What are Candlestick Charts?

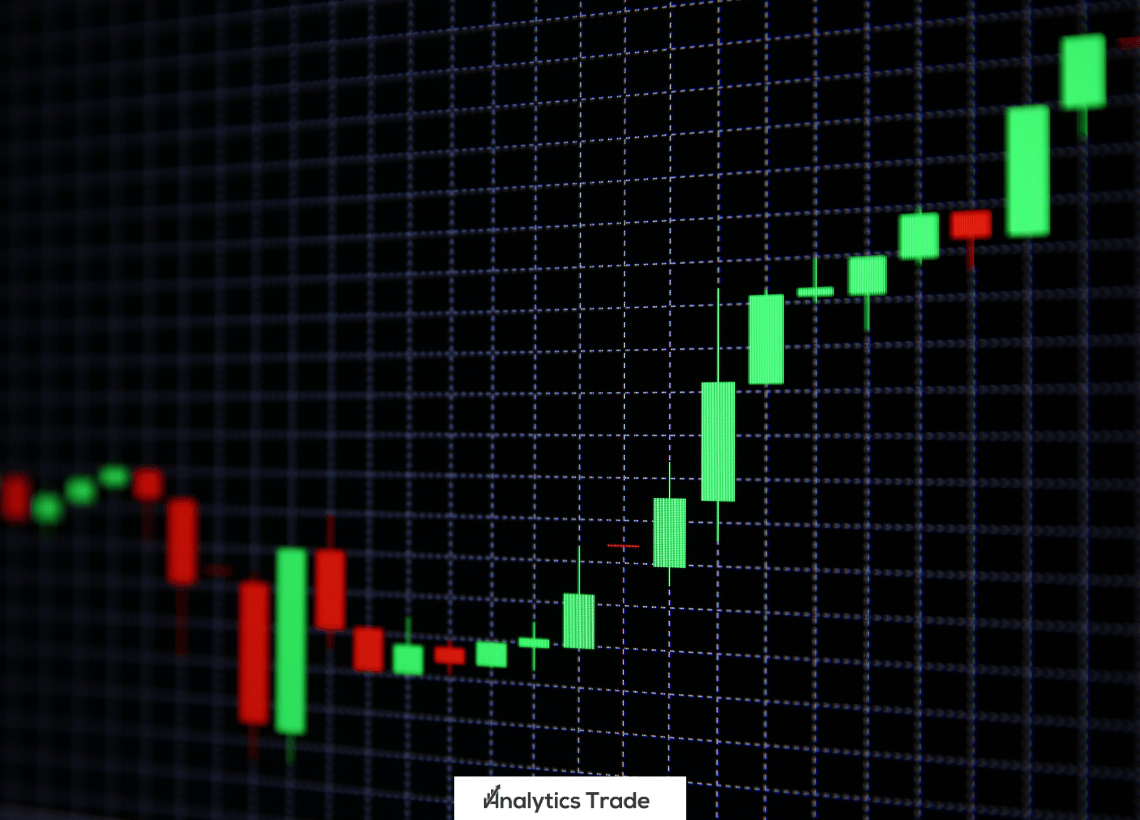

Candlestick charts are a type of financial chart used to track the price movements of a security or currency. They are one of the most popular tools used by forex traders as they provide a visual representation of the price action. Candlestick charts are composed of a series of vertical lines that represent the opening and closing prices of a security, as well as the highs and lows. Each candlestick is composed of a body and a wick, which are used to indicate the direction of the price movement.

How to Read Candlestick Charts

Reading candlestick charts is relatively straightforward. The body of the candlestick represents the opening and closing prices of the security. If the body is filled in, it indicates that the closing price was lower than the opening price. If the body is hollow, it indicates that the closing price was higher than the opening price. The wick of the candlestick represents the high and low prices of the security. If the wick is above the body, it indicates that the high price was higher than the closing price. If the wick is below the body, it indicates that the low price was lower than the opening price. Also, forex traders need to know about japanese candlestick charting techniques“}” data-sheets-userformat=”{“2″:15103,”3”:{“1″:0},”4”:{“1″:2,”2″:11847399},”5”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:1}]},”6”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:1}]},”7”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:3}]},”8”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:3}]},”9″:0,”10″:2,”12″:0,”14”:{“1″:2,”2″:0},”15″:”Arial, sans-serif”,”16″:11}”>Japanese Candlestick Charting Techniques.

What Do Different Candlestick Patterns Mean?

Candlestick patterns can be used to identify potential trading opportunities. Different patterns can indicate different types of price action. For example, a bullish engulfing pattern indicates that the price is likely to move higher, while a bearish engulfing pattern indicates that the price is likely to move lower. Other patterns, such as the hammer and the hanging man, can indicate potential reversals in the price action.

How to Use Candlestick Charts in Forex Trading

Candlestick charts are a valuable tool for forex traders. They can be used to identify potential trading opportunities, as well as to confirm existing trades. Traders can use candlestick patterns to identify potential reversals in the price action, as well as to identify potential breakouts. Candlestick charts can also be used to identify support and resistance levels, as well as to identify potential trend lines. japanese candlestick charting techniques“}” data-sheets-userformat=”{“2″:15103,”3”:{“1″:0},”4”:{“1″:2,”2″:11847399},”5”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:1}]},”6”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:1}]},”7”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:3}]},”8”:{“1”:[{“1″:2,”2″:0,”5”:{“1″:2,”2”:0}},{“1″:0,”2″:0,”3”:3},{“1″:1,”2″:0,”4″:3}]},”9″:0,”10″:2,”12″:0,”14”:{“1″:2,”2″:0},”15″:”Arial, sans-serif”,”16″:11}”>Japanese candlestick charting techniques is one of the best forex traders ever known.

Answers and Questions

Q: What are Candlestick Charts?

A: Candlestick charts are a type of financial chart used to track the price movements of a security or currency. They are composed of a series of vertical lines that represent the opening and closing prices of a security, as well as the highs and lows.

Q: How to Read Candlestick Charts?

A: Reading candlestick charts is relatively straightforward. The body of the candlestick represents the opening and closing prices of the security. The wick of the candlestick represents the high and low prices of the security.

Q: What Do Different Candlestick Patterns Mean?

A: Different candlestick patterns can indicate different types of price action. For example, a bullish engulfing pattern indicates that the price is likely to move higher, while a bearish engulfing pattern indicates that the price is likely to move lower. Other patterns, such as the hammer and the hanging man, can indicate potential reversals in the price action.

Q: How to Use Candlestick Charts in Forex Trading?

A: Candlestick charts are a valuable tool for forex traders. They can be used to identify potential trading opportunities, as well as to confirm existing trades. Traders can use candlestick patterns to identify potential reversals in the price action, as well as to identify potential breakouts. Candlestick charts can also be used to identify support and resistance levels, as well as to identify potential trend lines.

Summary

Candlestick charts are a valuable tool for forex traders. They provide a visual representation of the price action and can be used to identify potential trading opportunities. Different candlestick patterns can indicate different types of price action, such as potential reversals or breakouts. Traders can also use candlestick charts to identify support and resistance levels, as well as to identify potential trend lines. By understanding how to read and interpret candlestick charts, traders can make better trading decisions and increase their chances of success.

Comments