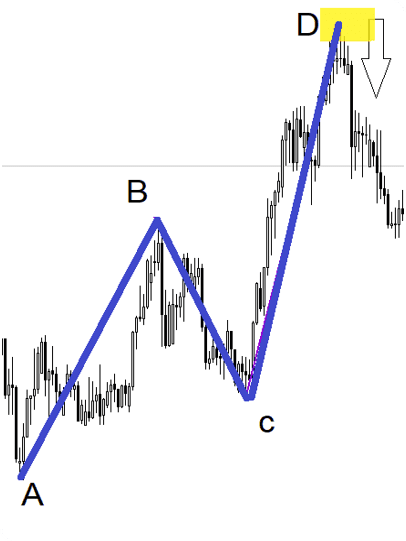

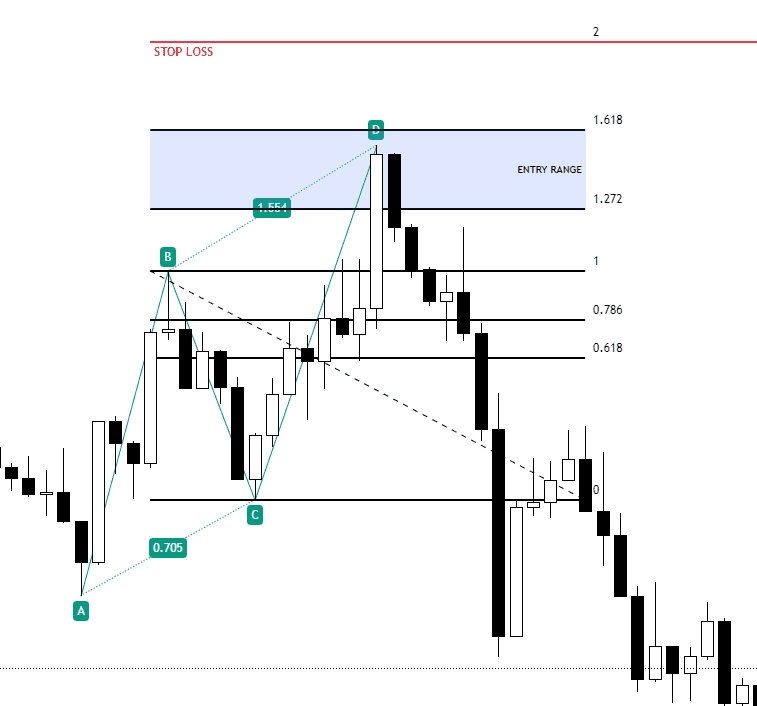

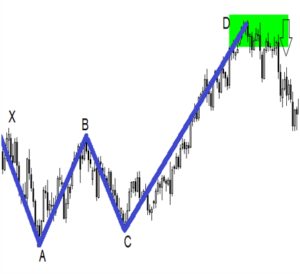

How to measure the ABCD harmonic pattern?

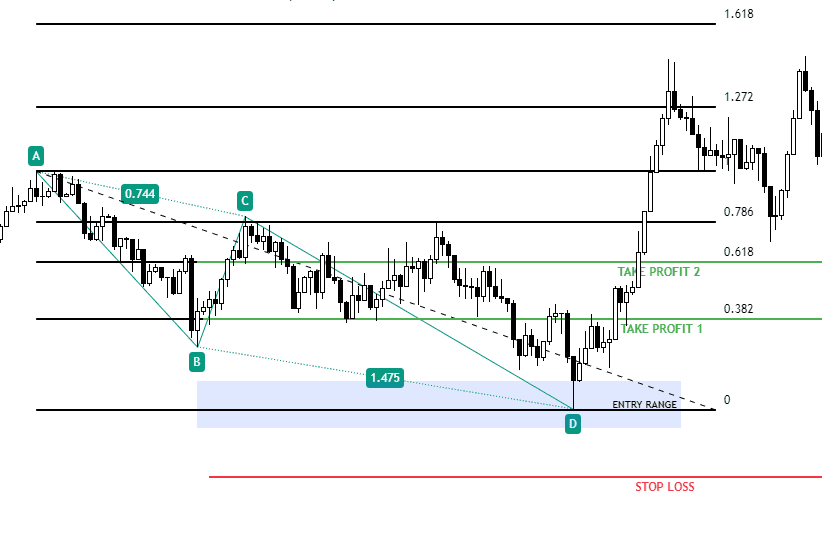

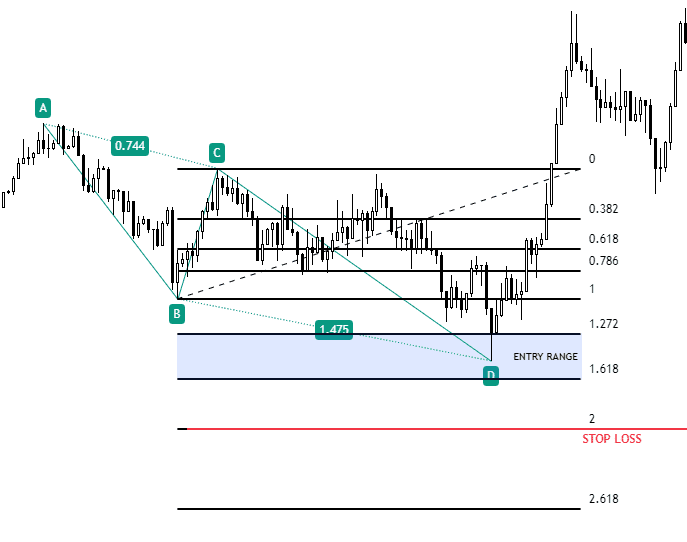

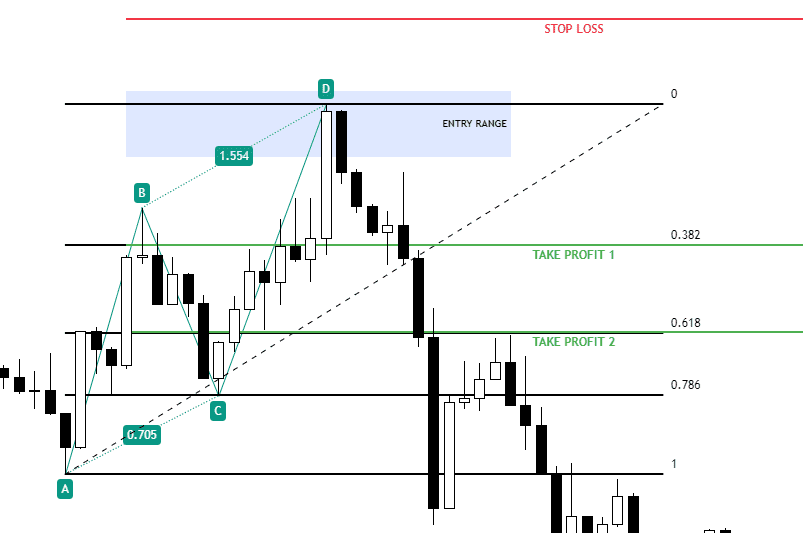

Stage 1 – Formation of BC leg, you must first identify an impulse leg (AB leg) to measure a retracement from and the extent of such retracement leg (BC leg) must only fall within 0.618 to 0.786 Fibonacci retracement

Stage 2 – Formation of CD leg, once a 0.618 to 0.786 Fibonacci retracement is met, price now must react all the way to 1.272% to 1.618% Fibonacci extension measuring the BC leg to successfully form the ABCD pattern.

| ABCD | |

| AB | Any impulse leg |

| C | 0.618; 0.786 AB |

| D | 1.272; 1.618 BC |

| Stop loss | 2.000 BC |

| Take profit | 0.382; 0.618 AD |

Long Trade example

Short Trade example

Comments