What is Support and Resistance?

Support and resistance are two of the most important concepts in currency analysis. Support is a price level at which buyers are likely to enter the market and push prices higher, while resistance is a price level at which sellers are likely to enter the market and push prices lower. By understanding how support and resistance work, traders can identify potential trading opportunities and make better trading decisions.

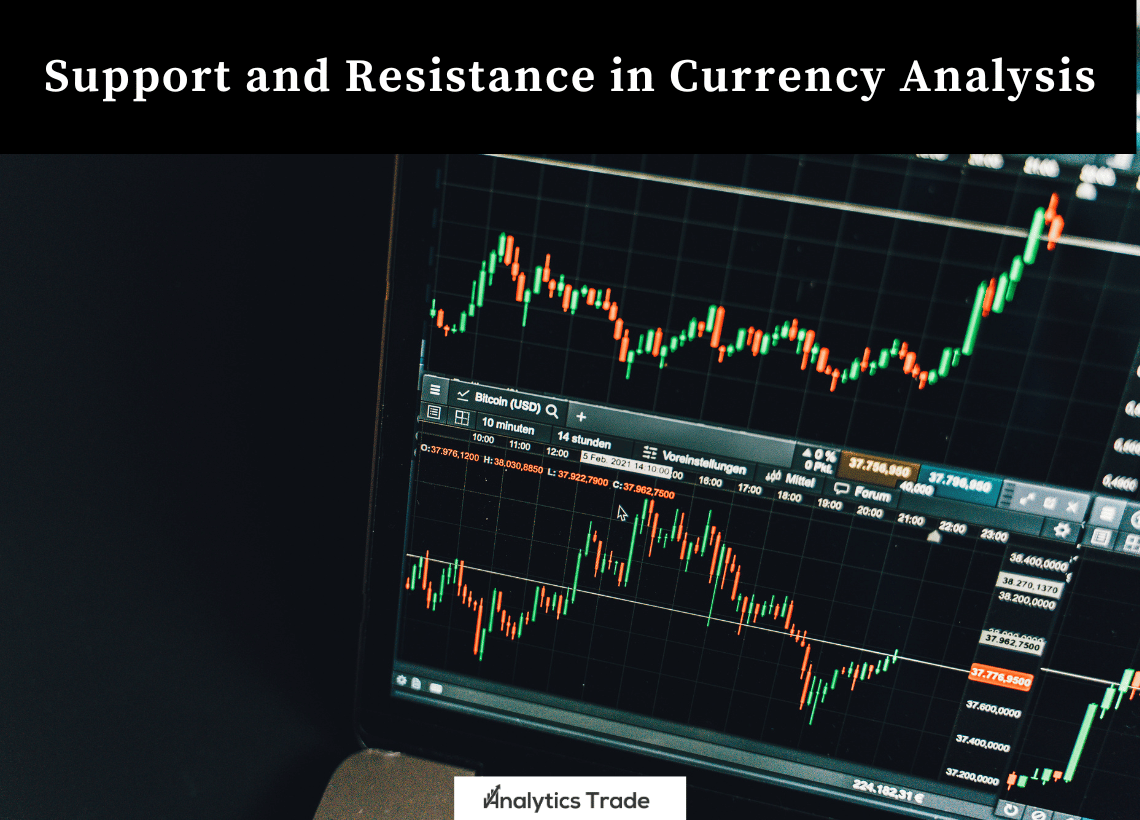

How to Identify Support and Resistance

Support and resistance levels can be identified by looking at a currency pair’s price chart. Support levels are typically identified by looking for a price level at which the currency pair has previously found buying interest, while resistance levels are typically identified by looking for a price level at which the currency pair has previously found selling interest.

Support Levels

Support levels are typically identified by looking for a price level at which the currency pair has previously found buying interest. This buying interest can be identified by looking for price patterns such as double bottoms, higher lows, or bullish reversals. When a support level is identified, forex traders can look for potential buying opportunities if the currency pair’s price moves back up to that level.

Resistance Levels

Resistance levels are typically identified by looking for a price level at which the currency pair has previously found selling interest. This selling interest can be identified by looking for price patterns such as double tops, lower highs, or bearish reversals. When a resistance level is identified, traders can look for potential selling opportunities if the currency pair’s price moves back down to that level.

How to Use Support and Resistance in Currency Analysis

Once support and resistance levels have been identified, traders can use them to identify potential trading opportunities. For example, if a currency pair’s price moves up to a previously identified resistance level, traders can look for potential selling opportunities. Conversely, if a currency pair’s price moves down to a previously identified support level, traders can look for potential buying opportunities. Traders can also use support and resistance levels to set stop-loss and take-profit orders. For example, if a trader is looking to buy a currency pair, they can set a stop-loss order below the identified support level. Similarly, if a trader is looking to sell a currency pair, they can set a take-profit order above the identified resistance level. Support and resistance levels can also be used to identify potential breakouts. If a currency pair’s price breaks above a previously identified resistance level, traders can look for potential buying opportunities. Conversely, if a currency pair’s price breaks below a previously identified support level, traders can look for potential selling opportunities.

Conclusion

Support and resistance are two of the most important concepts in currency analysis. By understanding how support and resistance work, traders can identify potential trading opportunities and make better trading decisions. Traders can use support and resistance levels to identify potential trading opportunities, set stop-loss and take-profit orders, and identify potential breakouts. For more information on how to use support and resistance in currency analysis, please visit Wikipedia.org.

Comments