What is Volatility Smile?

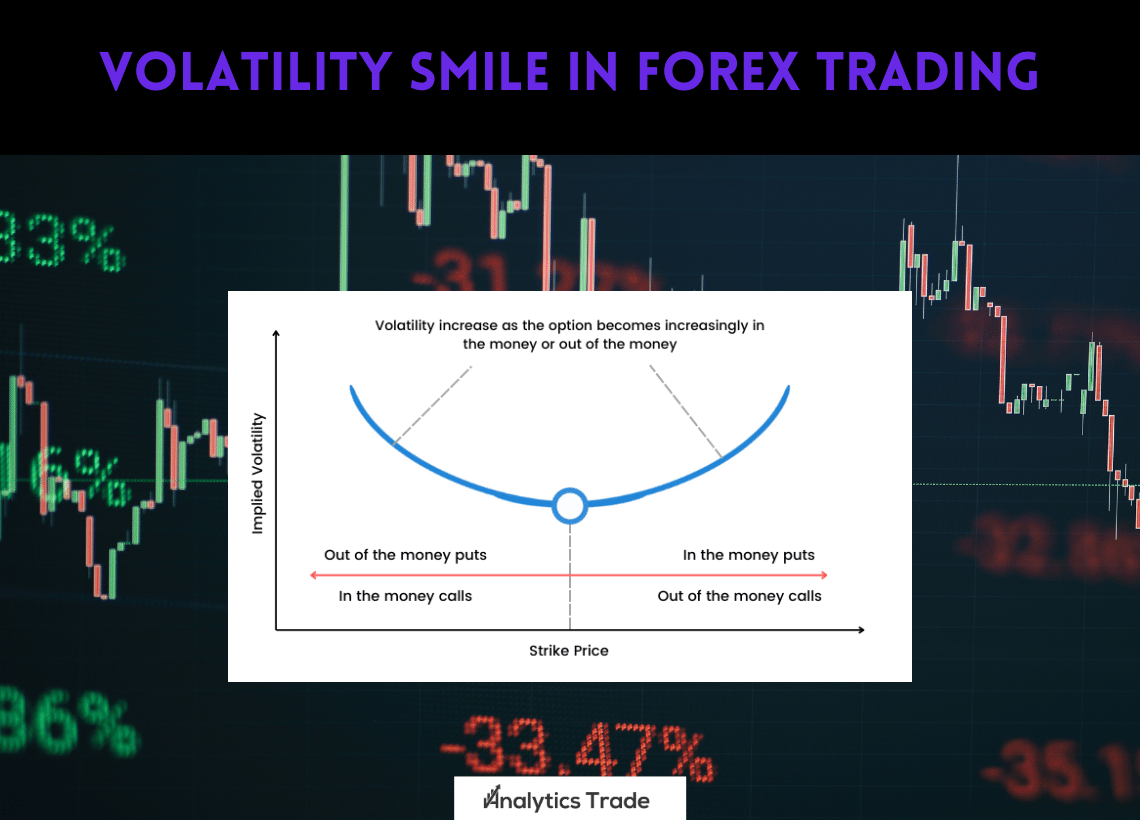

Volatility smile is a graphical representation of the implied volatility of a given option. It is usually plotted on a graph with the implied volatility on the y-axis and the strike price on the x-axis. The shape of the graph is usually curved, resembling a smile. The shape of the graph is determined by the market sentiment and the current price of the underlying asset.

How to Use Volatility Smile in Forex Trading?

Volatility smile can be used in forex trading to identify potential trading opportunities. By analyzing the shape of the graph, traders can determine whether the market is bullish or bearish. If the graph is curved upwards, it indicates that the market is bullish and traders should look for buying opportunities. On the other hand, if the graph is curved downwards, it indicates that the market is bearish and traders should look for selling opportunities.

1. Identify the Volatility Smile

The first step in using volatility smile in forex trading is to identify the shape of the graph. This can be done by looking at the implied volatility of the option and the strike price. If the implied volatility is higher than the strike price, then the graph will be curved upwards. If the implied volatility is lower than the strike price, then the graph will be curved downwards.

2. Analyze the Market Sentiment

Once the shape of the graph has been identified, the next step is to analyze the market sentiment. This can be done by looking at the current price of the underlying asset and the implied volatility of the option. If the current price is higher than the implied volatility, then the market is bullish and traders should look for buying opportunities. On the other hand, if the current price is lower than the implied volatility, then the market is bearish and traders should look for selling opportunities.

3. Use Technical Analysis

Once the market sentiment has been identified, the next step is to use technical analysis to identify potential trading opportunities. Technical analysis involves looking at the price action of the underlying asset and using trading indicators such as moving averages, support and resistance levels, and trend lines to identify potential trading opportunities.

4. Use Options Strategies

Once the potential trading opportunities have been identified, the next step is to use options strategies to capitalize on them. Options strategies such as covered calls, straddles, and spreads can be used to take advantage of the market sentiment and capitalize on potential trading opportunities.

5. Monitor the Market

The final step in using volatility smile in forex trading is to monitor the market and adjust the strategy as needed. This involves keeping an eye on the current price of the underlying asset and the implied volatility of the option. If the market sentiment changes, then the strategy should be adjusted accordingly.

Answers and Questions

Q: What is Volatility Smile?

A: Volatility smile is a graphical representation of the implied volatility of a given option. It is usually plotted on a graph with the implied volatility on the y-axis and the strike price on the x-axis. The shape of the graph is usually curved, resembling a smile.

Q: How to Use Volatility Smile in Forex Trading?

A: Volatility smile can be used in forex trading to identify potential trading opportunities. By analyzing the shape of the graph, traders can determine whether the market is bullish or bearish. If the graph is curved upwards, it indicates that the market is bullish and traders should look for buying opportunities. On the other hand, if the graph is curved downwards, it indicates that the market is bearish and traders should look for selling opportunities.

Q: What are the steps to use Volatility Smile in Forex Trading?

A: The steps to use volatility smile in forex trading are: 1) Identify the Volatility Smile; 2) Analyze the Market Sentiment; 3) Use Technical Analysis; 4) Use Options Strategies; and 5) Monitor the Market.

Table

| Step | Description |

|---|---|

| 1. Identify the Volatility Smile | Identify the shape of the graph by looking at the implied volatility of the option and the strike price. |

| 2. Analyze the Market Sentiment | Analyze the current price of the underlying asset and the implied volatility of the option. |

| 3. Use Technical Analysis | Use indicators such as moving averages, support and resistance levels, and trend lines to identify potential trading opportunities. |

| 4. Use Options Strategies | Use options strategies such as covered calls, straddles, and spreads to capitalize on potential trading opportunities. |

| 5. Monitor the Market | Monitor the current price of the underlying asset and the implied volatility of the option and adjust the strategy as needed. |

Volatility smile is a powerful tool that can be used in forex trading to identify potential trading opportunities. By analyzing the shape of the graph, traders can determine whether the market is bullish or bearish. By using technical analysis and options strategies, traders can capitalize on potential trading opportunities. Finally, by monitoring the market, traders can adjust their strategies as needed. By using volatility smile in forex trading, traders can increase their chances of success.

Comments