What is Scalping?

Scalping is a trading strategy that involves taking small profits on a regular basis. It is a short-term trading strategy that seeks to capitalize on small price movements in the market. Scalpers look to take advantage of small price movements in the market by entering and exiting trades quickly. Scalpers typically use technical indicators such as the Zigzag indicator to identify potential trading opportunities.

What is the Zigzag Indicator?

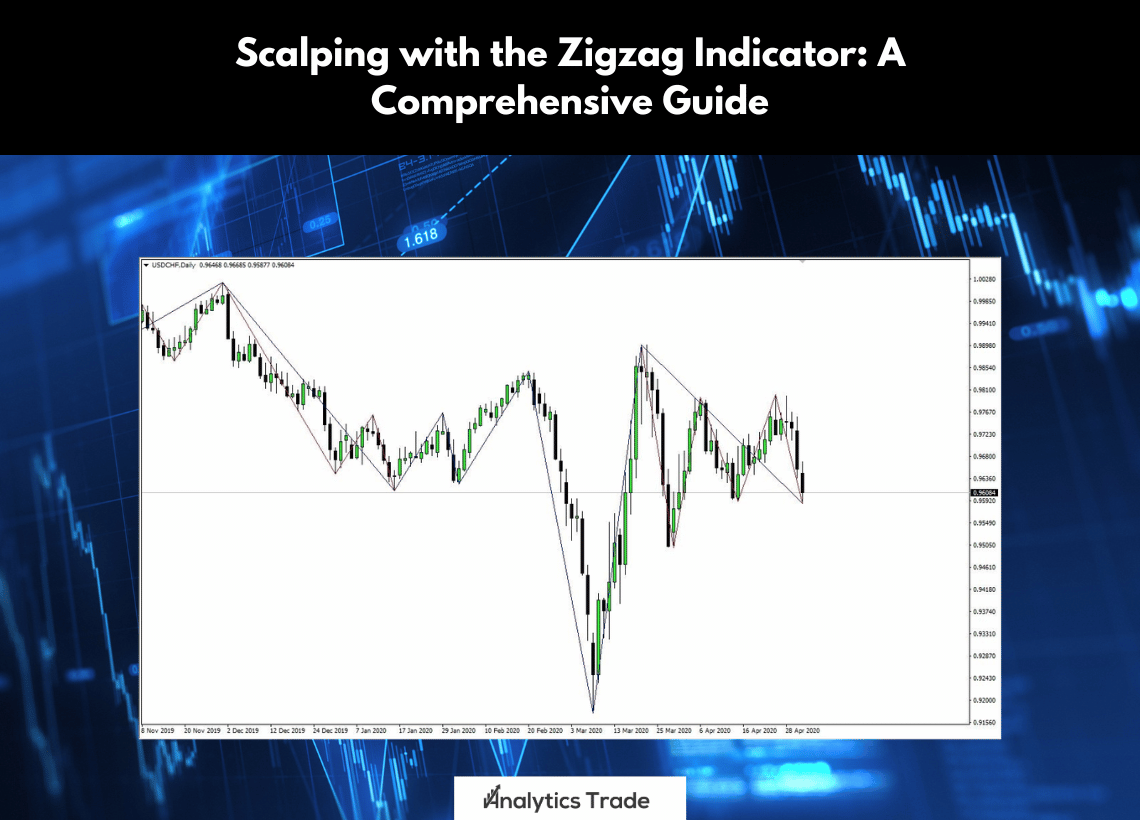

The Zigzag indicator is a technical indicator that is used to identify potential trading opportunities. It is a trend-following indicator that is designed to identify potential reversals in the market. The Zigzag indicator is based on a mathematical formula that uses three successive highs or lows to identify potential reversals in the market. The Zigzag indicator is often used by scalpers to identify potential trading opportunities.

How to Use the Zigzag Indicator for Scalping?

The Zigzag indicator can be used for scalping in the forex market. Scalpers look to take advantage of small price movements in the market by entering and exiting trades quickly. The Zigzag indicator can be used to identify potential trading opportunities in the market.When using the Zigzag indicator for scalping, traders should look for potential reversals in the market. The Zigzag indicator is designed to identify potential reversals in the market. Traders should look for potential reversals in the market and enter trades when the Zigzag indicator identifies a potential reversal.

1. Identify Potential Reversals

The first step in using the Zigzag indicator for scalping is to identify potential reversals in the market. Traders should look for potential reversals in the market and enter trades when the Zigzag indicator identifies a potential reversal.

2. Set Stop Loss and Take Profit Levels

The next step in using the Zigzag indicator for scalping is to set stop loss and take profit levels. Traders should set stop loss and take profit levels to protect their capital and maximize their profits. Stop loss and take profit levels should be set based on the trader’s risk tolerance and trading strategy.

3. Monitor the Market

The final step in using the Zigzag indicator for scalping is to monitor the market. Traders should monitor the market to identify potential trading opportunities. Traders should also monitor the market to ensure that their stop loss and take profit levels are not breached.

Conclusion

Scalping with the Zigzag indicator is a popular trading strategy among forex traders. The Zigzag indicator is a trend-following indicator that is designed to identify potential reversals in the market. Traders should look for potential reversals in the market and enter trades when the Zigzag indicator identifies a potential reversal. Traders should also set stop loss and take profit levels to protect their capital and maximize their profits. Finally, traders should monitor the market to identify potential trading opportunities and ensure that their stop loss and take profit levels are not breached.

Comments