What are harmonic patterns?

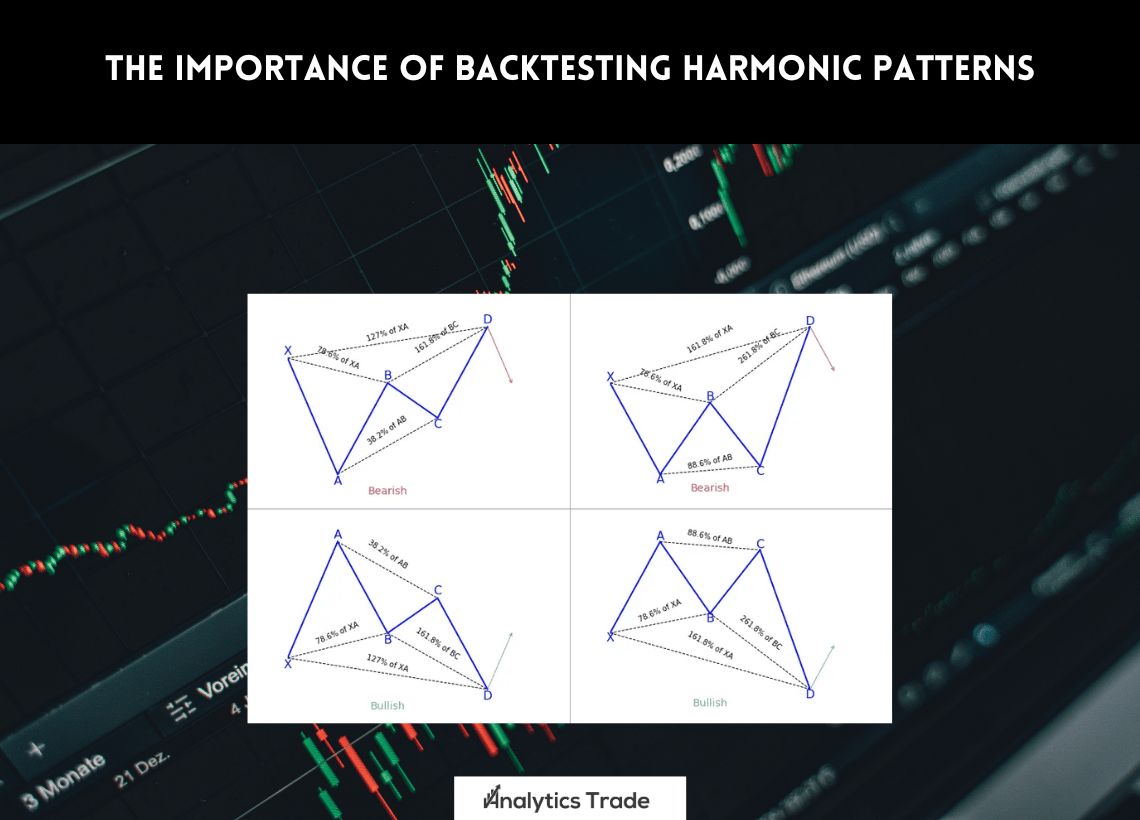

Harmonic patterns are a type of technical analysis used to identify potential price reversals in the forex market. They are based on Fibonacci ratios and use specific price patterns to identify potential reversals. The most common harmonic patterns are the Gartley, Butterfly, Bat, and Crab patterns.

Why is backtesting important?

Backtesting is an important part of any trading strategy. It allows traders to test their strategies in a simulated environment before risking real money. Backtesting can help traders identify potential trading opportunities, as well as identify potential weaknesses in their strategies.

How to backtest harmonic patterns?

Backtesting harmonic patterns is relatively straightforward. Traders can use a variety of software programs to backtest their strategies. These programs allow traders to input their trading parameters and then test their strategies against historical data. This allows traders to identify potential trading opportunities and refine their strategies.

What are the benefits of backtesting harmonic patterns?

Backtesting harmonic patterns can provide traders with a number of benefits. It can help traders identify potential trading opportunities, as well as identify potential weaknesses in their strategies. Backtesting can also help traders refine their strategies and improve their trading performance.

What are the risks of backtesting harmonic patterns?

Backtesting harmonic patterns can be risky. As with any trading strategy, there is no guarantee of success. Backtesting can help traders identify potential trading opportunities, but it cannot guarantee profits. Traders should always use risk management techniques when trading and never risk more than they can afford to lose.

Questions and Answers

Q: What are harmonic patterns?

A: Harmonic patterns are a type of technical analysis used to identify potential price reversals in the forex market. They are based on Fibonacci ratios and use specific price patterns to identify potential reversals. The most common harmonic patterns are the Gartley, Butterfly, Bat, and Crab patterns.

Q: Why is backtesting important?

A: Backtesting is an important part of any trading strategy. It allows traders to test their strategies in a simulated environment before risking real money. Backtesting can help traders identify potential trading opportunities, as well as identify potential weaknesses in their strategies.

Q: How to backtest harmonic patterns?

A: Backtesting harmonic patterns is relatively straightforward. Traders can use a variety of software programs to backtest their strategies. These programs allow traders to input their trading parameters and then test their strategies against historical data. This allows traders to identify potential trading opportunities and refine their strategies.

Q: What are the benefits of backtesting harmonic patterns?

A: Backtesting harmonic patterns can provide traders with a number of benefits. It can help traders identify potential trading opportunities, as well as identify potential weaknesses in their strategies. Backtesting can also help traders refine their strategies and improve their trading performance.

Q: What are the risks of backtesting harmonic patterns?

A: Backtesting harmonic patterns can be risky. As with any trading strategy, there is no guarantee of success. Backtesting can help traders identify potential trading opportunities, but it cannot guarantee profits. Traders should always use risk management techniques when trading and never risk more than they can afford to lose.

Summary

Backtesting harmonic patterns is an important part of any forex trading strategy. It allows traders to test their strategies in a simulated environment before risking real money. Backtesting can help traders identify potential trading opportunities, as well as identify potential weaknesses in their strategies. Backtesting can also help traders refine their strategies and improve their trading performance. However, backtesting harmonic patterns can be risky and traders should always use risk management techniques when trading and never risk more than they can afford to lose.

Comments