What is Correlation Trading?

Correlation trading is a type of trading strategy that takes advantage of the relationship between two or more financial instruments. It is based on the idea that when one instrument moves in one direction, the other instrument will move in the same direction. This type of trading is often used by traders who are looking to diversify their portfolios and reduce their risk exposure.The concept of correlation trading is based on the idea that when two instruments move in the same direction, they are said to be correlated. This means that if one instrument moves up, the other instrument will also move up. Conversely, if one instrument moves down, the other instrument will also move down.

How to Use Correlation Trading in Forex

Correlation trading can be used in Forex trading to identify opportunities to buy or sell a currency pair. By looking at the correlation between two currency pairs, traders can identify when one currency pair is likely to move in the same direction as the other. This can be used to identify potential trading opportunities.For example, if the EUR/USD and GBP/USD are positively correlated, then when the EUR/USD moves up, the GBP/USD is likely to move up as well. This means that a trader could buy the EUR/USD and sell the GBP/USD at the same time, taking advantage of the positive correlation between the two pairs.

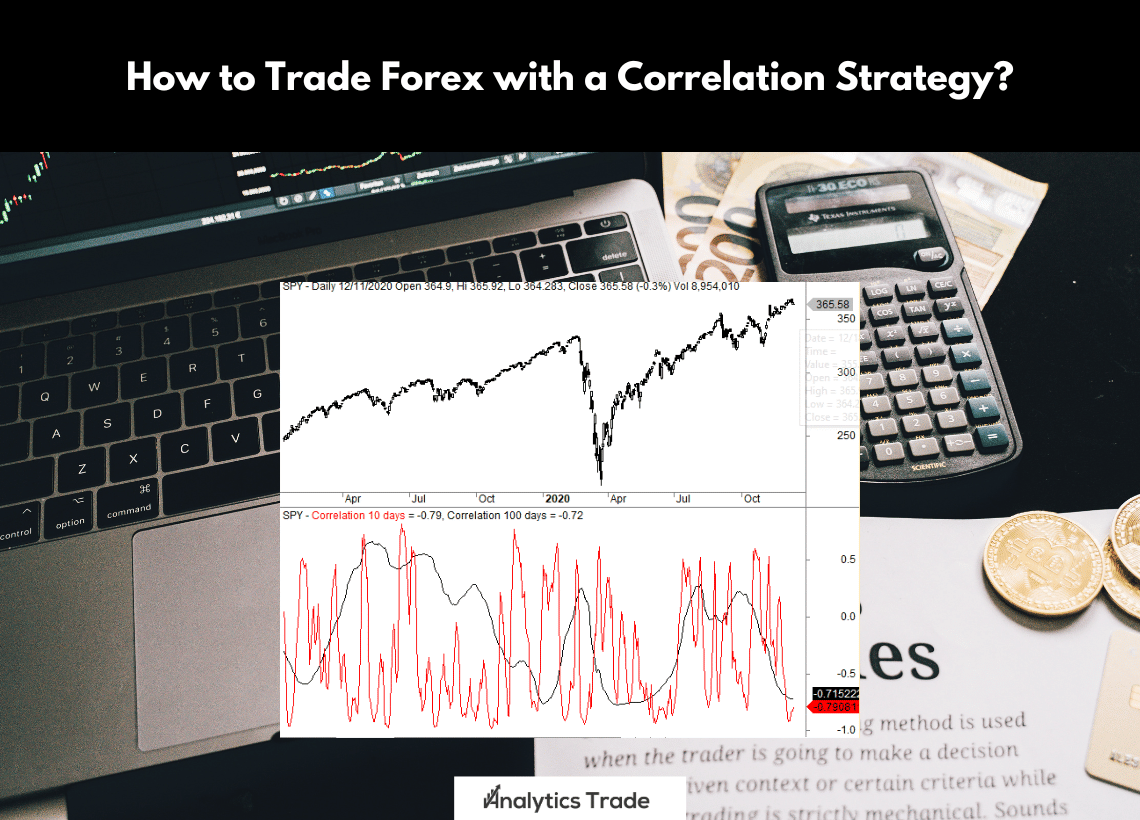

Identifying Correlations

The first step in using correlation trading in Forex is to identify the correlation between two currency pairs. This can be done by looking at the historical price data of the two pairs and seeing how they have moved in relation to each other. If the two pairs have moved in the same direction over a period of time, then they are said to be positively correlated. Conversely, if the two pairs have moved in opposite directions over a period of time, then they are said to be negatively correlated.

Using Correlation Trading Strategies

Once a trader has identified the correlation between two currency pairs, they can then use a correlation trading strategy to take advantage of the relationship. One of the most popular correlation trading strategies is the “pairs trading” strategy. This strategy involves buying one currency pair and selling another currency pair at the same time. This allows the trader to take advantage of the positive correlation between the two pairs and potentially make a profit.

Risk Management

It is important to remember that correlation trading is not without risk. As with any type of trading, there is always the potential for losses. Therefore, it is important to use risk management techniques such as stop-loss orders and position sizing to limit losses and protect capital.

Conclusion

Correlation trading is a type of trading strategy that takes advantage of the relationship between two or more financial instruments. By looking at the historical price data of two currency pairs, traders can identify when one currency pair is likely to move in the same direction as the other. This can be used to identify potential trading opportunities. However, it is important to remember that correlation trading is not without risk and traders should use risk management techniques to limit losses and protect capital.

Personal Opinion

Correlation trading is an interesting and potentially profitable trading strategy. It can be used to diversify a portfolio and reduce risk exposure. However, it is important to remember that correlation trading is not without risk and traders should use risk management techniques to limit losses and protect capital.

Comments