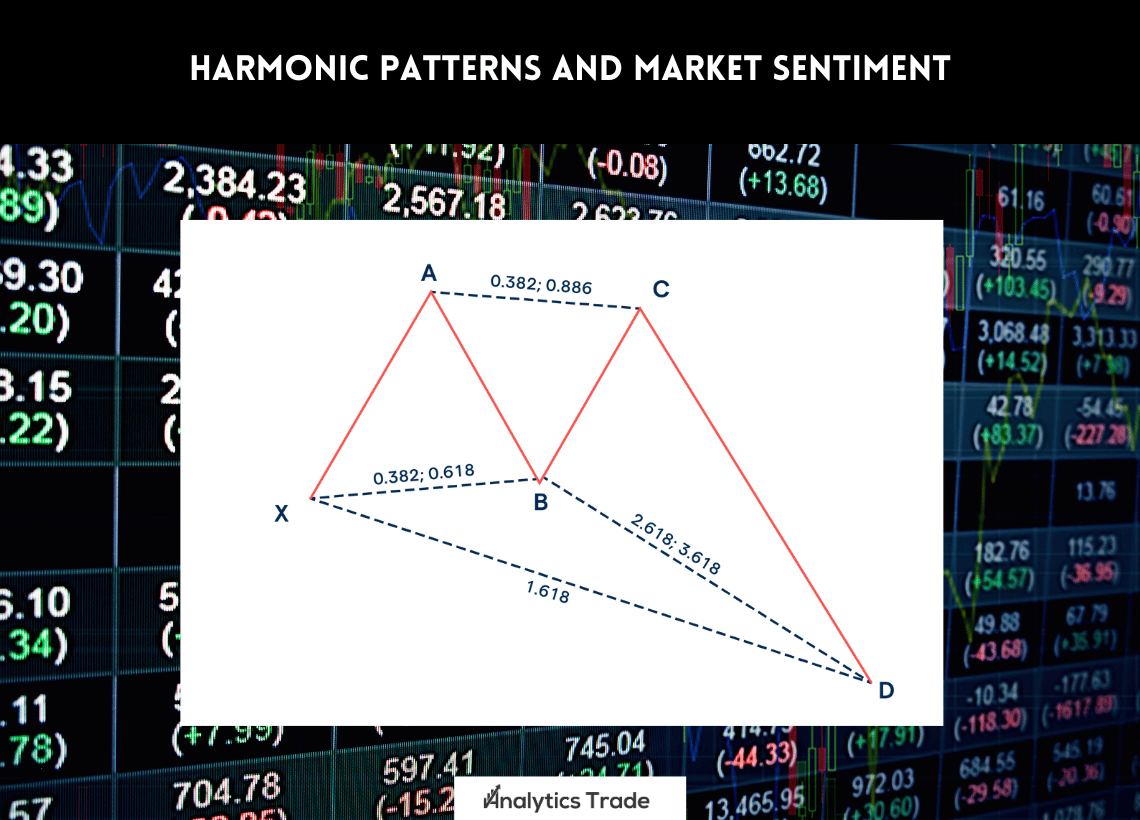

The Gartley pattern is a harmonic pattern that is used to identify potential reversals in the market. The Gartley pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Gartley pattern is made up of five points: X, A, B, C, and D.The Gartley pattern is used to identify potential reversals in the market. The pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Gartley pattern is made up of five points: X, A, B, C, and D.

Butterfly Pattern

The Butterfly pattern is a harmonic pattern that is used to identify potential reversals in the market. The Butterfly pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Butterfly pattern is made up of four points: X, A, B, and C.The Butterfly pattern is used to identify potential reversals in the market. The pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Butterfly pattern is made up of four points: X, A, B, and C.

Bat Pattern

The Bat pattern is a harmonic pattern that is used to identify potential reversals in the market. The Bat pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Bat pattern is made up of three points: X, A, and B.The Bat pattern is used to identify potential reversals in the market. The pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Bat pattern is made up of three points: X, A, and B.

Crab Pattern

The Crab pattern is a harmonic pattern that is used to identify potential reversals in the market. The Crab pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Crab pattern is made up of four points: X, A, B, and C.The Crab pattern is used to identify potential reversals in the market. The pattern is based on Fibonacci ratios and uses price action to identify potential reversals in the market. The Crab pattern is made up of four points: X, A, B, and C.

Market Sentiment and Harmonic Patterns

Harmonic patterns are a powerful tool for traders to identify potential reversals in the market. However, it is important to understand that harmonic patterns are not the only factor that can influence the market. Market sentiment is also an important factor that can influence the market.Market sentiment is the collective opinion of the market participants. It is the collective opinion of the market participants about the direction of the market. Market sentiment can be influenced by a variety of factors such as economic news, political events, and technical analysis.When trading with harmonic patterns, it is important to consider the market sentiment. Market sentiment can be used to identify potential reversals in the market. For example, if the market sentiment is bearish, then a trader may look for a bullish harmonic pattern to identify a potential reversal in the market.

Using Market Sentiment to Identify Reversals

When trading with harmonic patterns, it is important to consider the market sentiment. Market sentiment can be used to identify potential reversals in the market. For example, if the market sentiment is bearish, then a trader may look for a bullish harmonic pattern to identify a potential reversal in the market.It is also important to consider the market sentiment when trading with harmonic patterns. For example, if the market sentiment is bullish, then a trader may look for a bearish harmonic pattern to identify a potential reversal in the market.

Using Technical Analysis to Identify Reversals

In addition to market sentiment, technical analysis can also be used to identify potential reversals in the market. Technical analysis is the study of price action and can be used to identify potential reversals in the market. Technical analysis can be used in conjunction with harmonic patterns to identify potential reversals in the market.

Conclusion

Harmonic patterns are a powerful tool for traders to identify potential reversals in the market. They are based on Fibonacci ratios and use price action to identify potential reversals in the market. Market sentiment and technical analysis can also be used to identify potential reversals in the market.By combining harmonic patterns with market sentiment and technical analysis, traders can make better trading decisions. To learn more about harmonic patterns and market sentiment, watch this video.

Comments