Trade duration is the timeframe during which the trader executes his trade. Trade duration can vary on multiple different factors. But, the main reason is what the trader desires.

The time duration varies depending on the experience you have in trading. Skilled traders use most of the time short time durations.

With such a wide variety of trading techniques, you are sure to get confused at some point.

That is why you should take your time learning all the trading strategies to see which one suits you the best.

Whether they want to trade in a few minutes or hold onto the trade for several months is totally up to the trader’s needs.

Forex trade durations

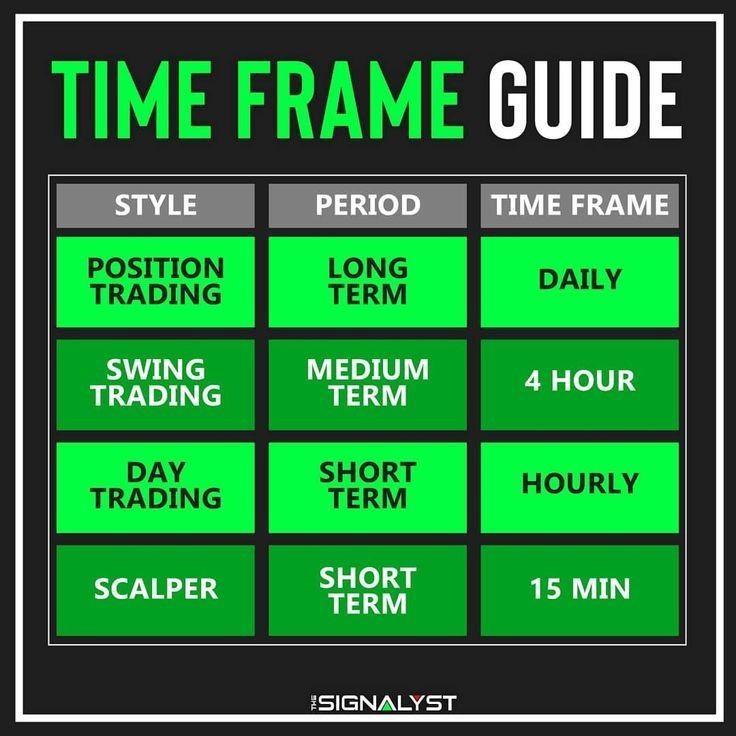

People may fall into different categories depending on the time they hold onto their trade. They are as follows.

Scalping

Scalping is the type of trade usually done to get a quick buck. Scalping is done on smaller time frames, mainly ten pips on average. Scalping usually lasts for only a few seconds to a couple of minutes.

Scalping is done based only on technical analysis. Scalpers usually use time frames of a few seconds to one minute.

Scalping sure attracts new traders, but it requires months or even years of experience.

Day trading

People who open the trade and close before the trading session ends. These trades take about 5 to 10 minutes to be executed by traders.

These trades give more leeway than scalping.

Swing trading

From this point on, the trades start to become safer than before. If you are a new trader, then you should start from this time duration. Swing traders buy a trade and then hold it for a week at most. Most people hold onto these trades for 3 to 5 days.

These types of trades are better if you want to make some safe profits. Swing trades require both fundamental and technical analysis.

Position trading

Traders do position trading to get long-term gain. Instead of making a quick buck, this type of trading takes more patience, and in return, the risk to reward is low. Most of these trades may last up to a month.

People usually take these trades when strong fundamental bases back up the trade. The timeframe for these trades is 4 hours or even one day.

Final thoughts

Initially, it might not be easy to choose the time duration you want to trade in. It is better to get complete experience first, then hop on to trades that are mid to long-term because they are safer and more mature.

Short-term trades are usually for people who work full-time and do not treat trading as part-time. It takes some real nerves to profit from scalping and day trading, so be prepared.

Comments