What is Scalping?

Scalping is a trading strategy that involves buying and selling a security within a short time frame. It is a popular strategy among traders who are looking to make quick profits in the markets. Scalping involves taking advantage of small price movements in the markets and can be done on any time frame.

What is the Momentum Indicator?

The momentum indicator is a technical indicator that measures the rate of change in price. It is used to identify the direction of the trend and to determine when a trend is likely to reverse. The momentum indicator is a popular tool among traders who are looking to scalp the markets.

How to Use the Momentum Indicator for Scalping

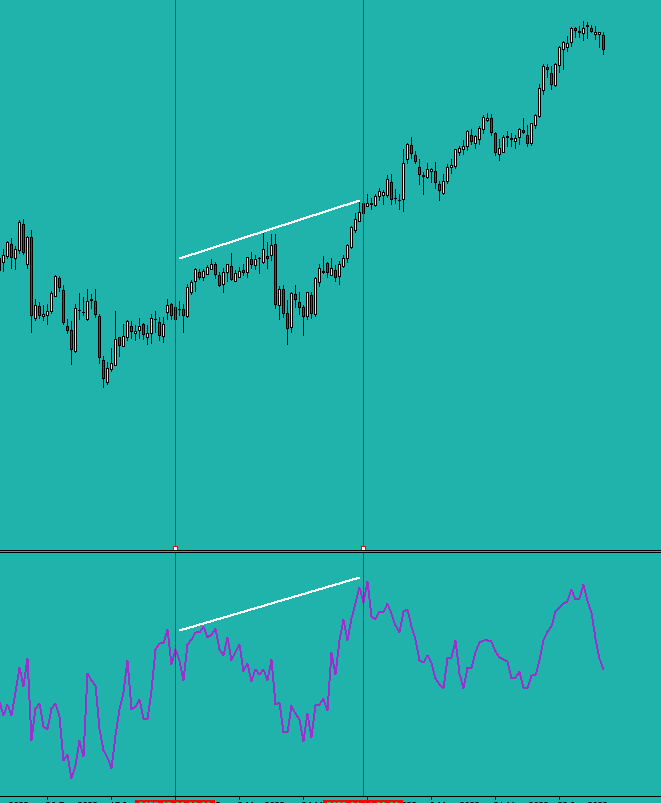

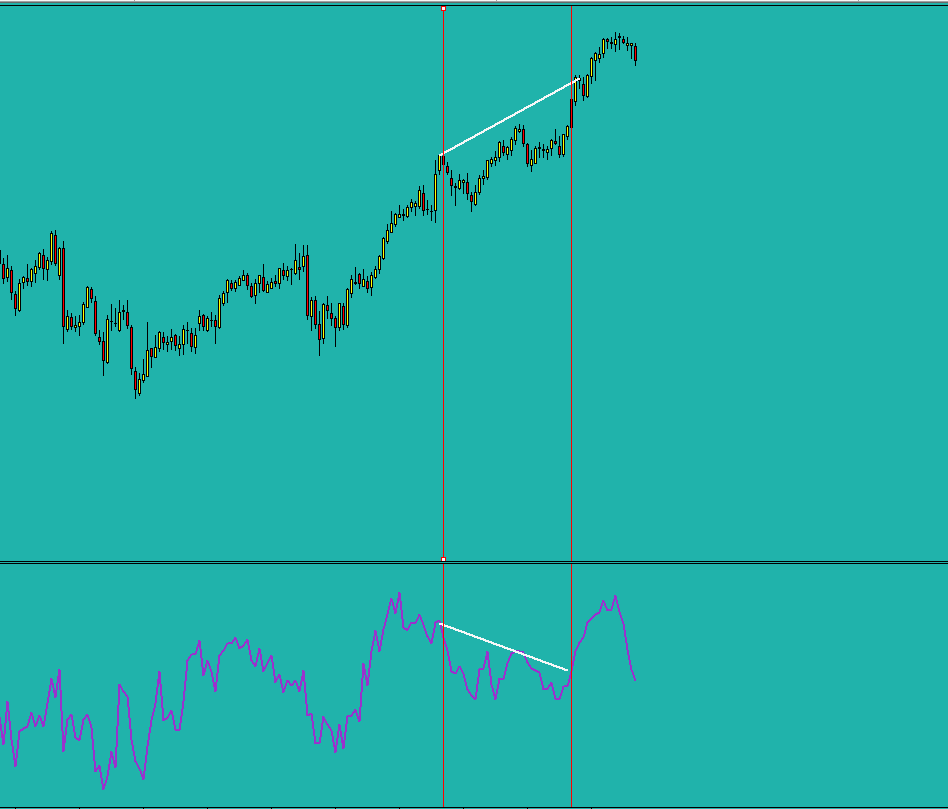

The momentum indicator can be used to scalp the markets by looking for divergences between price and the indicator. A divergence occurs when the price is making a higher high, but the momentum indicator is making a lower high. This indicates that the trend is weakening and could be a signal to enter a short position.

1. Identify the Trend

The first step in using the momentum indicator for scalping is to identify the trend. This can be done by looking at the price action and the momentum indicator. If the price is making higher highs and the momentum indicator is making higher highs, then the trend is up. If the price is making lower lows and the momentum indicator is making lower lows, then the trend is down.

2. Look for Divergences

Once the trend has been identified, the next step is to look for divergences between the price and the momentum indicator. A divergence occurs when the price is making a higher high, but the momentum indicator is making a lower high. This indicates that the trend is weakening and could be a signal to enter a short position.

3. Enter the Trade

Once a divergence has been identified, the next step is to enter the trade. This can be done by placing a sell order at the point where the divergence occurs. The stop loss should be placed above the high of the divergence and the take profit should be placed at a level where the price is likely to reverse.

4. Exit the Trade

Once the trade has been entered, the next step is to exit the trade. This can be done by either taking profit at the target level or by using a trailing stop loss. A trailing stop loss is a stop loss that is moved up as the price moves in the trader’s favor. This allows the trader to lock in profits while still giving the trade room to move.

Conclusion

Scalping with the momentum indicator is a popular strategy among traders who are looking to make quick profits in the markets. The strategy involves looking for divergences between the price and the indicator and entering trades when a divergence is identified. The stop loss should be placed above the high of the divergence and the take profit should be placed at a level where the price is likely to reverse.

Personal Opinion

I have found scalping with the momentum indicator to be a useful strategy for making quick profits in the markets. It is important to remember to use a stop loss and take profit when entering trades and to use a trailing stop loss to lock in profits. The strategy can be risky, so it is important to practice risk management and to only trade with money that you can afford to lose.

Table

| Strategy | Description |

|---|---|

| Scalping with the Momentum Indicator | A trading strategy that involves looking for divergences between the price and the momentum indicator and entering trades when a divergence is identified. |

Scalping with the momentum indicator is a popular strategy among traders who are looking to make quick profits in the markets. It is important to remember to use a stop loss and take profit when entering trades and to use a trailing stop loss to lock in profits. The strategy can be risky, so it is important to practice risk management and to only trade with money that you can afford to lose. For more information about scalping with the momentum indicator, you can visit Wikipedia.org.

Comments